When NVIDIA announced its acquisition of Mellanox, and then when the more recent Arm acquisition was announced, I remained adamant that AMD needed to purchase Xilinx as a next step. That finally happened, albeit much later than I had expected. As a $35B deal, this is a large transaction, and the question some are asking is simply “why?” I wanted to share my perspective on why this makes sense.

Xilinx has a Complementary Portfolio that AMD Needs

My reasoning that AMD needed to buy Xilinx went well beyond a simple explanation such as “Intel has FPGAs, AMD does not.” The fact is that Xilinx has some leading-edge IP that it is already integrating into products that AMD does not have. Further, the Xilinx portfolio has breadth in key segments that AMD does not have. In this section, I wanted to focus on a few examples.

Xilinx IP Portfolio Leverage

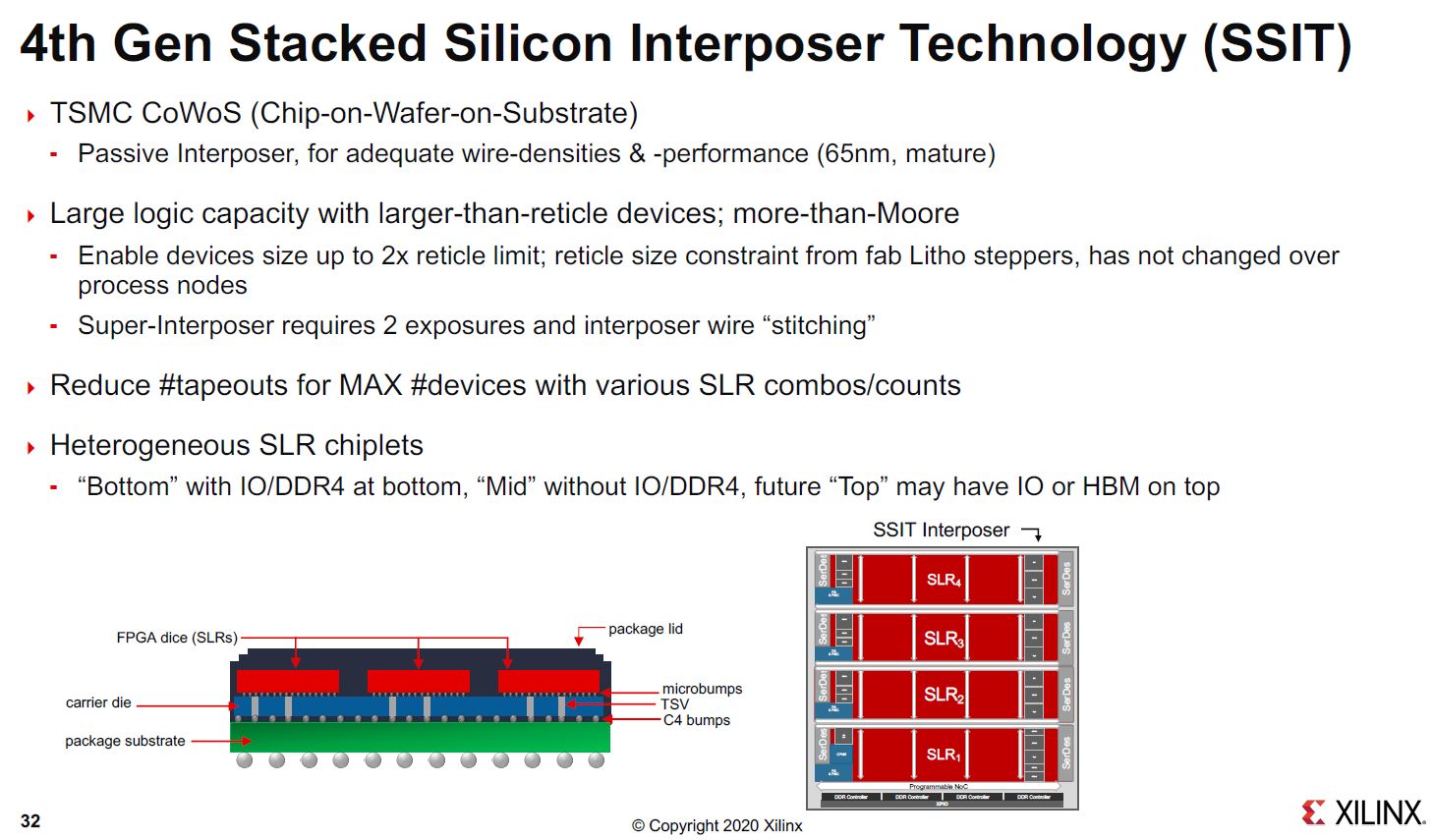

Xilinx makes very high-value FPGAs. Making a modern FPGAs is not just about having an array of logic gates. Instead, these days Xilinx has hardened IP blocks, SerDes, and the ability to bring multiple IP tiles together for customized market and customer solutions. While AMD has fairly basic, albeit revolutionary in the application, integration with its Ryzen and EPYC CPUs, and more advanced packaging for its GPUs, Xilinx’s business dictates that it is great at integration. Technologies such as Intel’s EMIB are often first displayed on the FGPA side and then brought to other segments. To compete, Xilinx has some great technology here that it is already shipping.

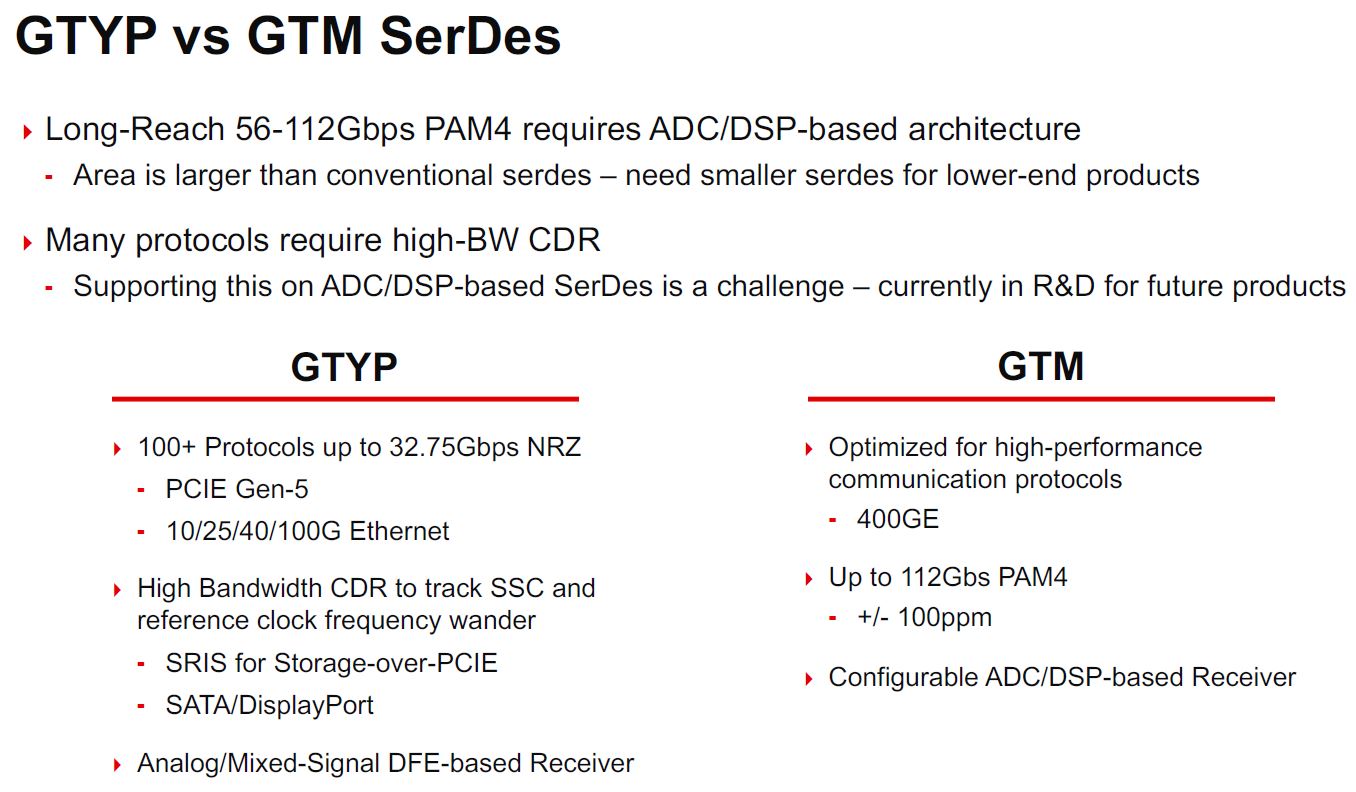

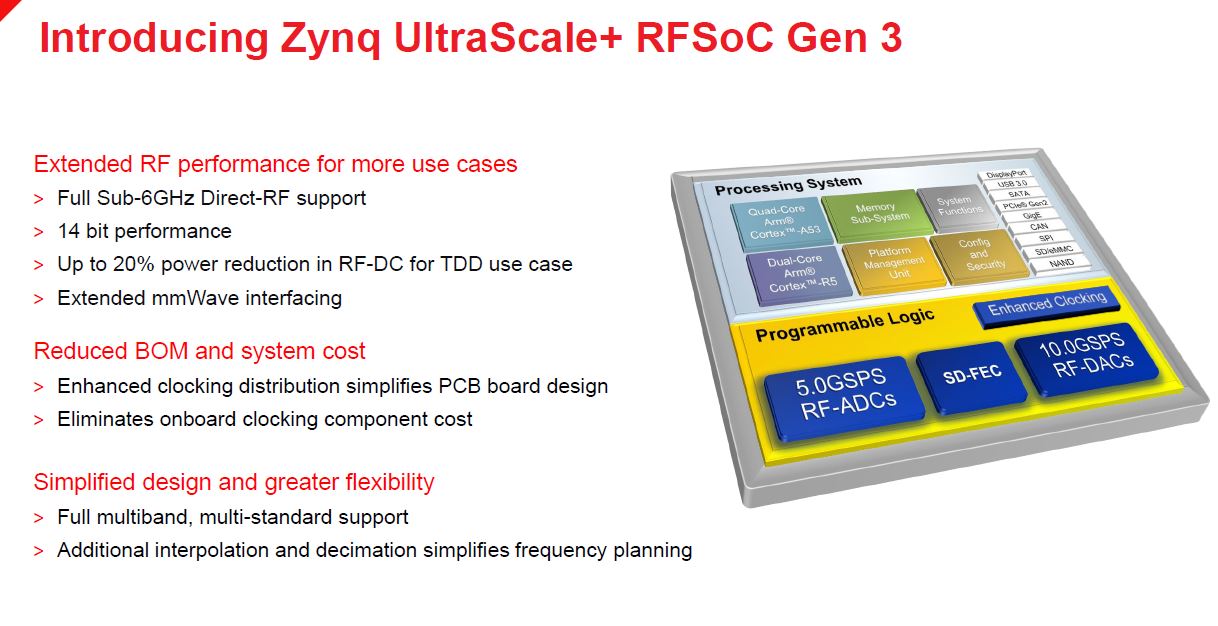

Part of this is going to be SerDes. Xilinx has hardened IP blocks for various accelerators, but also SerDes. Getting data in and out of modern processors is becoming a greater challenge. While Intel has seen challenges on the SerDes and transceiver front, Xilinx has been executing on delivering huge I/O.

In a world of heterogeneous die integration, adding Xilinx I/O, DSP, and other IP blocks is something AMD will need to compete against Intel and others in the industry.

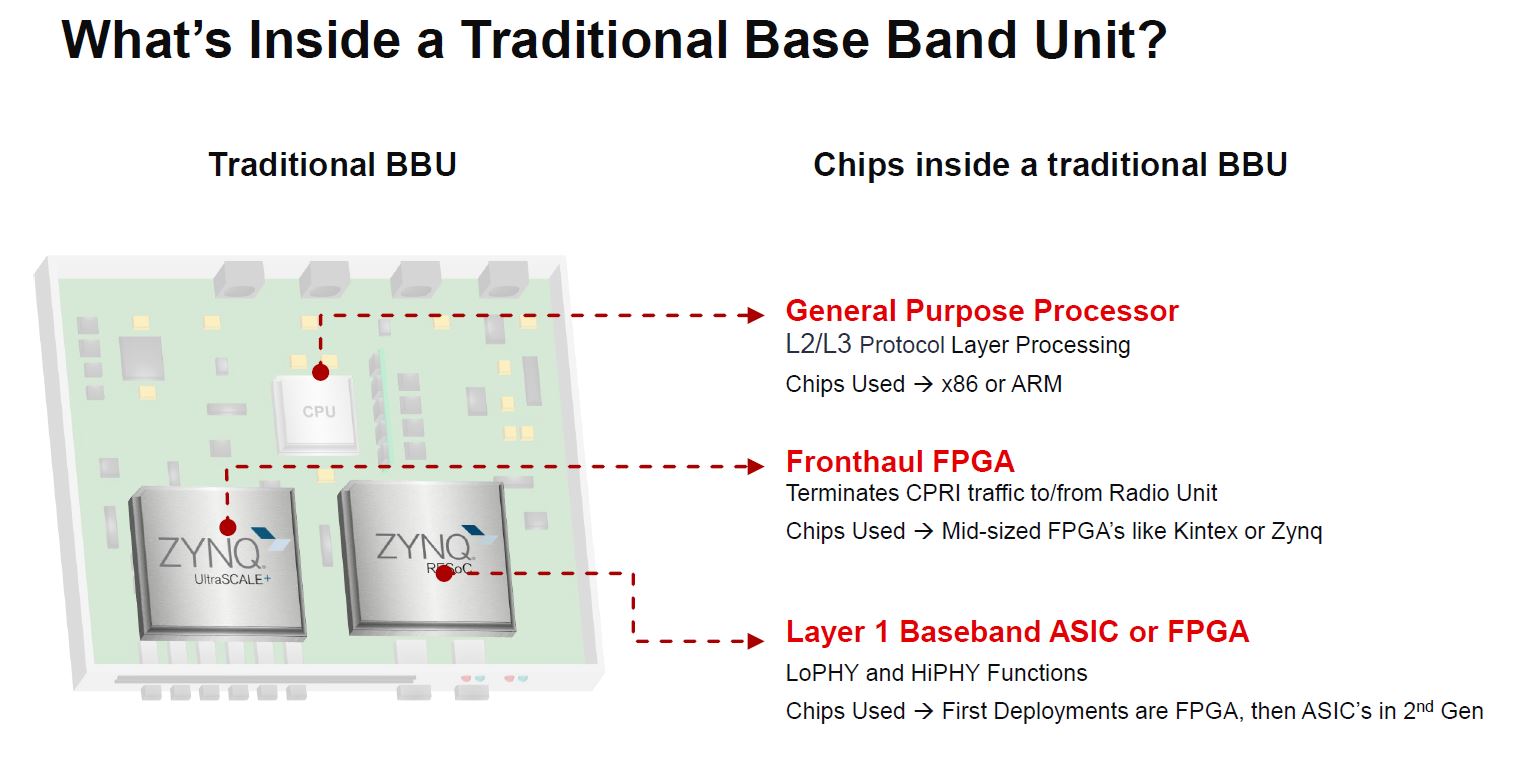

AMD Adds a 5G Edge Story and Markets

While AMD has grown its PC and notebook business by a huge amount, and now is looking at double-digit data center EPYC sales (that we commonly cover), AMD has not had a great edge story. We have been covering the edge computing space for almost a decade. We covered the AMD EPYC Embedded 3000 Series Launch and have lots of AMD EPYC 3000 Coverage where we have reviewed a number of processors and platforms in the space. AMD also has the AMD Ryzen Embedded R1000 and V1000 series for different markets. Intel has a strong 5G story but AMD has been relatively quiet. Conversely, Xilinx has been very aggressive in the 5G market. To see the opportunity, let us look at a traditional baseband unit that we covered in our Xilinx T1 FPGA for ORAN Baseband Unit piece.

Here we can see three main chips that make up a baseband unit solution. Xilinx has been focused on the Fronthaul FPGA and the Layer 1 baseband chips. Since the Layer 1 side is often displaced by ASICs as designs mature, Xilinx has been adding hardened IP blocks for this Layer 1 chip “socket” to hold onto this socket beyond initial deployments. The Fronthaul socket often stays a FPGA over time and is less prone to moving to ASICs just due to the diversity of connections required. Where Xilinx basically did not play is in the CPU space. With the acquisition, AMD will be able to address all three chips and bundle. Where Xilinx previously did not have the portfolio to address all three AMD-Xilinx will and that has big implications for integrating traditional CPUs, FPGAs, and hardened IP blocks with high-end I/O in the future.

Using this as a model that can be expanded to other sectors such as automotive, aerospace, and defense, AMD simply does not have the same level of relationships for these high-margin embedded markets that Xilinx has. Intel, conversely, has a broader portfolio that it can bring to the table and has relationships in most of these segments. As a result, there is an opportunity for Xilinx to pull AMD embedded products into higher-margin markets, accounts, and deals.

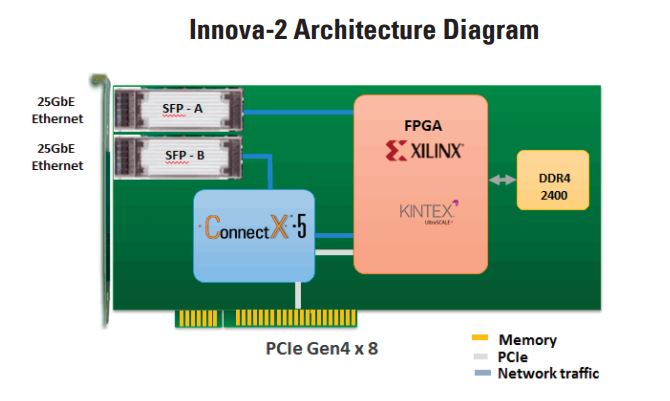

Another great example of product portfolio synergies is in the SmartNIC space. We saw that Xilinx acquired SolarFlare for SmartNIC capabilities because it is a growing space with the DPU (Data Processing Unit) being the next step up. AMD has networking IP, but if we are being frank, it does not have the leading networking IP. For example, AMD tried to offer 10GbE with Zen1 as the market was transitioning to 25GbE. The Zen integrated 10GbE MACs lacked some of the NIC features that may make them useful in fields such as virtualization servers, so we do not see Naples designs with these 10GbE ports enabled on the server-side and on the embedded side sometimes the EPYC 3000 designs do not utilize these onboard NICs. Xilinx was the basis for many SmartNICs including the Mellanox Innova-2 with 25GbE and Xilinx FPGA.

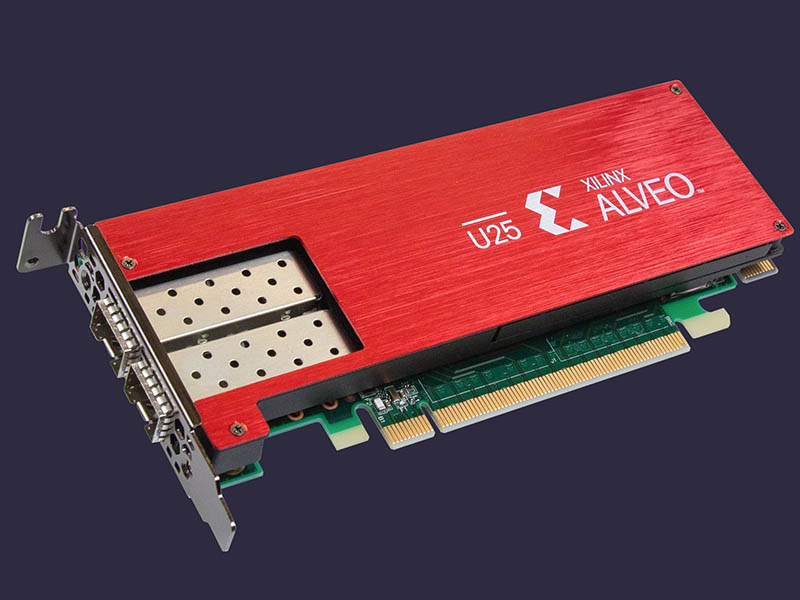

Since then, NVIDIA has acquired Mellanox and is pushing BlueField-2. Xilinx acquired SolarFlare which effectively had products to compete in this space.

By purchasing Xilinx, AMD now has a SmartNIC story which is one that translates into a number of different markets even beyond the traditional data center. SolarFlare has some awesome software IP for networking as well which we cannot overlook on the driver side of high-speed networking. AMD’s alternative was to buy a smaller company like Chelsio or something with a larger portfolio such as Marvell, but Xilinx provides a story and a bigger impact to revenue. AMD now has a data center networking story.

Overall, we just showed some examples here, but the nice part about having complementary product portfolios instead of competing ones is that there are a lot of opportunities to open markets.

The FPGA Czar Sub-Plot

I wanted to take a moment and pause on what AMD will have in terms of the people aspect. Dan McNamara was previously the head of the Intel-Altera business. We had an interview with Dan when he was still in that role. He is now at AMD leading EPYC.

With Xilinx, AMD also is adding Victor Peng and the Xilinx team. When it comes to large FPGA customers, AMD has folks that had the ultimate responsibility for selling FPGAs from either Altera or Xilinx legacy businesses. The industry is still a relationship industry and AMD will have FPGA relationships. AMD and Xilinx have been working together for years, however, this adds a fun wrinkle to the mix.

Financial Reasoning

We do not cover the financial aspects of these companies, however, financially, this makes sense. Xilinx has much higher margins. By the time synergies are realized with the combined companies, the margin profile gets even better. AMD cannot do an acquisition style such as Seagate-Maxtor and instead will need to continue to invest in R&D. Beyond the product and IP portfolio financially the combined company can look great if these synergies move margins up a few percentage points. Even if the companies cannot cross-sell, one can argue that the deal will add shareholder value to make financial sense. AMD does not need to make $35B to make the acquisition worthwhile, they need to drive the business’ valuation by more than $35B. Those are two different discussions as the market diverged more greatly from traditional valuations.

Final Words

While some may balk at the price tag, AMD needs to get an expanded embedded/ edge market story where there are longer product lifecycles and higher margins. Purchasing Xilinx does that for the company. As someone who covers both AMD and Xilinx products, and who in a former role did M&A consulting, this deal makes a lot of sense.

The big question is if I drive down 237 to Marvell’s campus today whether they have a big “Open house” or “For sale” or “Buying semis” sign off the freeway. Marvell has some great technology and has a NIC, switch, 5G, Arm processor, and more in their business. Marvell is increasingly looking like it needs to find a partner to compete in an industry with giants such as Broadcom, Intel, AMD-Xilinx, and NVIDIA-Arm.

A quick congratulations are in order for Victor and the Xilinx team. They are very smart people who have built a great business.

Bonus Video

Given the Marvell-Inphi deal was announced just after this one, we have a short video on the two deals. You can find that here:

Since this is a long one, we suggest just opening on YouTube and listening since it is more of a discussion versus looking at hardware.

A video clip on this issue on YT would be highly anticipated and will probably have lots of views!

Hetz – Perhaps. A bit busy today since we have something cooler that is going live in a few minutes including a video.

PK – great work as always. Your commentary and analysis of complex STH issues makes things easier for other tech enthusiasts to follow, and the layman to understand. Thanks for all your efforts.

“Marvell is increasingly looking like it needs to find a partner to compete in an industry with giants such as Broadcom, Intel, AMD-Xilinx, and NVIDIA-Arm.”

That’s is exactly what I was thinking some time ago, it’s an even more pressing issue these days. I expect the shareholders will vote the deal through, it makes a lot of sense. FYI I own shares in AMD and MRVL.

“Marvell Nears Deal to Acquire Inphi for $10 Billion”

I’m not sure if I can post links in here, so you’ll have to search for articles on the news.

I hope STH will do a write up.