A small nugget in Intel’s Q2 2022 earnings call is that the Intel Optane business is winding down. The wind-down was a quick comment, along with the drone business winding down on the call. In the earnings release, it showed up as a $559M inventory impairment.

Intel Optane $559M Canned Q2 2022 Wind-Down

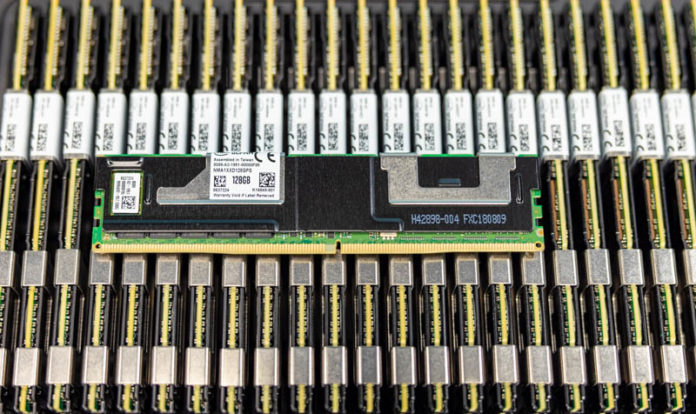

If you want to learn more about the Intel Optane business, and why Micron quit the venture before Intel, check out our Glorious Complexity of Intel Optane DIMMs and Micron Exiting 3D XPoint.

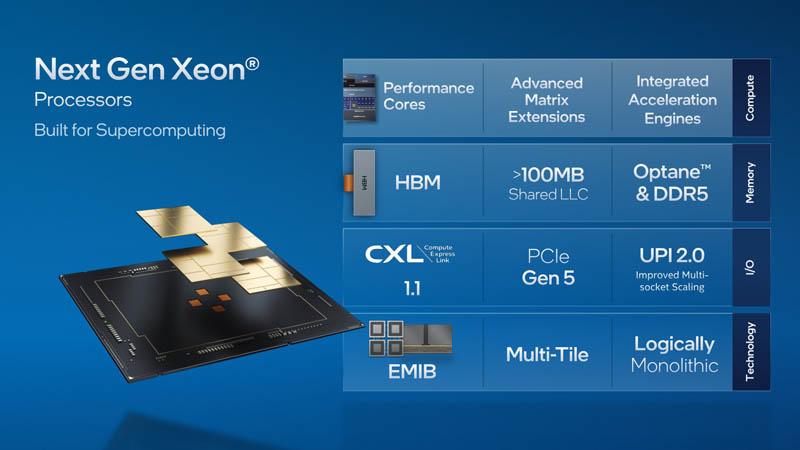

We saw some evidence of this in the slides we looked at yesterday in More Cores More Better AMD Arm and Intel Server CPUs in 2022-2023. Here is the SC21 (Nov 2021) slide on Sapphire Rapids with Optane:

Here is the Q2 2022 slide, with only DDR5:

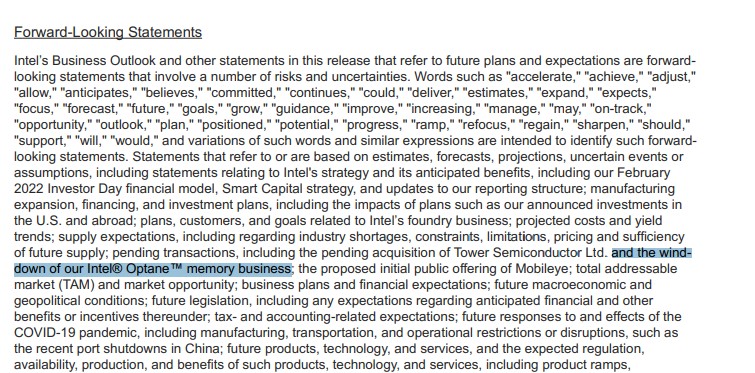

Here is the earnings release statement discussing the wind-down of the Optane business in Forward-Looking Statements.

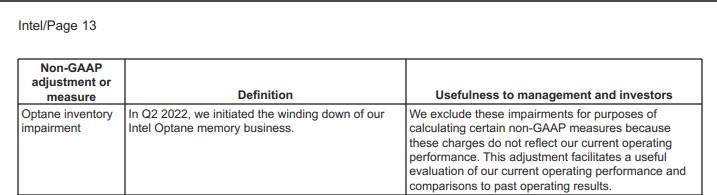

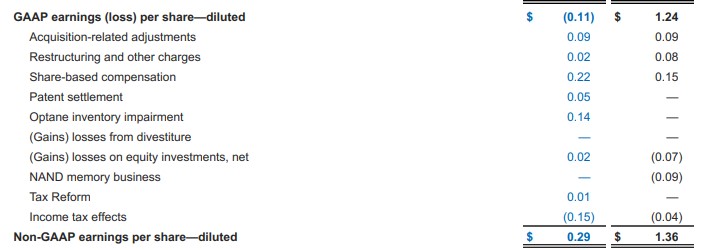

Here is the Non-GAAP adjustment or measure entry:

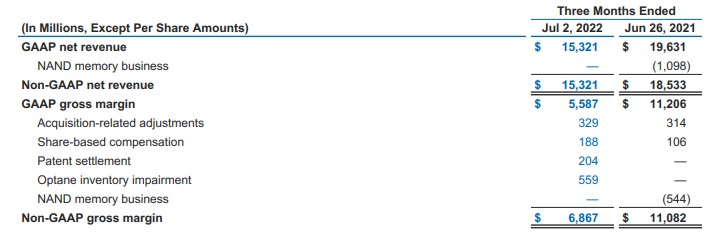

This is the $559M Optane inventory impairment. Just for a sense of scale, this is huge impairment.

Here is the EPS adjustment:

While exiting the drone business made a lot of sense, this is a much larger business that Intel is leaving.

Final Words

A few items stand out here. First, this was a hyped and cool technology but the implementation was Intel only and a bit strange, as we discussed in the above video. Second, it is interesting that Intel is taking that large of an impairment. Third, Intel, and others, are putting weight behind CXL. In the earlier video, we noted that Micron left Optane for CXL memory since that allows relatively arbitrary media to be used. It seems like the industry is moving in that direction, so CXL’s time has come.

Still, this was a really interesting technology, albeit one that is now over.

“this was a hyped and cool technology ”

Not really. STH was a main driver of the hype for the last few years. Patrick really needs to be more critical of manufacturer statements when the facts show otherwise.

@Lasertoe Most media hyped it. LTT (and specifically Linus) always pushed it as the best drive possible, and quite frankly it was. It was just too expensive and the lack of sequential performance hurt the marketing side too much.

Unfortunately the cost never really made sense for most people, especially as the benefit you would get sometimes wasn’t even noticeable.

I’m sad, but not surprised, to see it go. I was holding out hope a rev2 or rev3 would drop price enough that it would make sense for myself, but as soon as the consumer sales never materialized and the introduction to the wide market was very tiny drives with HDDs that seemed to have a massive failure rate, I knew it was doomed.

@will

1. Patrick hyped way too long.

2. We’re not talking about drives here, we’re talking about the mem tech.

3. The tech was just completely useless once it didn’t scale. Just having fast drives is absolutely possible with NAND too at lower cost (Samsung and Toshiba have shown that). NAND cells even offer faster reads than 3DXpoint, but you need SLC and the string size needs to be short. That goes back to cost.

Optane drives have a massive real-world latency advantage over any available NAND drives. If latency is everything for you, then there aren’t really many alternatives.

But few users actually care about ~2 usec latency in and of itself. In Optane’s favor, extra-low latency means that at QD=1, they’re dramatically faster than NAND, which makes them more effective without any tuning. If you have a workload that has limited parallelism, then maybe Optane is a good choice. Otherwise, it’s cheaper to spend some time increasing your effective queue depth.

Fundamentally, the only people who really *need* Optane (drive or memory) are people trying to run larger-than-RAM DBs with really high write IOPS and consistency needs. If you can shard the DB and mostly only care about reads, then scaling out is cheaper than using hyper-fast single-source drives.

There’s a fascinating space where Optane memory makes sense, where you have really high I/O rates with a bigger-than-RAM DB that is still small enough to fit into the number of Optane DIMMs that will fit into a single box. But the architecture of a system like that looks almost nothing like the architecture for a RAM-and-SSD system, and it has hard scaling limits, and you’re limiting yourself to a single source for storage *and* CPUs. If you have a problem that fits into that space, then cool. Sounds like fun. But those problems are really rare. I’m not exactly sure who Intel was building this for, really. Apparently they don’t either, now.

“massive real-world latency advantage over any available NAND drives”

Only for writes. Even in 2019 Z-NAND had faster reads (lower latency) and if they wanted they could have made the strings shorter for more performance(+increase number of planes by a lot).

https://www.tomshardware.com/news/intel-optane-vs-samsung-z-nand-ssd,38987.html

I’m also still waiting for Kioxia FL6 reviews with XL Flash updates.

“larger-than-RAM DBs”:

Since we have 3DS DIMMs and more channels the number of “larger-than-RAM DBs” has gotten much smaller. CXL is allowing even more DRAM so that makes it worse.

I can see the move toward CXL being the nail in the coffin for optane specifically in the ‘DIMMs with peculiar performance characteristics you can only use with specific Xeon systems’ incarnation; but it strikes me as a rather flat explanation for why the tech seems to be getting the boot overall(with Micron already getting out and Intel being pretty lukewarm even before this): if its cost/performance were there CXL would be an *ideal* bus for a not-quite-as-fast-as-RAM-but-faster-than-NAND format to live on; now with an expanded audience of anything that supports CXL rather than only specific Xeon systems.

The fact that they are just calling it a day, rather than showing off a CXL-attached optane module suggests that they don’t see a path forward in terms of threading the needle between flash controllers doing clever things to disguise NAND’s character flaws and normal DRAM.

We have used Optane successfully in a few servers.

1) We are in the sweet spot. In our case larger-than-ram is a normal course of action for a DB. For our business everything needs to be accessible all the time. We have a machine with Optane in App Mode which can hit a specific ‘hot’ shard of the DB. This is working really well and it’s a shame to see it go.

2) We have another machine that feeds the DB with millions of tiny files. Those files are on an Optane App Mode drive. Sounds goofy, but the latency reduction of thousands of files * microseconds does add up.

Between #1 and #2 we had jobs that struggled to complete in 24hrs that can complete much faster now.

We also have these for some really large instances of Solr where it was cheap to get a few TB of Optane as pseudo RAM vs purchasing outright.

If only Intel had kept it off the DDR bus it could have been interesting.

Optane was just way too limited – only Intel CPUs, only Xeon platinum, only certain motherboards with BIOS support etc. If I had one for my i7 I would have bought a few!

thanks for the article.

so the optane dimms are going, does that mean the optsne ssds are also doen for?

The industry doesn’t want to get locked into proprietary solutions, and a lot of players are willing to pay a bit more in the short term (avoiding a performance advantage/hitting the performance target a different way) in order to keep supplier options open in the long term. Intel desperately wants to get back to the days when it could charge a captive market whatever it wanted, but that’s not something their customers are looking for. If you really bought into optane you had to design your software around the hardware, and now you’re screwed and need to redesign your software around some other solution.

Remember this when hyping QAT.

I wonder if this means that existing Optane chips will really go into some landfill or if they’ll try to sell them (at bulk?) to whoever might want to take them.

In the past Intel seems to have sold practically any inventory, no matter how sad or outdated e.g. Ice Lake SoCs without working iGPUs or Kaby Lake G chips, which then suddenly popped up at some Chinese ratailer who was quick enough to turn it into a cheap one-off.

I sure won’t mind taking some Tbyte units of SATA-Optane off their hands at HDD prices :-)

But I guess the inventory is mostly at raw chips level and can’t be turned into any usable product at reasonable cost, resulting in the complete write-off.