NVIDIA may have been known as a gaming company before, but it is certainly far from one today. In the company’s Q4 FY24 results it achieved $22.1B in revenue. Of that, a whopping $18.4B came from its data center segment. For some context, gaming was only $2.9B. Pro visualization and automotive make up the balance. These are huge results.

NVIDIA Blows-out Earnings as Over 83 Percent of Revenue From the AI Data Center Boom

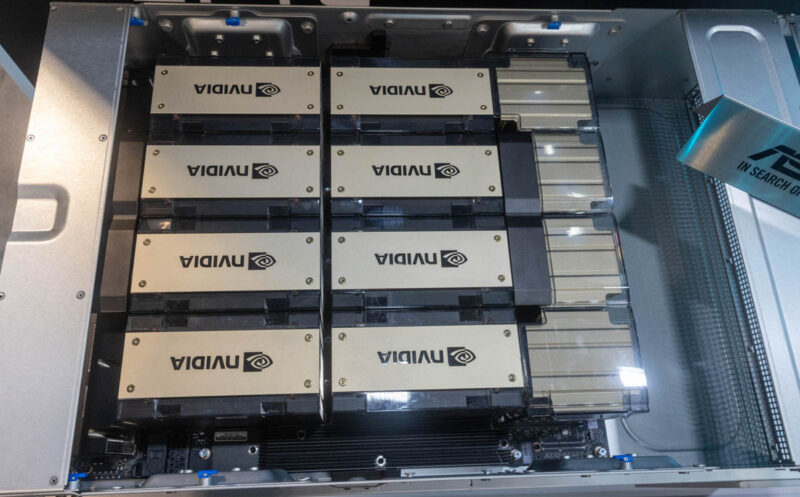

It is no secret in the server industry that the NVIDIA H100 servers are selling extremely well. That is despite large OEMs like Lenovo not even having 8x H100 servers in the US. The demand for the H100 is enormous, and as a result, NVIDIA has had to increase its capability to sell the parts, while simultaneously extracting higher prices than it had in its previous generations.

For some context around how big a $22.1B quarter is, Intel’s 2023 full-year revenue was around $53.2B. AMD’s 2023 revenue was around $22.7B. To say NVIDIA had a massive quarter would be an understatement.

Final Words

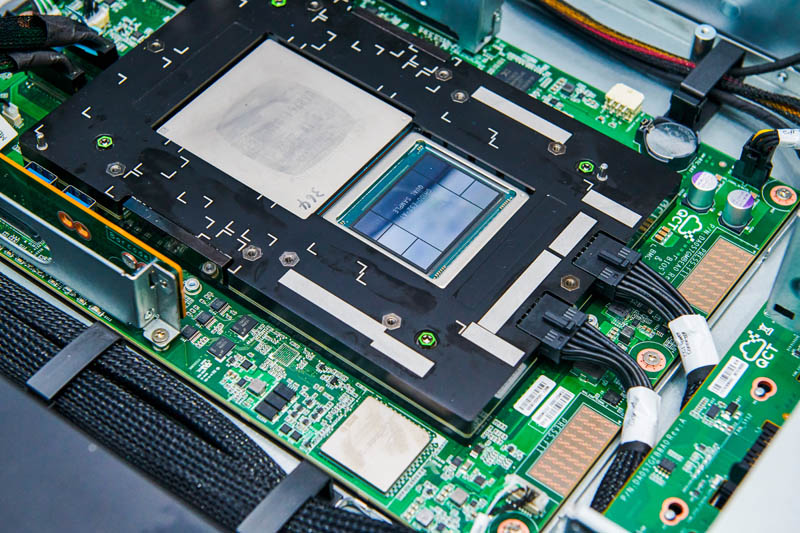

Perhaps the craziest part of the results is what is next. NVIDIA is set to start talking more about not just the H200, an update to the H100 design this year, but also its next-gen B100 design. This is just as NVIDIA’s competitors from AMD with the MI300X, Intel with its Gaudi3, various startups, and its customer/ competitors such as the large cloud players all try to capture parts of the AI training and inference markets.

We also expect NVIDIA to continue pushing its vertical integration for AI systems, pushing with Arm CPUs like its Grace Superchip/ Grace Hopper and its interconnect assets from its Mellanox acquisition to further increase its wallet share in the AI build-out.

Something few were saying a decade ago when it was best known as a gaming GPU company, is that NVIDIA has a decent chance to have the revenues of AMD and Intel combined in the next year.

While some bemoan NVIDIA’s gaming GPUs today, what is clear is that it is driving huge revenue from its data center business, and those revenues are on track to increase even seeing export license challenges on some of its data center products.

So crypto hype cycle jacked them up for a few years, and now the AI hype cycle is doing it. What happens in a year or two if no fundamental breakthroughs in AI happen? Current AI is almost more of a liability. in multiple ways, than benefit.

Without fundamental improvements to how AI functions, this wave won’t last.

Gamers still getting ripped off. NGREEDIA not happy making a fortune from data centers.

GPU prices are horrendous. The figures don’t lie. Gamers are being shafted.

@Andy: Yeah but what can they do? If they don’t put their prices up they’ll end up like Raspberry Pi, with months-long shortages where you can’t buy anything at all, and when you can, some scalper got there first so you end up paying double the price anyway, just the profit goes to someone unscrupulous instead.

The only thing they can do is increase production but, again like Raspberry Pi, if you’re already running at max output it’s not really an option.

@Malvineous: So you’re saying that Nvidia should be unscrupulous so that nobody else will be unscrupulous?

@Troy Frank nVidia has been able to ride from bubble to bubble exceptionally well. Growth in AI will inevitably slow down due to market saturation and maturity, it isn’t going to go away. I do think nVidia needs to plan for the next-big-thing in the market.

The other thing with data center is that nVidia has also absorbed Mellanox among several other companies to round out their portfolio for the market. In short, while AI is driving the data center side, it isn’t the only thing that they’re offering in that segment now.

In the mean time, gaming has been their traditional fall back option if their various gambles didn’t pay off. Even now, with gaming becoming an increasingly smaller set of revenue they should continue to make investments there as they know that they are riding a bubble. Traditionally their gaming, workstation and data center products were all coming from the same designs but that has changed over recent years with the A100 and H100 chips never having a consumer counter part (even Volta had the Titan V). As nVidia’s data center products shift toward a chiplet style design, I’m hoping that various chiplets will be recycled for usage on their high end consumer chips. Bad yields have to go some where.

@All the above. Look at it a different way: nVidia saw 16 years ago that GPGPU would be huge and alone among the vendors it went forth and created a turnkey SDK for that purpose. You could say that CUDA enabled all these ‘bubbles’. That’s not nVidia being opportunistic that’s nVidia capitalizing in an opportunity. Compare to the perpetual slow kid in the marketing dept AMD: any of you remember it’s series of GPGPU effort? Mostly you had to write +/- GPU ass’y language.

First of all, let’s make it clear: what is being called “AI” is neither artificial nor intelligent, it is simply very dense algorithms running at very dense scale. It’s useful but it’s not “thinking”.

And right now, Nvidia seems to be the only game in town when it comes to selecting hardware for such algorithms. This is an attractive short term play, but the industry has a habit of busting up monopolies.

May the day come soon when this stuff is fully commoditized. And the hype needs to wear down.