After reading numerous news articles about how ARM will destroy Intel in the data center, I thought it was about time to share a counterpoint. The market recently saw Calxeda shutdown operations after investors decided it was not worth the effort. Calxeda was one of the most promising ARM vendors making product announcements at the same time as HP Moonshot. Those partners that we spoke to having seen Calxeda in action in HP’s Moonshot were generally positive. AMD recently announced ARM chips are a step in the right direction but the task at hand is significant: unseat Intel from a dominant market position. In the next week or so we will have a piece spinning this in the other direction, but for now, here is a perspective on how Intel can hold its leadership position at least over the next few years.

Intel got serious about process proliferation

Most ARM vendors have three major fab choices: TSMC, Samsung and Global Foundries. Intel introduced its 22nm process with Ivy Bridge. 22nm has since seen its second generation Haswell desktop/ mobile processor, the Intel Avoton/ Rangeley microserver processors, Bay Trail for mobile, and Ivy Bridge-E and Ivy Bridge-EP. FinFET (Fin field effect transistors) Tri-Gate manufacturing and a smaller process help with economies of scale. Altera managed to ink a deal with Intel to have some of its ARM processors built by Intel, but it is unlikely Intel will turn itself into a fab for products that significantly threaten its market share.

TSMC is perhaps the closest behind Intel process wise and is just hitting 20nm production this quarter, but still using High-k Metal Gate (HKMG) processes. TSMC’s next step at 16nm will be its FinFET while Intel will be shipping mainstream processors in quantity at 14nm this year, and those will be a second generation FinFET design. Samsung also is moving to a 20nm process this year.

Looking from 2014 to 2016 Intel will likely have a process lead if it can deliver 10nm in 2016. The major caution here is that manufacturers are finding it increasingly difficult to shrink their manufacturing technology so a schedule miss narrows the gap for competition.

Bottom line: Intel should have roughly equal or better process technology for the next three years than the majority of ARM vendors. That should give Intel lower power consumption and potentially lower manufacturing costs (assuming processes mature fast enough and dies are made smaller as a result.)

The micro server market has under-performed

Early predictions were that micro servers will reach 10% of the market by 2015. Rumored figures I have heard from some semiconductor industry executives peg 2013 at anywhere from 0.75% to 1.25% of the market in terms of volume not dollars spent. If micro servers are indeed growing much more slowly than anticipated, that makes economics in many ways favor Intel.

As mentioned earlier ARM vendors are generally fab-less which means there is an extra third party step in the supply chain. That step has costs involved. Manufacturing semiconductors has historically been a market that closely follows principles of economies of scale. This is true in other areas of high precision volume manufacturing such as with hard drives. If the target market does not hit growth projections, then the total volumes will be lower and ARM vendors will have difficulty hitting the economies of scale to price competitively against Intel.

This has another implication. If you are a start up company trying to sell in the market, having your total addressable market shrink may make investors thing twice about pouring more money into the enterprise (e.g. Calxeda)

Bottom line: If the microserver market does not grow significantly, ARM vendors may not be able to ship the quantities to offer a significant price advantage over Intel.

Specialized processing

In the early days of the cloud, the mantra was really scale-out homogeneous hardware. Recently this has changed significantly. Amazon, for example has more than just a homogeneous mix of hardware. One can easily add SSD instances, x264 encoding instances, GPU compute instances in the Amazon EC2 cloud. The move towards specialized process has been cited as a potential opportunity for ARM.

There are two major challenges with this approach unless one has a well defined large scale deployment e.g. Google (who has been deploying ARM en masse according to rumors.)

First, if ARM processors adopt proprietary specialized co-processing they may lose the ability to run code across different vendors. For example, if a company releases a design with a proprietary codec, there may be no secondary supplier of chips that can run code optimized for that IP. As a result, a customer choosing that design and optimizing its application around that codec would be locked-into a vendor. One should remember vendors still have the Thailand flooding that hit the hard drive supply chain in mind. As a result, major vendors have internal programs on supply chain resiliency. The ARM buyers do have an eye on this topic.

Second, the more customized processors are, the more SKU proliferation occurs. Intel actually makes very few server SKUs:

- Really Big: E7 Series

- Main server die: E5-1600, E5-2600/ 4600-EP, Core i7 (LGA2011)

- The why can’t we have Westmere back: E5-2400

- Mainstream deskstop/ server (ok there are 2 and 4 core variants granted): Core i3, i5, i7 and Xeon E3-1200 series, Pentium

- Microserver: Atom C2000

- Microserver + GPU: Bay Trail (Not really server but maybe heading there next generation for VDI applications)

- Many Core – Xeon Phi

- And maybe a few other parts not top of mind

Sure there are other Intel processors out there such as Quark but these are the mainstream server processors. At the end of the day, even with massive market share, Intel only manufacturers seven or so parts, several of which are shared with consumer platforms. Models are then binned and finished off accordingly. Many of these parts compete in the higher end of the market where dollars per chip are high.

Now, if a company customizes ARM chips for different customer needs it will face two problems. First, manufacturing costs for lower volume parts will be higher per part due to lower volume. Second, yields go down. For example, Intel can take a 12 core Ivy Bridge-EP part with four defective cores, and sell it for over $1,000 as an E5-2650 V2. Having large market share and relatively few parts to build allows Intel to sell more of its chips even if there are manufacturing defects.

On the subject of IP Intel has a fairly significant amount of IP it can integrate into its cores if another competitor found a large enough market for specialized processors. It has IP for video encoding, cryptography, storage controllers, networking interconnects and etc.

Bottom line: Specialized parts have their place, but ARM vendors may have difficulty going over the mass market with this strategy.

The Silvermont defense

The market has been buzzing with ARM’s dominance of mobile (tablets and phones.) Silvermont is still not a perfect mobile architecture as the level of component integration on Bay Trail SoCs is still below that of some ARM solutions in the space.

We have done a number of benchmarks published on this site over the past six months or so and the Intel Atom C2000 series is certainly a huge evolutionary step forward for the Atom. Whereas previous generations were slow, and may have had applications for low-end NAS appliances or pfsense machines, the new Avoton/ Rangeley parts can actually run mainline VMware ESXi, Microsoft Hyper-V and several other Linux based hypervisors fairly well. That opens up larger cold storage applications, lightweight virtualization, web hosting, network appliance and other applications to the Atom line that were traditionally the domain of low power Xeon E3 parts.

At the end of the day, Intel has made something “good enough” for the time being and furthermore has it in the market place with items such as chipset drivers already integrated into mainstream kernels. When the Avoton/ Rangeley processors first launched, NICs did not work in default RedHat/ CentOS/ Ubuntu and etc. installations. CentOS 6.5 and Ubuntu 13.10 supported the onboard i354 NICs out of the box so everything “just worked”.

The Xeon E3 Ceiling

Where ARM is focused at this point is still in the market below the Intel Xeon E3-1200 line. The idea is simply that for many web servers and similar applications, low power is all that is needed.

Just to give one an idea of performance, STH is trending as a top 100,000 worldwide website on Quantcast and Alexa. The site utilizes WordPress which is known to be relatively less resource efficient. Still, our initial testing shows that a single Intel Atom C2750 with 32GB of RAM might be able to handle the site’s traffic, adding a second for redundancy. Of course, this is something we are going to go a bit more in depth on soon with using copies of the STH production VMs for testing. While there are plenty of websites that get more traffic, and have more interactive models, WordPress is run on well over 50 million websites. As a result, there are many applications that can run in a virtual machine.

We recently spoke to several hardware companies and the feedback on the Intel Atom C2000 line has been fairly consistent. Good processors, but dedicated server buyers will pay the currently small premium to buy up to a Xeon E3 for single threaded performance. I have gone on record (many times) saying that the Intel Atom C2000 platform is great but priced too high so it competes with the Xeon E3 line. This is clearly happening in the market. Remember, if the other hardware stays the same (e.g drives/ memory), and the chips are similar in price, the cost difference between the Atom C2000 and a Xeon E3 is basically power and cooling. Odds are, the current Intel Atom C2000 lineup is a higher margin part for Intel and serious ARM competition will force prices down.

The other side – Intel needs an AMD

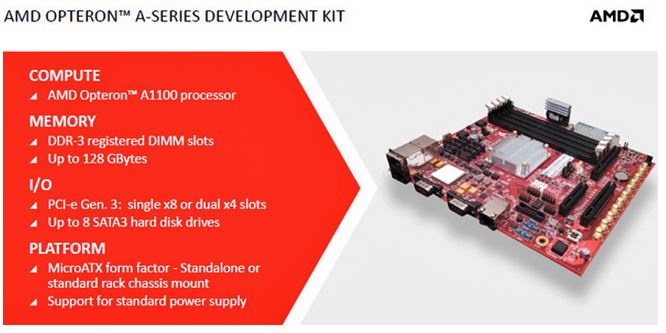

Another interesting model is if ARM gets too big in the microserver market, Intel can always allow companies to build their own IP blocks onto chips Intel manufacturers with x86 cores. In fact, this may be something Intel wants to do since AMD has almost vacated the x86 market at this point. Essentially, Intel would need to build its own “AMD” to keep x86 competition going. For any company interested in this, the fact that chips could be used even as alternatives in the break/ replace market for x86 servers would make it interesting. If Intel opened up its IP and fabs today, it would be a major setback for the ARM world as x86 is a lower risk for venture money.

Intel needs competition and we as an industry need ARM to make inroads places other than at major web properties such as Google and Facebook. If ARM fails now that AMD is abandoning the higher-end x86 market, Intel is going to need to find another solution if it does not want to end up with too dominant of a market position. If it has to build its own arch nemesis just to keep the appearance of competition, that may be a good result for the market.

Final thoughts (for this side)

I do think ARM will make inroads. I simply do not subscribe to the mantra that in three years ARM will up-end the server world. The ARM guys still have technical, production and market forces to contend with. The good news is that there are several dozen companies trying to solve problems and come up with the “secret sauce” to take market share. In the meantime, we get to enjoy shipping products like the Intel Atom C2000 series that are a direct response to perceived market threats. The threat of ARM has not meant that I can buy an ARM server today, but it does mean I can buy a new class of Intel server that is significantly better than previous generations.

What do you think? We started a thread over on the STH Forums and I would love to hear perspectives. I also alluded to the idea that ARM actually likely has 50% share or more so this article is just sharing one perspective on the matter. Comments are not turned on for this article so please use the forums to discuss.