Back in 2015, Intel announced a deal that shocked many with its intention to acquire Altera for its FPGA business. In the years since, we saw Altera’s main competitor Xilinx acquired by AMD. Now, Intel is looking to spin out the business in the form of an IPO, which should be much larger than some of the smaller announcements like the Intel Optane wind-down, selling its server business to MiTAC, or its NUC business to ASUS. The somewhat different part of this is that one can make an argument that FPGAs provide Intel with an early integration opportunity for IP and it is part of an xPU strategy like AMD is pursuing.

Intel Altera Experiment Ending as PSG Goes Standalone En Route to IPO

Before we get too many people saying that just because PSG will run as a standalone business it does not necessarily mean Intel will focus on an IPO for the business, here is a quote from the Intel press release:

“Our intention to establish PSG as a standalone business and pursue an IPO is another example of how we are consistently unlocking more value for our stakeholders. This will give PSG the independence it needs to keep growing share in the FPGA market, differentiating itself with capacity and supply resilience from IFS, and allowing Intel product teams to focus on our core business and long-term strategy,” said Intel CEO Pat Gelsinger. (Source: Intel Press Release on PSG going standalone)

That seems to strongly indicate that PSG is being set up to be its own standalone entity and then to do an IPO. For those who have never done a spin or divestiture, it usually takes a long time to separate companies like this. Some examples of why go beyond accounting and creating 3 years of financials. Usually, new roles need to be created and filled on the G&A side. Contracts need to be negotiated with suppliers, partners, customers, and so forth. That also has to happen not just for commercial customers, but also for government customers. Having done the HPE and HPI split, I remember having to spin up teams all over the world with the right security clearances to go look through contracts and also Azerbaijan not allowing contract assignments without novation, even if the original contract had assignment language. If you cannot tell, I have some scars from doing management consulting in this space.

The point is, this announcement sounds like Intel is readying the spin, it just needs time to separate out the business.

A big congratulations to Sandra Rivera who is set to transition from a DCAI leadership position at Intel to become the CEO of the new PSG business.

Final Words

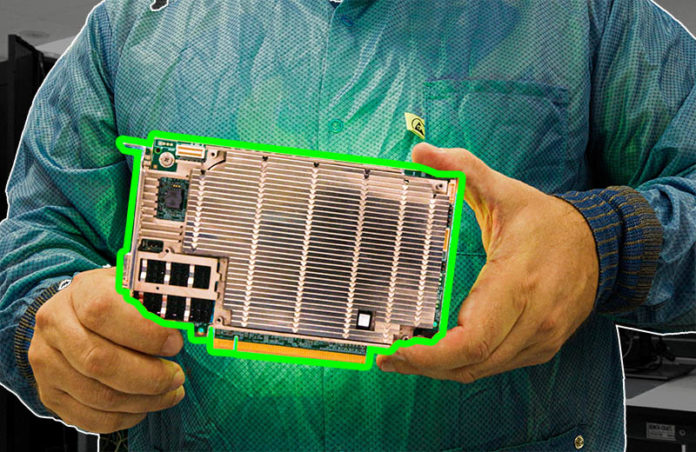

Pat Gelsinger and the Intel Board of Directors have been talking about xPUs and streamlining the business for a long time. Intel’s chief competitor in the FPGA space, AMD, is talking about how its business is seeing a pull-through with the Xilinx acquisition. It will be interesting to see how PSG fares as its own standalone business. Even things like OneAPI and Dev Cloud integration that PSG gets as part of Intel are set to change. An example is that we did a piece on Big Spring Canyon IPU which was an Intel FPGA with an Intel Xeon D sold to a large hyperscale client.

One thing is for sure, this is not going to be the last silicon company to be spun off or acquired. Things have to stay exciting. Something that is really intriguing here is that we would expect a lot of PSG’s future parts would be either fabbed at IFS or use IFS packaging. Intel is effectively creating a new publicly traded customer for IFS.

Wow. Classic. Altera was doing well, then Intel bought them, ran them into the ground, and allowed Xilinx to dominate. Now Xilinx will be stuck under AMD while a wounded Altera is thrown back out into the wild.

FPGA’s don’t compete well in many data center applications with huge scale where they can afford ASIC’s. Intel tried to push them in DC while ignoring customers in niche areas that were long time FPGA users and had the engineers to design with them. Xilinx was happy to step in and thrive. Now Xilinx is heading down the same path.

Classic Intel failure/folly of Intel’s billion dollar acquisitions! It’s been happening for 20+ years. Intel gets duped by Bankers and Wall Street underwriters and other company CEOs to buy them out. Then Intel pats lot more than market price and can’t do anything w that $billion purchase! PATHETIC! Intel gets duped by Israeli companies and their cunning “start ups” and USA Indian startups. All of these startups are failures if left alone but Intel rescues them and makes the VPs rich.

PSG stands for what? Unsexy new term programmers won’t approach so much? “We thought of 7 separate units that should perform the former Altera IP but stuck it all back together because of habit.” Intel does seem to need a fine arts and design forward division, not least so it doesn’t act so cyclical (as in self-toxic.)

Who gets the money from the IPO, Intel or the spinoff? Is it Intel spinning it off in an IPO, retaining a large number of shares and selling them to get value out of the deal? How does this work for Intel’s bank account?