NVIDIA and Arm have had a long courtship. We first covered the deal in September of 2020 in NVIDIA to Acquire Arm in Major Shift. After well over a year of not getting regulatory approval, the deal is now officially off.

NVIDIA – Arm Merger Canned and a New Path Forward

This is one of those deals that there were certainly two camps on. Many said there would be no way it would go through. Personally, I thought that given a different administration and political atmosphere the deal would have gone through. When I took antitrust in law school, this deal would have gone through. Ultimately what doomed the deal was the political pressure from various governments.

The path forward for Arm is interesting. Rene Haas is the new CEO of Arm following the failed acquisition. Since Arm is currently owned by SoftBank in Japan, the next step will be to IPO the company to provide an exit for SoftBank. SoftBank will reap a huge windfall and a large part of that is because the markets, in general, have pushed valuations much higher over the past few years. Before going IPO, Arm may need to address its China operation especially since China is such a large market for Arm.

For NVIDIA, it can still license Arm, but it is now a chip provider without a CPU architecture. Its rivals Intel and AMD have x86 and have Arm licenses. Apple uses its Arm cores with its GPU IP pushing NVIDIA out of that ecosystem. RISC-V is set as a potential disruptor in some markets to Arm’s dominance, but Intel just joined RISC-V International and is aggressively focused on that ecosystem building its foundry business. To be clear, NVIDIA does not need a CPU architecture, and it has become an extremely valuable company without one.

Final Words

The bigger question is what happens next. With the UK pushing against the acquisition of the Japanese-owned Arm that will become something that the US may very well use for the next UK company acquisition. Likewise, China just gave the go-ahead for AMD-Xilinx, but it never gave approval for this deal.

Going forward, we expect NVIDIA to push hard on extracting software revenue from the AI ecosystem. MLPerf has taught us that NVIDIA has competition, but a virtual monopoly on a large swath of the AI hardware space. The company’s direction lately has been to introduce software support and features for the enterprise to further increase revenue, at a high margin, without having to ship more GPUs. That is NVIDIA’s key growth driver now as that software push is akin to “Wintel” in the late 90’s, except NVIDIA has both the software and the hardware.

China regulators probably wouldn’t have approved it because the former president of ARM-China has gone totally rogue and started his own company while still saying he “owns” ARM in China. ARM Global in the UK has cut him off from acquiring anymore IP, but he is using ARM license revenue in China to fund his little escapade and the CCP seems to be permitting this. This is total IP theft and while ARM Global is trying to ban any fabs producing product without a proper license, this guy seems to be “in” with many of the Chinese sourced products that utilize an embedded ARM technology. As long as there is demand in China for this ARM spinoff, he will continue to exist. But his reach outside China will be cutoff eventually by ARM Global.

Obviously Nvidia had some sort of bigger plan in mind(whether it be allocating ARM’s R&D to their purposes or doing a little squeezing of everyone who has no realistic short to mid term alternative to licensing ARM cores; which is basically everyone) to offer the downright stratospheric amount of money that they were offering; but in terms of Nvidia’s freedom to implement ARM stuff have they actually lost anything by failing to aquire?

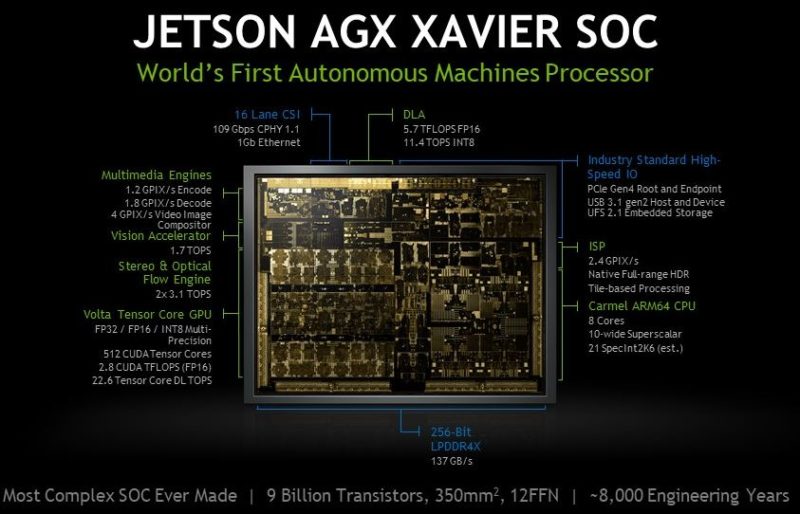

My understanding was that Nvidia has been doing fully custom armv8 implementations from Denver through Carmel, which implies that they have the highest level of flexibility in terms of what they can do with the ISA; and they enjoy the right to license whatever bits of ARM IP that are for sale to anyone on the same terms as the rest of the market.

It seems as though Nvidia has lost any exclusivity-based plays; but that they still enjoy full freedom of action in terms of ARM implementations. Am I missing or misunderstanding a detail?

@fuzzyfuzzyfungus

NVidia valuation is $618 billion. It could allow a $40 billion acquisition in a heart beat.

—

On the long term, for the server market vertical solutions:

INTEL: CPU architecture, check. Networking, check. Compute accelerators, check. Good!

AMD: CPU architecture, check. Networking, check(*). Compute accelerators, check. Good!

(*) Thanks to buying Xilinx who itself owns SolarFlare.

NVIDIA: Networking, check(**). Compute accelerators, check. CPU architecture, mmm…, huh…, boohoo. Bad!

(**) Thanks to Mellanox acquisition.

This means that each time NVIDIA wants to sell a complete solution, it will often have to deal with a triangular relationship: NVIDIA, the customer and INTEL or AMD.

NVIDIA is #1 and several years ahead with CUDA. But if INTEL or AMD catch up, by themselves or with a 3rd party compute accelerators, then NVIDIA is in the manure.

Not good on the long term.

That was the goal of NVIDIA for acquiring ARM, and they had zero honest intention to make efforts in the other areas of the ARM market.

Nvidia: Mining GPUs => check

AMD: Mining GPUs => check

Intel: Mining GPUs => nope