At AMD’s Q2 2021 earnings call, the company gave an update on its EPYC line. While the focus was on the financial performance, data center is now a big business (trending in the 20%+ of AMD revenue range) so it is one that gets a feature as AMD updates the market on its business. Suffice to say, EPYC is growing fast and given what we saw, this growth seems to be at the expense of Intel Xeon.

AMD EPYC Business Growth 1H 2021

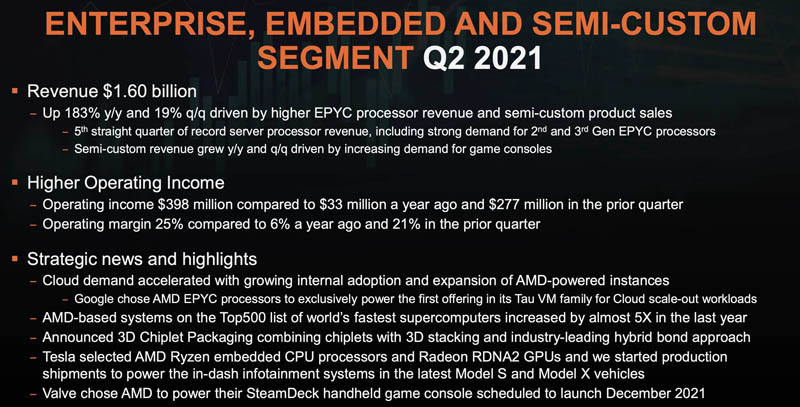

AMD EPYC sales fall into its Enterprise, Embedded, and Semi-custom segment. This segment also includes chips made for game consoles and even the embedded chip in the new Tesla Model S and X.

Revenue is up 183% on an increasing margin but there is something really interesting going on in this slide, and it was highlighted in the earnings commentary. While all indications are that EPYC is growing very fast, one will notice that this slide notes “strong demand for 2nd and 3rd Gen EPYC processors.” In some of the commentary around the release, AMD said cloud customers were early in adopting the 3rd gen EPYC 7003 “Milan” but that in the second half of the year would see more enterprise adoption of the new part.

Anecdotally, this makes sense as we have heard numerous stories of smaller customers that want Milan struggling to quickly get servers with the new parts. As we saw in our AMD EPYC 7003 Milan launch piece, the new EPYC 7003 parts seem to use more power, but also offer a lot more performance making them highly desirable. Reading between the lines, this should ease in the second half of 2021 as it is important for AMD’s business. Cloud drives volume but not necessarily margin dollars. Cloud companies offer enormous orders, but also want chips early to launch standardized instance types globally. They use those large blocks of revenue to push pricing down (lowering margin) but also cutting ahead in the line to get chips earlier than smaller customers.

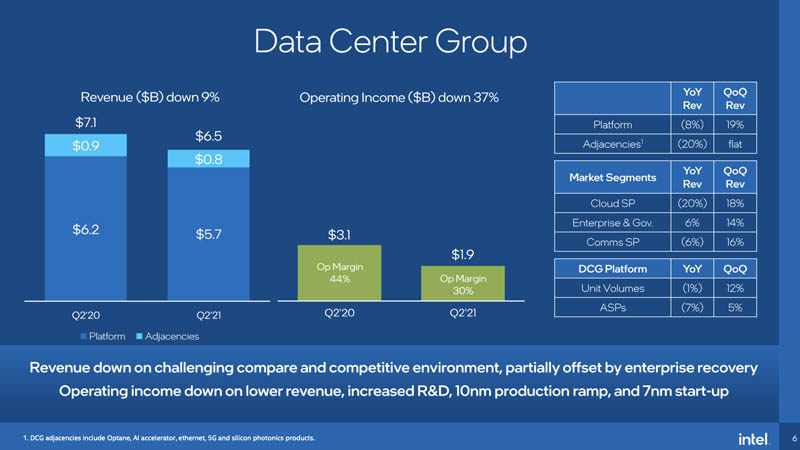

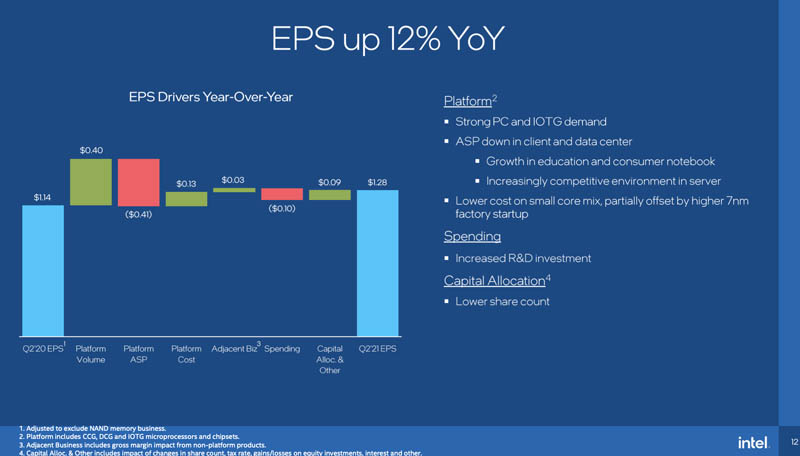

Taking a look at Intel, the picture was less upbeat on the data center side. The Intel Xeon Ice Lake edition launch happened at the beginning of Q2. As a result, Q1 saw some customers waiting for the huge generational update and thus we see a quarterly improvement in the business. At the same time, Intel is showing a major downswing in terms of year-over-year performance. While revenue is down, so is the operating margin, and by a drastic amount.

In the appendix to Intel’s announcement, the company that had something huge like 97% market share a few years ago now notes “Increasingly competitive environment in server.” At the start of 2017, Intel basically had no competition and a monopoly in the server space.

So what we are left with is two divergent pictures. Intel either is seeing the Osborne Effect from delaying its Ice Lake processors and demand shifting before a supply of the new parts arrives. We may also see genuine competition slowly eroding the Xeon monopoly from AMD and Arm vendors (we will include AWS as an Arm vendor here.)

So while AMD is positioning 2021 as a year of growth with significant margin upside, Intel is positioning a tough year where it will discount to drive volume. Intel has a plan to get back into the semiconductor manufacturing leadership position by 2025 and that would, in theory, help it to make more competitive products.

Although we generally focus on Milan versus Ice Lake these days, as we did in Top500 June 2021 Our New Systems Analysis AMD Wins Big article, what is interesting here is that AMD is effectively saying that “Rome” is driving a lot of its share gain even in the quarter where Intel’s next-gen Ice Lake chip was released early in the quarter. This leads to a strange interpretation that the 2019 AMD EPYC 7002 Rome is winning against Intel’s 2021 Ice Lake Xeon flagship. We actually saw this in the Top500 piece and discussed it in this video:

To be fair, Rome was designed to be a direct competitor (and win share) against Ice Lake in 2019, Intel just delayed its part by many quarters.

We covered a direct comparison example at 32 cores in Intel Xeon Gold 6314U v AMD EPYC 7543P the 1S 32-core Options.

Final Words

Our sense is that AMD is going to pick up more market share when the next set of numbers are released. At the same time, it may be more of revenue rather than unit volume. In a global chip shortage that impacts not just server chips, but also all of the other chips that go into servers, higher core count parts start to become more attractive. If one can only procure 100 servers, and AMD’s yield is similar on 64 core and 32 core parts, then many customers will want to use higher core count parts to minimize the supply chain impact on server purchases.

Beyond the market share gains, the good news is that AMD is setting Wall Street expectations that its EPYC CPU mix will have more enterprise sales in the second half of the year which means we should see more availability for our non-hyperscale readers.

For the site that covers server gear, it is fun that we are finally seeing some competition in the market as we had when we started STH in 2009.

AMD’s data center sales didn’t really grow much more than Intel’s this past quarter. Q/Q, Intel’s data center group revenue grew 16% and AMD’s enterprise, embedded, and semicustom grew 19%.

AMD said its embedded and semi custom business did not grow as much as data center and that EPYC was growing faster than DC GPU.

AMD needs to break out EPYC.

Semicustom is at least $700 million and most certainly grew because as many PS5 systems are being sold as can be made. Embedded also grew. The growth of EPYC was likely more than 19% but not by a large amount. AMD likely increased server CPU market share slightly in Q2. If AMD had 12% of the server market in Q1 and grew server sales by 25% in Q2 and Intel had 88% of the server market in Q1 and grew server sales by 16% in Q2, then AMD would have 12.8% of the server market in Q2. That’s the rough situation we are looking at.

Hey Patrick, do you have any idea on 3004 series and if manufactuers like SuperMicro will be looking at releasing end user / small business ITX products using it?

Q/Q is the wrong lens from which to examine market share IMO especially since Intel’s Q1 DC performance was so abysmal. Y/Y gives a better sense of what is happening in the DC landscape.

Intel’s Q1 likely was abysmal because Ice Lake and Milan were about to launch. And when they did, AMD’s market share gain slowed down. It’d be wrong to ignore the fact that Intel’s 14 nm offerings were getting long in the tooth and that was the reason for AMD’s competitive advantage and the reason for AMD’s large market share gain in Q1. Perhaps you now think that it was an abberation, and therefore Intel’s Q1 can be ignored and Q/Q is not important. But then that would mean that AMD’s Q1 triumph did not mean AMD was really gaining market share. It was just the result of an abyssmal quarter by Intel. But the two companies are operating in the same market with the same market conditions. I wonder if after Q1 results you might have preferred the viewpoint that the relative Q1 results of the two companies meant something significant in terms of AMD’s momentum and market position but now after Q2 you prefer the viewpoint that it didn’t mean much, and so Q/Q is not important.

One indicator, the server board SKUs at supermicro.com, Intel vs. AMD:

Gen 11, X11 (87) vs. H11 (9)

Gen 12, X12 (26) vs. H12 (22)

But people do have the right and choice to be milked by Intel, don’t they? : )