We have covered the Qualcomm Centriq 2400 platform several times including the presentation at Qualcomm Centriq 2400 ARM CPU from Hot Chips 29 and more recently the New Qualcomm Centriq 2400 details 48 cores 60MB L3 cache over 2GHz. As we get to the product launch, I wanted to share some perspective on the headwinds the product will face. During our launch coverage, we will focus more on the architecture and opportunities. For now, we wanted to focus on some of the headwinds the company will face launching into the market.

These headwinds will be organized into a few key points.

- First generation server product challenges

- Architectural challenges

- AMD Competition

- Cavium Competition

You may wonder why we are not positioning this in terms of competition for Intel. The reason is simple: with Intel’s commanding market share over generations the race is really to offer an alternative to Intel. For an organization selecting a subsequent generation Intel part is a low risk path forward. Selecting anything else can be tricky so we are working with the assumption that the current generation of IT buyers will buy Intel unless they have good reason to do otherwise. The most consistent reason we have heard organizations evaluate and buy non-Intel architectures is to put pricing pressure on Intel.

First Generation Server Product Challenges

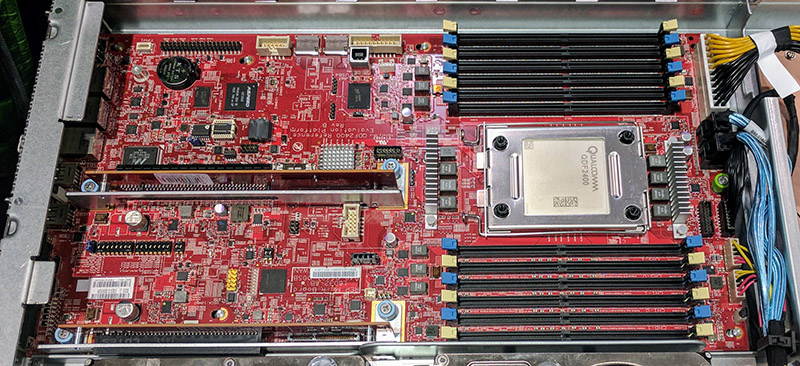

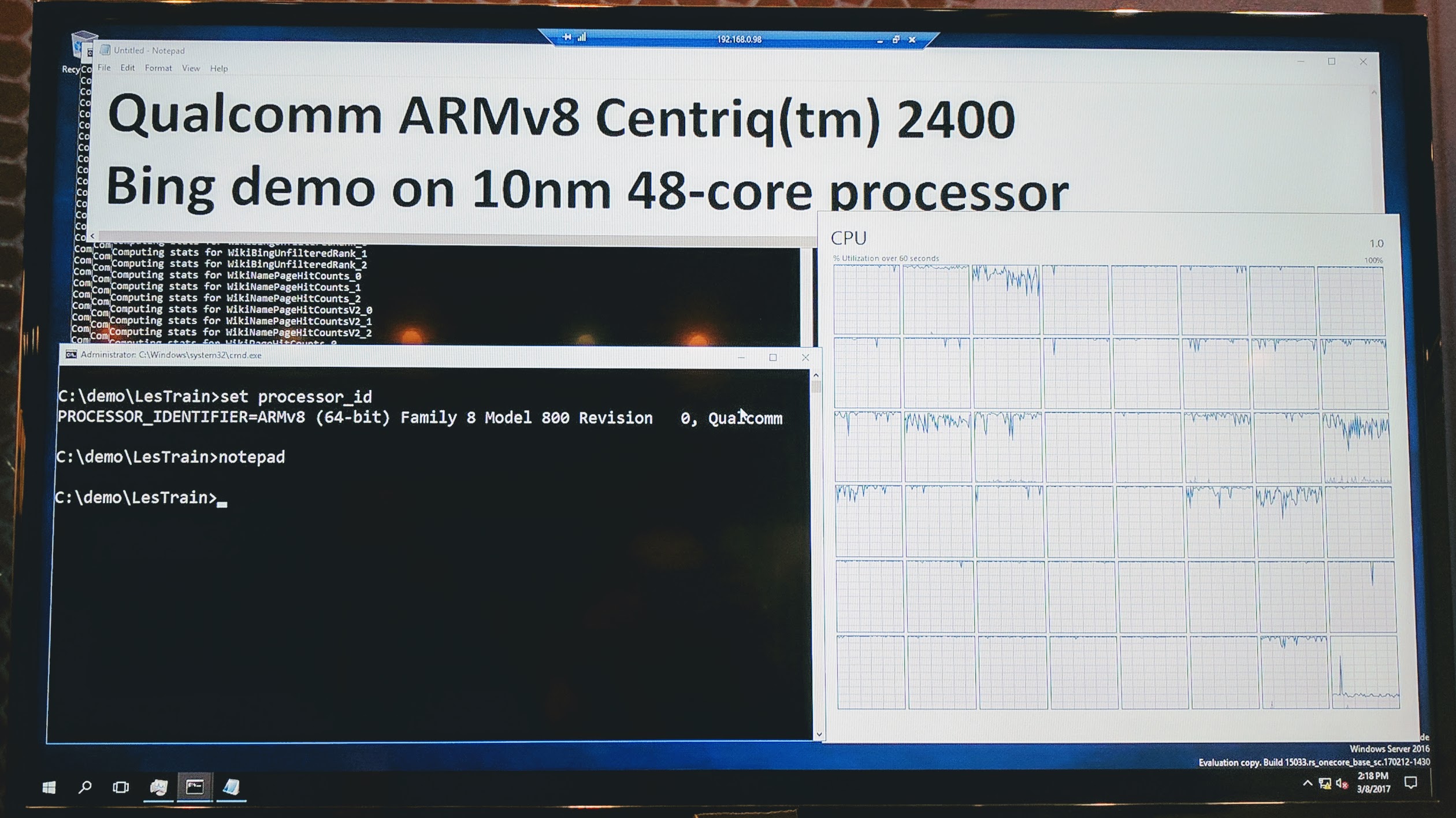

A key question is going to be along the lines of whether this is going to be a sustainable business for Qualcomm. We think Qualcomm has made strides to allay this fear. For example, Qualcomm had Microsoft, months before the official launch, showing off its use of the Centriq 2400 chip.

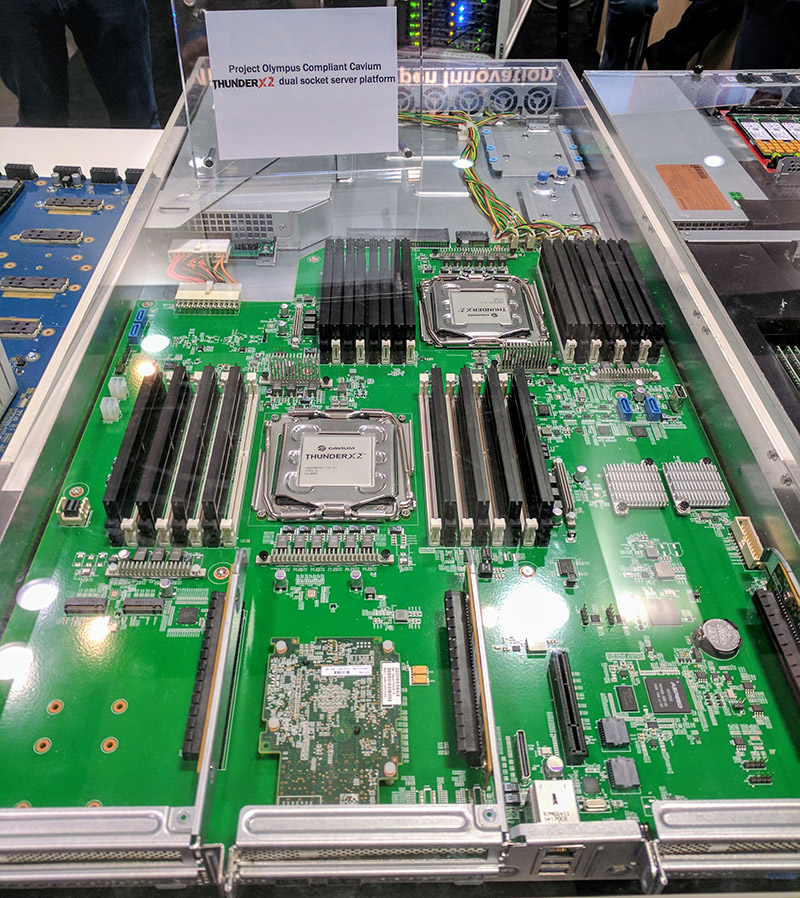

Beyond this, news this week of the unsolicited bid by Broadcom for Qualcomm is going to give people pause. Broadcom essentially shuttered its Vulcan ARM server chip product line which has become the Cavium ThunderX2. One will question whether Broadcom will continue with the server project or whether the company will look into selling this. Furthermore, one needs to question whether Broadcom has any non-compete agreement with Cavium after the Vulcan IP and engineering team transactions.

Finally, there is a question as to whether the market will see the “why” in this. The market is littered with failed ARM server vendors, so there is a precedent for ARM server chips simply not getting adoption to ramp fast enough. Once it is adopted, can Qualcomm get foundry prices down to be competitive with Intel for hyper-scale customers?

The benefit Qualcomm has is that it is much larger than companies like AMD, AppliedMicro (X-Gene was recently sold to the Carlyle group), and Cavium who have struggled for adoption.

Architectural Challenges

There are two main challenges I have heard from organizations asking about the Qualcomm Centriq 2400. First, is the fact that it is a single socket only design. Second, that it is not x86. Third, there are limited external I/O options.

Single Socket Only Design

The single socket design is great for many types of applications. If companies are looking to minimize data center costs, it is usually less expensive to consolidate two single socket servers into one dual socket server. Not only are there cost savings for items such as the server chassis, PSUs, local drives and motherboards, but external costs are lower as well. There are fewer switch ports needed, fewer per-server licenses to be acquired (for some software), fewer PDU ports and etc. There is a good reason that dual socket server sales dwarf single socket figures. With Qualcomm Centriq 2400 targeting the single socket market, much of the compute market will be off limits especially without being a native x86 ISA.

Single socket servers are popular in some scenarios such as storage. For example, 1U 3.5″ storage servers are often based on low power CPUs, including ARM CPUs from companies like Amazon’s Annapurna Labs. High-density storage enclosures (90-104 bay) are popular these days. One vendor who had released a single socket version of their high-density storage server told us recently that it was “a miss” because “everyone wants dual socket in this form factor.” We see the Qualcomm Centriq 2400 as a potential 1U/ 2U storage server platform.

The Not x86 Server Architecture

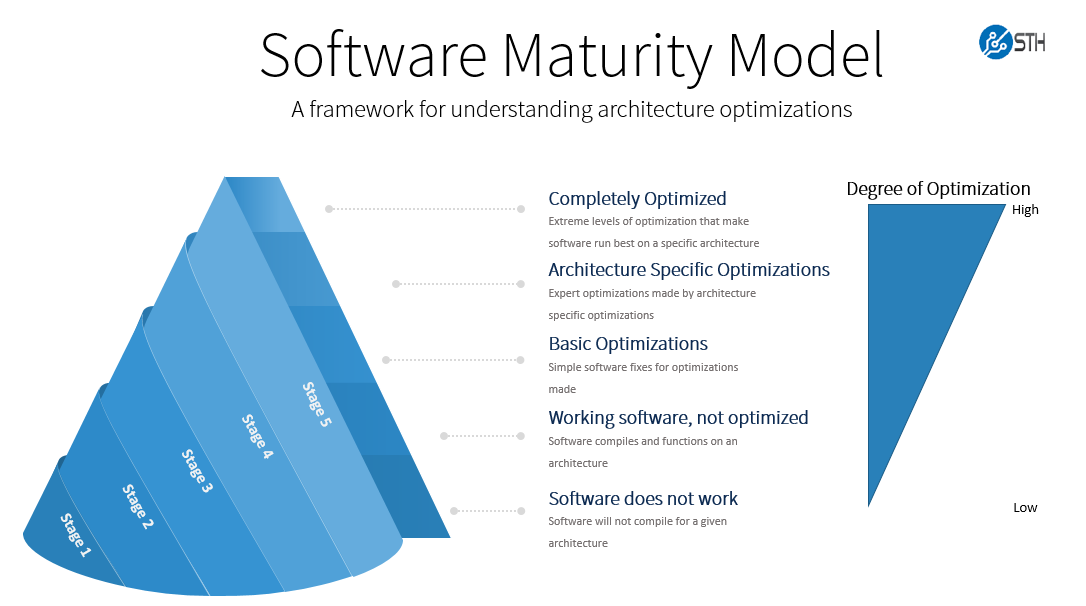

Not being native x86 has some clear advantages that we will cover again during the Qualcomm Centriq 2400 launch. At the same time there are disadvantages. By far, the number one challenge is that existing code needs to be re-compiled to run on ARM. Many of the tools that have been ported to aarch64 do not have the degree of optimization that we see on the Intel side. There are still a few cases where you would be accustomed to using a yum install, apt install or docker run command and aarch64 versions are not available. We covered this extensively in the Cavium ThunderX Benchmarks Part II: Why enterprise ARM developers need these machines piece in 2016 where we introduced our software maturity model:

If the code is not optimized, has to run through emulations, or does not work out of the box, fixing takes time that many organizations simply do not want to spend. Furthermore, items taken for granted on the Intel side, such as being able to do virtual machine live migrations with existing servers do not work when changing architectures.

For big organizations like Microsoft that can come out ahead on a cost/ benefit analysis for putting in engineering resources to gain benefits from Qualcomm Centriq 2400, this is great. Indeed, the company showed off a partially working internal Windows Server port at the Open Compute Summit 2017. For smaller organizations, it is easier to save the engineering resources.

Expansion Options

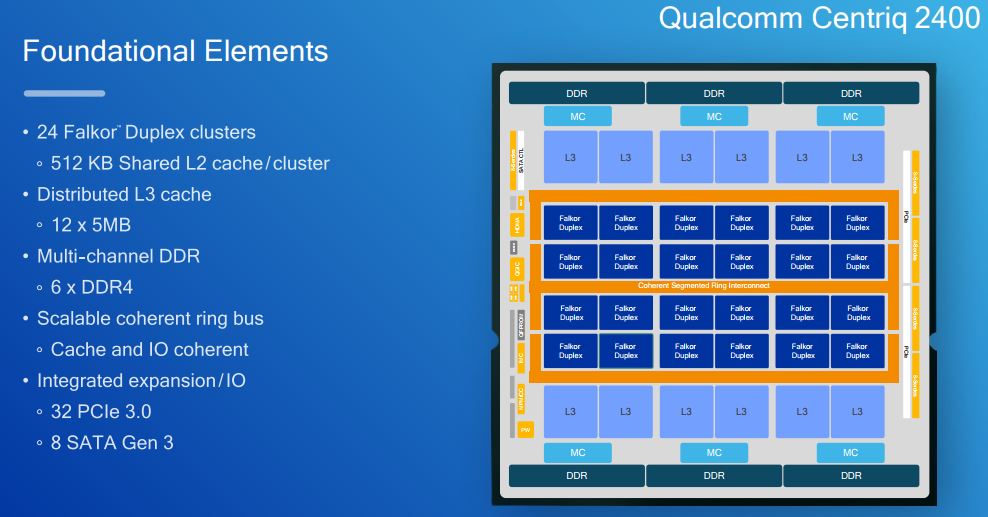

One area we did want to point out is the expansion for the Qualcomm Centriq 2400. The external I/O consists of 8x SATA III 6.0 gbps ports and 32x PCIe 3.0 lanes.

In the market, this is a relatively minimal set of I/O capabilities. The 8x SATA III lanes are “good enough” for low-density 1U or half-width 1U servers, however typical 1U 3.5″ single CPU storage servers we see now have 12 or more hard drives. Further, without high-speed networking, 4-16 PCIe lanes will likely be used to provide basic high-speed networking, even if that is only 10GbE. Adding high-speed networking is risky to add as many hyper-scale customers, the target of the Qualcomm release, will want to use their own. Likewise, major server OEMs (for example Dell EMC) use their own high-speed NICs instead of Intel PCH 10GbE.

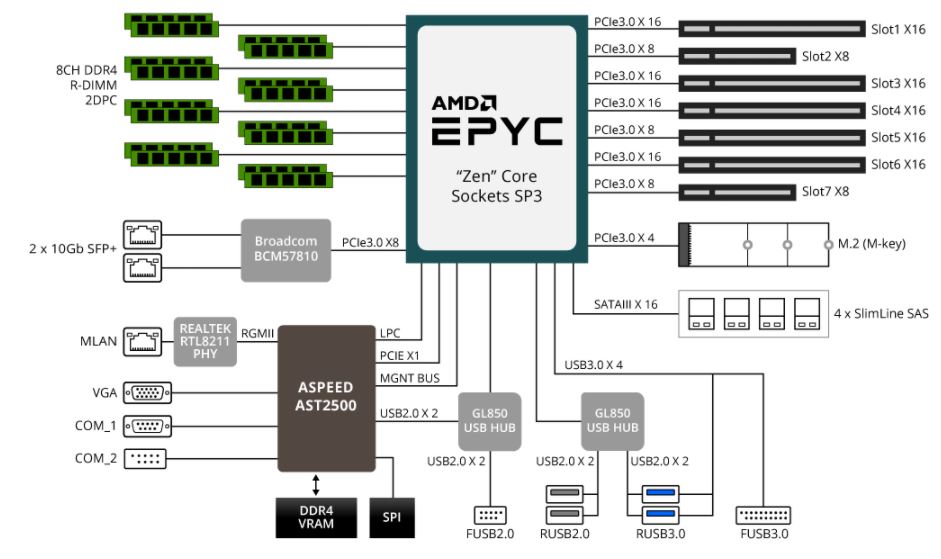

If you compare this expansion picture to an Intel Xeon Silver 4108 platform, a pattern emerges. While the Intel Xeon Silver will likely have less compute onboard (unnecessary for storage), the low-end Xeon Silver platform will have more SATA III (14 v. 8), more PCIe 3.0 (48 v. 32), and potentially 10GbE. This is where the Intel PCH design helps. Intel will have a better expansion story and AMD EPYC’s single socket I/O capabilities blow Intel’s out of the water.

With limited I/O capabilities, Qualcomm will need to focus on low power, high compute density applications.

AMD Competition

There is an entire server market that I like to call “ABI” or “Anything But Intel”. Intel is so dominant that there needs to be competition. In this market, IBM POWER9 is unlikely to be that competition. When the Cavium ThunderX (1) and the X-Gene were launching, AMD was in sleep mode trying their own ARM design with the AMD Opteron A1100. From what we initially heard, the current AMD EPYC platform was supposed to also house an ARM based CPU variant in the same socket. AMD shuttered the ARM CPU project and did a frankly awesome job delivering EPYC.

AMD does not have the size of Qualcomm but it has something else: relationships. At the AMD EPYC launch, we saw a huge number of OEMs support the new x86 chip. Furthermore, companies like Dell EMC, HPE, and Supermicro have AMD lines that they can revive with the new EPYC chips.

AMD EPYC is a killer for a few reasons. First, is instruction set capability. If you are not a hyper-scale shop and do not want to invest resources in porting to ARM, you can add AMD EPYC. Your Docker containers that ran on Intel will run (sometimes better) untouched on AMD EPYC. That is a huge benefit and one that pays off in the ABI space. Not only can the largest hyper-scale shops use AMD EPYC as a bargaining chip with Intel, but other companies can as well, even software companies spec’ing appliances.

Aside from the instruction set, and drop-in ease of use (in most cases), AMD EPYC has another ace up its sleeve: I/O. AMD in a single socket platform can have 33% more memory modules than Qualcomm Centriq 2400. AMD has 128 PCIe lanes to Qualcomm’s 32 + 8 SATA ports. There is an enormous set of servers that run at sub 5-10% CPU load and simply need I/O capacity and RAM. AMD has this.

Beyond the AMD EPYC 7000 series, the company has an extremely easy path forward to get lower power and competitive. They can use a single die EPYC part to compete against a 32 PCIe lane solution (e.g. the EPYC version of Ryzen) or a dual die EPYC part, (e.g. the EPYC version of Threadripper) to compete with a 64 lane solution. AMD has a lot of options to scale the EPYC platform.

Whereas 36 months ago, AMD was not strong competition for Intel, AMD is there now. The AMD EPYC 7000 series is very good and it is essentially a drop-in replacement for Intel. People are taking note. Furthermore, AMD is shipping EPYC versus Qualcomm who is starting as a new entry in the market. We expect Qualcomm to have better power figures, but again, it is a smaller platform.

Cavium Competition

Cavium has a few interesting options. First, when we reviewed ThunderX (1) servers and when we were first briefed on the ThunderX2 family, Cavium was touting integration with its networking IP to provide high bandwidth networking built-in. Now Cavium has a HPC chip on its hands with ThunderX2. Cavium has chips that scale to two sockets and that can address more DIMMs than Qualcomm Centriq 2400 can. Cavium is competitive in the dual socket market.

One area that we saw Cavium not deliver on with ThunderX (1) was power consumption. While the chip had many cores, it did not have a focus on power consumption that we see in the Intel Xeon and Qualcomm Centriq 2400.

At the same time, Cavium is a much smaller and less well-known company. It does not have the broad relationships that Qualcomm has. As a result, Qualcomm can potentially invest its way past Cavium in the market.

Final Words

This analysis was done before the official Qualcomm Centriq 2400 launch, so we expect Qualcomm to have answers. The one curveball may be a potential non-compete with the Broadcom acquisition. That can take many quarters to close as the US, EU and Chinese anti-trust officials weigh in. If the server project looks to be jettisoned, that is the answer that we may not get at the Qualcomm Centriq 2400 launch.

We will, undoubtedly, get more information as the actual launch process happens for the Qualcomm Centriq 2400 line. What we hope you gained from this perspective is a sense regarding some of the headwinds Qualcomm is launching into. Organizations tend to innovate more on the software side than with hardware so as many companies have found, this is a tough market to break into. STH will be covering the Qualcomm Centriq 2400 launch so stay tuned for more information as that happens.