AMD EPYC has started to notch market share gains. While casual observers may have expected huge market share numbers with AMD EPYC “Naples” the fact is that, unlike the consumer space, this is a slow-moving market. We wanted to give our take on AMD’s progress as we have had a first-hand view at the forefront of the movement. In 2019 we are entering the dawn of the server CPU wars, and AMD’s first shot in mid-2017 with Naples has put the industry on notice.

The Mercury Research CPU Share Figures

AMD’s press release used a table with the server, desktop, and notebook segments. Since STH primarily deals with servers, embedded products, and high-end workstations, we are instead going to focus on the “Server (excluding IoT)” line.

| Q417 | Q318 | Q418 | QoQ | YoY | Historical Comparison | |

| Server | 0.8% | 1.6% | 3.2% | +1.5% | +2.4% | Highest since Q4 2014 |

These gains are solid but may be smaller than some may expect. We think these are in-line with expectations and wanted to provide some context on why.

When we look at what AMD has done, one should remember that Arm competitors in many ways face an even more challenging task. The Arm CPU wave is coming later in 2019 and 2020 but for now, AMD is Intel’s primary threat in one and two-socket servers.

While 3.4% may be good, as is an increase from 0.8% in the year-ago period that takes some context. We wanted to put some context around AMD EPYC in 2017 and 2018 for our readers who do not follow the market as closely.

The 2017 CPU Share AMD EPYC Context

In Q4 2017, AMD EPYC 7001 “Naples” was already in the market. The HPE ProLiant DL385 Gen10 AMD EPYC system was unveiled in November 2017, although volume shipments started later. Still, it took until 2018 until AMD EPYC Powered Dell EMC PowerEdge servers arrived and HPE would add the HPE ProLiant DL325 Gen10 1P 1U AMD EPYC platform.

In short, we had the launch of Naples in June 2017. The full line of CPUs became available by August/ September 2017. The two major OEMs really started to ship AMD EPYC systems in Q1 2018. From a market perspective, imagine if on the consumer side a CPU line was launched and you could not buy them in systems from major vendors for ~3 quarters. That 0.8% number for Q4 2017 seems good in context.

There were other systems in the market, we had a dual socket Supermicro system and a Tyan single socket system pumping out AMD EPYC 7401P benchmarks in September 2017, but there is a difference between Dell EMC/ HPE and others in the market. Vendors matter and some organizations will only use Dell EMC or HPE. In that context, 0.8% seems reasonable.

The 2018 CPU Share AMD EPYC Context

Sometime after January 1, 2018, we saw the number of options in the market increase. We published our Dell EMC PowerEdge R7415 Review and have used both the HPE ProLiant DL385 Gen10 and ProLiant DL325 Gen10 in the lab daily since the fall of 2018. These systems are out there now, and they were not in 2017.

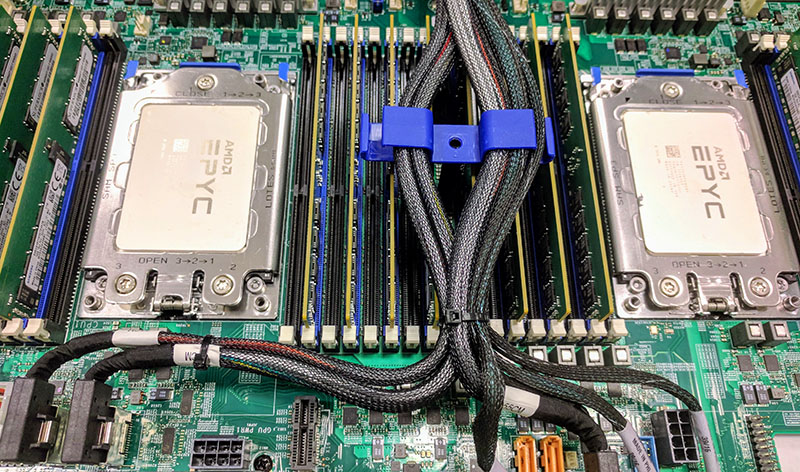

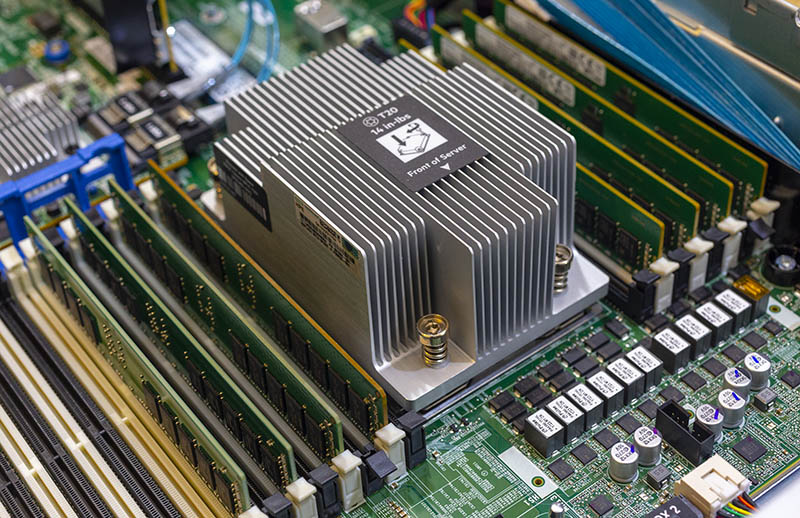

For those wondering, our review unit HPE ProLiant DL385 Gen10 has been ordered for weeks/ months so stay tuned. The above picture is from the unit we have in the lab, but we are working with HPE to review a model that better compares with the other systems we review.

In 2018 we saw systems like the Gigabyte H261-Z60 2U4N as well as the Supermicro BigTwin EPYC edition for density optimized installations. We saw various GPU options for AMD EPYC arrive. In 2017 there was an enormous delta between the form factors you could get on the Intel and AMD sides. Ending 2018, the majority of the volume shipment form factors were covered. Closing that gap allowed AMD to expand share, as did wins at places like Amazon AWS. Indeed, between penning this article and its go-live in 2019, Microsoft Azure Lsv2 instances based on AMD EPYC became available.

As we exit 2018 and enter 2019, Intel still has a lead in platform diversity, but AMD EPYC has enough platforms available to take well beyond 3-4% share.

IDC v. Mercury Research Market Share

At STH, we usually utilize IDC numbers. If you saw our Interview with Liu Jun, AVP and GM of AI and HPC for Inspur, you will see that we use IDC to show which server vendors are the largest. There are some differences in how each firm calculates its figures. The primary one is that IDC tracks servers shipped while Mercury Research focuses more on CPU units sold. Indeed, both are important metrics.

If you are looking at CPU vendor revenue, then tracking units sold makes a lot of sense. Here the figures are being used to assess the financial impact of market share gains in past and projecting into future quarters. For that purpose, the Mercury Research numbers are what you want to see.

On the other hand, if you want to see the market impact of the chips, the IDC Server Tracker figures are likely the ones you want to look at since that tracks usage and has some additional segmentation. An example of this segmentation is that Intel Xeon Gold and Platinum SKUs can be used in 4-socket servers. AMD EPYC 7001 CPUs cannot be used in 4-socket servers. Intel considers 4S part of its TAM while AMD does not. The IDC Server Tracker figures allow one to address share by TAM.

A driver of the differences we see between numbers is that not all CPUs sold end up in systems from major vendors. Indeed, there are strange market forces at work that make sense solely because of industry pricing and discounting. We discussed one of these market forces in our Channel Cobblers and a hole in the AMD EPYC line. There major systems vendors and channel partners are selling and buying low-end CPU SKU systems in order to replace those SKUs with different CPUs later in the process. That often leads to more CPUs being sold than systems from major vendors and is just one instance where this can play.

Taking Stock of 2018 and Looking to 2019

STH will turn 10 next quarter, about the same time as the AMD EPYC “Rome” generation launch. When STH started, there was still a legitimate battle between AMD Opteron and Intel Xeon. Intel Xeon won that round but there are a few similarities.

What is extremely interesting here is that in the AMD Opteron 4000 series had a number of cloud wins at places like Rackspace. Beyond that momentum in the early days, AMD had a strategy whereby the Opteron 6000 series could be used in 1P, 2P, or 4P configurations. In comparison, the mainstream Intel Xeons of the day were 1P and 2P only. Intel had solutions for 4-way and higher but they were different SKUs.

Fast forward to 2019 and it is now Intel Xeon that allows 4-way with its Skylake-SP SKUs, and AMD EPYC that is limited to 1P and 2P configurations.

Intel forged ahead with PCIe 3.0 when AMD stuck at PCIe 2.0 speeds. In 2019, we will see AMD EPYC “Rome” at PCIe Gen4 and Intel Xeon Cascade Lake at PCIe Gen3.

AMD is stealing Intel’s playbook from around the Sandy Bridge timeframe and using that on its larger competitor in 2019.

There are indeed major differences. Intel has had a dominant position for years now. Beyond just the CPU side, Intel now has FPGAs, memory (Optane), a large storage business, networking, a large software business, and several additional CPU lines that did not exist in 2012. Since the last Intel v. AMD round, Intel has expanded its TAM considerably.

Final Words

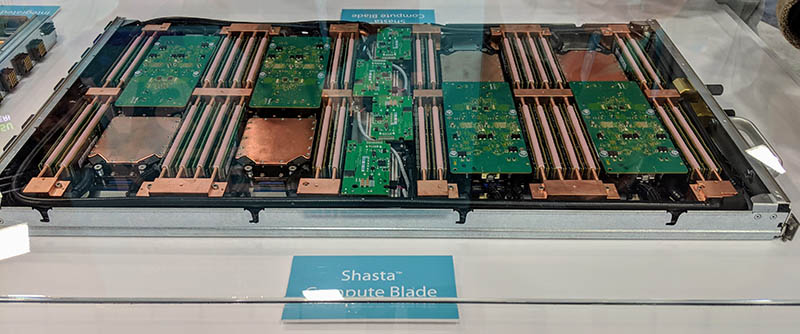

Outside of Intel, the question of 2019 is not whether AMD is going to gain server market share. Instead, it is how much share is AMD going to gain. The industry knows that the next generation of AMD EPYC Rome is going to offer features that Intel cannot match in the same timeframe. We believe that AMD is moving away from traditional x86 cores as the center of everything to the I/O hub is the center of a system and we may see support for features like CCIX with Rome. That is precisely the type of bold move that will get an industry ecosystem primed around AMD and will translate to share gains that will greatly outpace 2.4% year/year.

Low double digits are possible, but the musings that AMD will have 33%+ market share ending Q4 2019 we do not think are feasible either. The server industry moves slowly and unlike the consumer side that is always buying the newest generation, there are many customers that are buying older generations of systems even though Intel Xeon Skylake-SP has been in the market for over six quarters.

2018 was good to AMD, but we anticipate AMD to accelerate share gains in 2019. That is against a backdrop not just of increased Intel vigor in competition but also against emerging competition from Arm in the server space. 2019 will be a fun year to watch the server space but 2020 will be even more exciting.

What a bunch of crap.

Initial 1% gain in marketshare was literally just a testbed for budget aging Xeon replacement.

And this stupid idea was quickly dumped by everyone.

And it’s easy to see why.

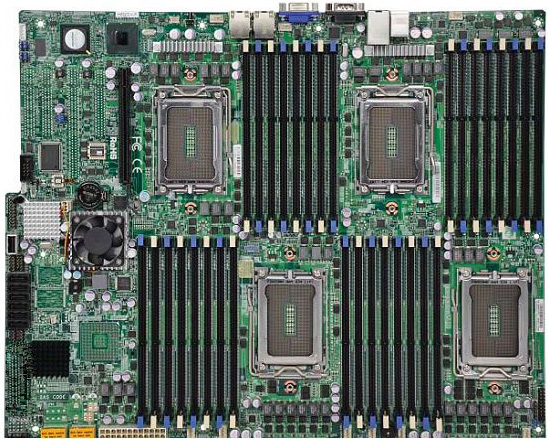

1. You can only have 2 EPYC CPU’s on one mobo while you can have 4/8 Xeons. Anyone with slightest clue about running multiple servers for one job understands why noone wants more separate servers to achieve same computing power.

2. $5000 EPYC 7601 is clubbed to death in DB latencies by 7+ yo Xeons which can be bought for $300-400 on Ebay.

3. EPYC 7601 is actually 4 separate 8-core CPU’s in one box. In parallelized environment it performs as expected – awfully.

4. Whoever has real experience with 6xxx and 8xxx Opteron’s and their failure to do the job will never buy 4 CPU’s in one box – the nonsoepyc EPYC.

And this miserable in terms of parellelized processes Opteron architecture had once (~10yo ago) a 20-25% marketshare.

But in this business, people learn from their mistakes pretty fast. So no sane sysadmin will buy EPYC. EPYC for servers is mostly bought by insecure hipsters which can get the job with fake Curriculum Vitae and get fired couple of months later due to incompetence.

Shuwix you realize that you’ve contradicted yourself. You say EPYC is bad because it only does 2S when 97% of the market is 1-2S. You then say how bad 4S is…

But yeah. I work at a big clod company we’ve already announced Naples deployment and we didn’t do that with the expectation we’d install less Rome.