In this week’s technology mega-deal, SK hynix is making a big move in the NAND storage business. In a deal valued at $9 billion, SK hynix is purchasing the NAND business, IP, and R&D resources, and a Dalian NAND manufacturing facility in China. This marks a major consolidation play in the NAND space.

SK hynix Acquiring the Intel NAND Storage Business

At STH, we have traditionally used Intel SSDs. Specifically, we use Intel DC S3700/ S3710 SSDs as our go-to 2.5″ SATA boot options in our server reviews. Over the past few quarters, we have heard partners describe Intel’s NAND supply as challenging. At first, these partners complained of an undersupply due to manufacturing. As the drive shortage eased, Intel saw increased demand leading to $2.8B of revenue for the company in just the first six months of 2020 ending June 27, 2020.

Prior to the $600M of operating income during this period, this was far from Intel’s most profitable business. The NAND business in many ways is more similar to the DRAM business than the traditional processor business. As a result, the industry would go into quarters of oversupply and undersupply that would swing pricing.

In the DRAM industry, the answer is consolidation. In servers we review, there are effectively three vendors who supply the majority of the DIMMs. These are Micron, Samsung, and SK hynix. For NAND suppliers, there are more. Both technologies are focused primarily on driving manufacturing to deliver more capacity per dollar in terms of innovation. The market generally prices NAND and DRAM on a cost per capacity basis. Standards generally dictate some level of interoperability with the rest of the ecosystem. As a result, supplier consolidation helps moderate spikes in supply which leads to lower commodity pricing.

Intel’s NAND SSDs, for years have been a gold standard in the industry. That is why STH has been using their data center SSDs for many years. We do see some SK hynix drives in systems STH reviews. We have reviewed many systems with the company’s M.2 22110 form factor NVMe SSDs.

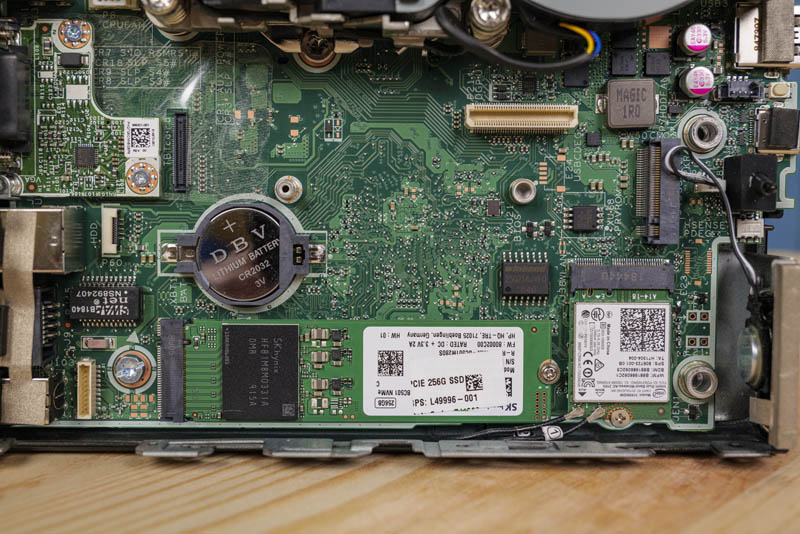

We also reviewed the SK Hynix Gold P31 1TB NVMe recently, but the company’s model is different than Intel’s. While Intel has a robust channel network, SK hynix is focused primarily on selling to larger hyper-scalers and OEMs/ ODMs. A great result is that SK hynix is not a traditional consumer SSD brand like Intel, but we saw a DRAM-less SK hynix NVMe SSD in our recent HP EliteDesk 800 G4 Mini Guide and Review. It will be interesting to see how SK hynix adopts a different sales and marketing channel versus how Intel has run its business.

For Intel and its customers and partners, this is a huge deal. Intel is retaining its Optane memory business, but the loss of the NAND SSD business is a big one. Intel has been discussing its data center (and broader) portfolios. In servers, NVMe SSDs often outnumber and make up more of the aggregate server price tag than CPUs, accelerators, and NICs combined. Here is a great example of the upcoming EDSFF standard and Intel 15TB NVMe ruler SSDs.

Intel brand SSDs are sold by every major OEM such as HPE, Dell EMC, Inspur, Lenovo, Supermicro, and others. Many of these OEMs also have relationships with SK hynix for SSDs and DRAM, but for many Intel is a large supplier that also has less commoditized technologies.

For Intel itself, getting $9B will help offset the 10nm challenges that the company has faced in other parts of its portfolio. Between having to do a different type of silicon manufacturing and operating in a more commoditized business than it typically does, it may have been an attractive piece to sell for Intel.

Final Words

This is certainly a big shift. It was announced late in the evening for the US and very early morning for much of Europe given it was set to a news cycle in Asia. We expect many channel partners to wake up to the news and rush to figure out the impacts to their business. Luckily, DRAM is also a major component cost in servers so most partners have a relationship with SK hynix as well.

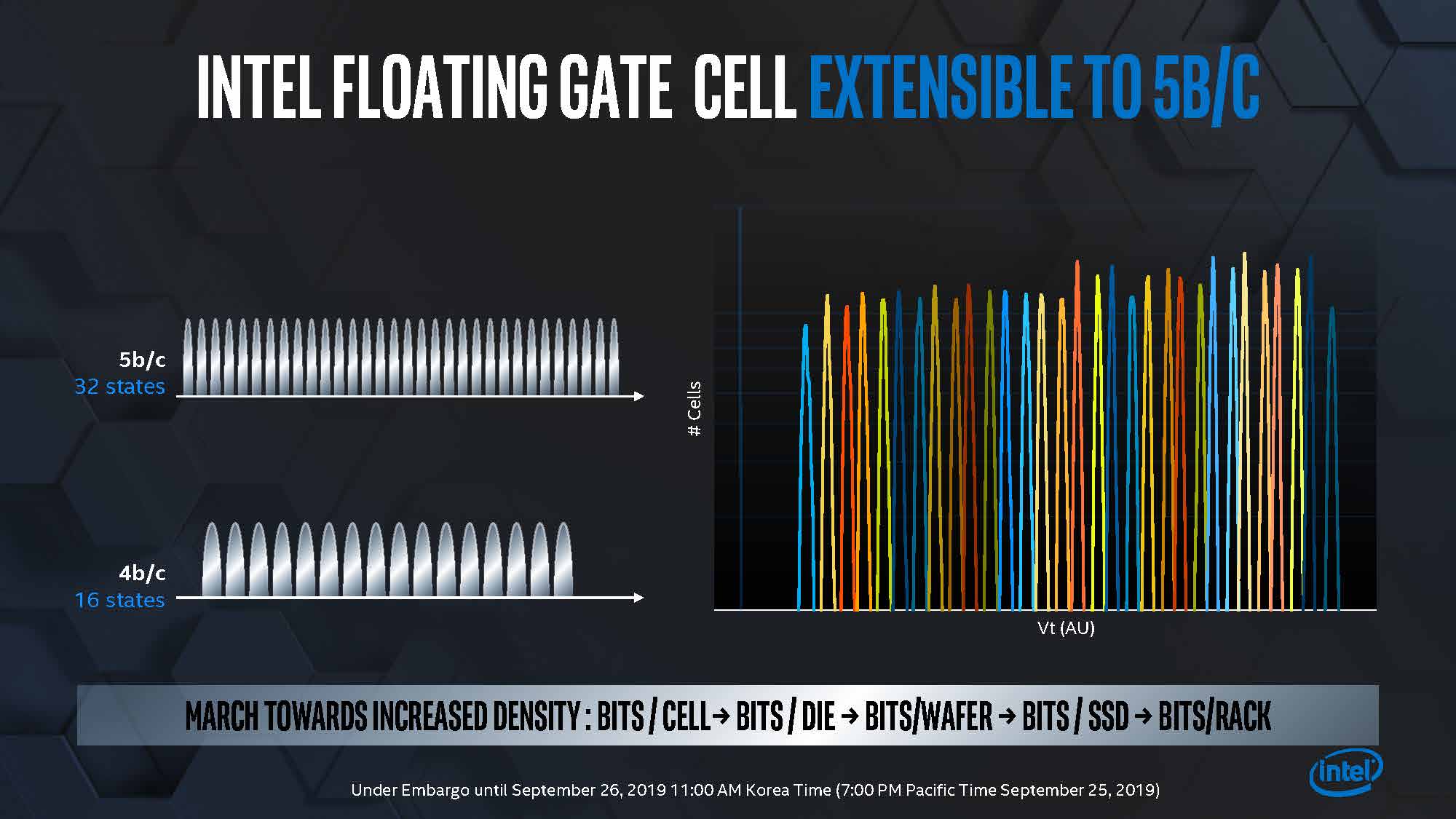

One must wonder whether there was a second reason that the Intel Memory and Storage Day 2019 that STH attended last year was held in Seoul, South Korea.

Source SK hynix.

Such sad news. I have always preferred Intel consumer SSD products over all others, mainly due to the 5 year warranty and their “it just seems to work” SSD firmware management tool. It was my “go to brand” for many years when I had to consider SSD purchases. Sadly, no more.

Lately I have been dabbling in consumer SSD products from Crucial, specifically the MX series. I have tried the BX series SSD products, but I was not impressed. The MX series products, IMHO, are comparable in quality to the Intel consumer SSDs that I used to buy.

Now, if only Crucial would “put a bullet” in their horrid Java-sickened SSD firmware management software that refuses to run on any PC that has any semblance of solid & performant security software on it. Crucial’s software insists on running a server inside your computer so you can access their software. ICK!

Intel has always used NAND as their Weapon for CPU sales. Giving away SSD for free with volume.

Interesting to see how this will turn out.

Thank you STH, one of the rare few ( if not the only two along with Anandtech ) site on the internet that actually give business case perspective.

Actually it’s a good move. They simply realized that those tlc/qlc’s was a wrong turn and decided to keep the only true performance storage – Optane. To retain association that Intel = Good and leave the rest for chineese.

Does this include their Optane business?

That would be very interesting considering how much Intel has tried to market Optane as necessary outside of certain server use cases.

Emile, “Intel is retaining its Optane memory business, but the loss of the NAND SSD business is a big one.” so I think Intel is just selling NAND not Optane per this article.

Tomas, not sure how i missed that, gonna go book in at opticians!

I would have been very surprised if they had sold off optane because it can be pretty lucrative and until they push into the next generation of CPUs is literally only one of two reasons to utilise Intel.

I have been a fan of the Intel SSDs for years. Not the cheapest, not the fastest by “headline” numbers, but strong in the P95-99% department which is what you buy an SSD for.

SK Hynix reminds me of Taiyo Yuden which for a long time had the only factory in the world that could make consistently good DVD-R blanks; you might buy Memorex or HP, but the discs were good or bad depending on if they came from the factory.

Is this move an indication from Intel that they think NAND has a limited future thanks to potential replacements like Optane/3D Xpoint? Does this mean Intel or Micron is ready to bring the cost of xpoint drives down, cutting deep into NAND’s market share?

We stuck with Intel because Intel enterprise SSDs had their NAND/Controller. We have been on board pretty much from day one.

While there have been a few firmware related glitches over the years, we have had great success with them.

Recently, we’ve been working with Micron’s products as well as Samsung in our labs to see how they stand up. So far, so good.

Now, the question is, do we have the confidence to pick one over the other to replace Intel’s products at this time? No. We don’t.