In 2020, we covered that AMD planned to acquire Xilinx continuing consolidation in the industry. It has been a long road, and perhaps the final (major) hurdle has been passed. China has given the go-ahead for the merger, with conditions. Let us discuss at a high level what the next steps will be.

Disclaimer: This is very high-level so it is not provided as legal or investment advice.

AMD Xilinx Merger Gets the Green Light From China

Word came a few hours ago that China has given the go-ahead. Since this is a material approval, AMD filed an 8K with the announcement:

On January 27, 2022, Advanced Micro Devices, Inc. (“AMD”) and Xilinx, Inc. (“Xilinx”) received clearance from the National Anti-Monopoly Policy Bureau of the State Administration for Market Regulation of the People’s Republic of China with respect to the merger (the “Merger”) of Thrones Merger Sub, Inc., a wholly owned subsidiary of AMD (“Merger Sub”), with and into Xilinx, with Xilinx surviving the Merger as a wholly owned subsidiary of AMD, pursuant to, and subject to the terms and conditions set forth in, that certain Agreement and Plan of Merger (the “Merger Agreement”), dated as of October 26, 2020, by and among AMD, Merger Sub and Xilinx. (Source: AMD 8K)

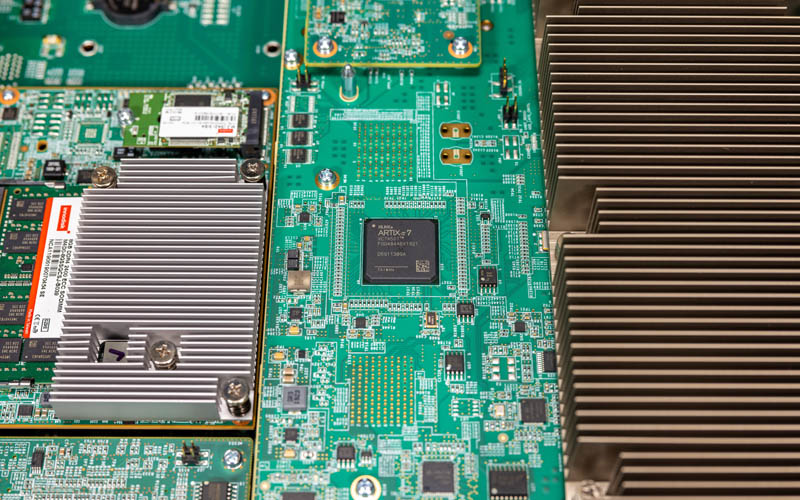

The approval from Chinese regulators came with some conditions around keeping the Xilinx products competitive and available. For some context, Xilinx historically had sold a lot of FPGAs in China so there has been a lot of investment there in building atop Xilinx platforms.

There is still a catch though, and it is actually a US regulation. The US Hart-Scott-Rodino Antitrust Improvements Act of 1976 (HSR) requires that parties to mergers and acquisitions notify the US Department of Justice and Federal Trade Commission of a merger. The notification for the AMD-Xilinx merger had an expiry of one year from the original DOJ/ FTC notifications with a new filing on January 10, 2022. Due to the timing of the Chinese conditional approval, the AMD-Xilinx deal missed its window under the original HSR filing and now needs to wait until a cooling-off period expires in a few days on February 9, 2022.

For those who are unfamiliar, in larger transactions, the companies must observe a statutory waiting period if the acquisition does not fit in an exemption provided by the HSR act. For most transactions, the waiting period is 30 days.

A few interesting items here. First, the 30-day requirement can be waved if there are no concerns but under the Biden administration, these waivers have largely stopped. Second, 2022 actually brought new thresholds topping $100M in deal size and $200M in the HSR Act’s size of person test. Third, the HSR filing fee for a large multi-billion dollar deal here is up to $280K.

Unless something drastic happens where the US decides it wants to block the merger changing its previous posture, this deal is now highly likely to close. AMD reaffirmed its guidance of a Q1 2022 close unless something pops up. If the Biden administration decides to, the new 30-day HSR waiting period can be truncated.

Final Words

It will be around a year and a half between when the deal was announced and when it will close. In the meantime, Xilinx’s business has been doing well. Assuming the deal now closes as expected, the next step is perhaps going to be the most exciting. This deal has been around for so long. The big question now is really for post-closing. We are excited to see what AMD planning to do in order to drive product and ecosystem synergies with Xilinx after the deal closes.