Xilinx is navigating an interesting era in the company’s history. Instead of simply being a FPGA provider, Xilinx is navigating a transition to help bring FPGAs to more markets. That means launching new product lines including its Versal line, Alveo PCIe cards, Kria SOMs, and Vitis software platforms. It is focusing on the data center market which it traditionally did not sell into. It was impacted by changing trade tensions that hit and then persisted through a global pandemic. There is a global semiconductor shortage which means there are limitations on supply. If that was not enough, the company is in the middle of being acquired by AMD. Change is inevitable, but it seems like Xilinx is managing change on a number of fronts, which is why getting the opportunity to hear from Victor and ask a few questions was great this week.

Xilinx 1H 2021 Update

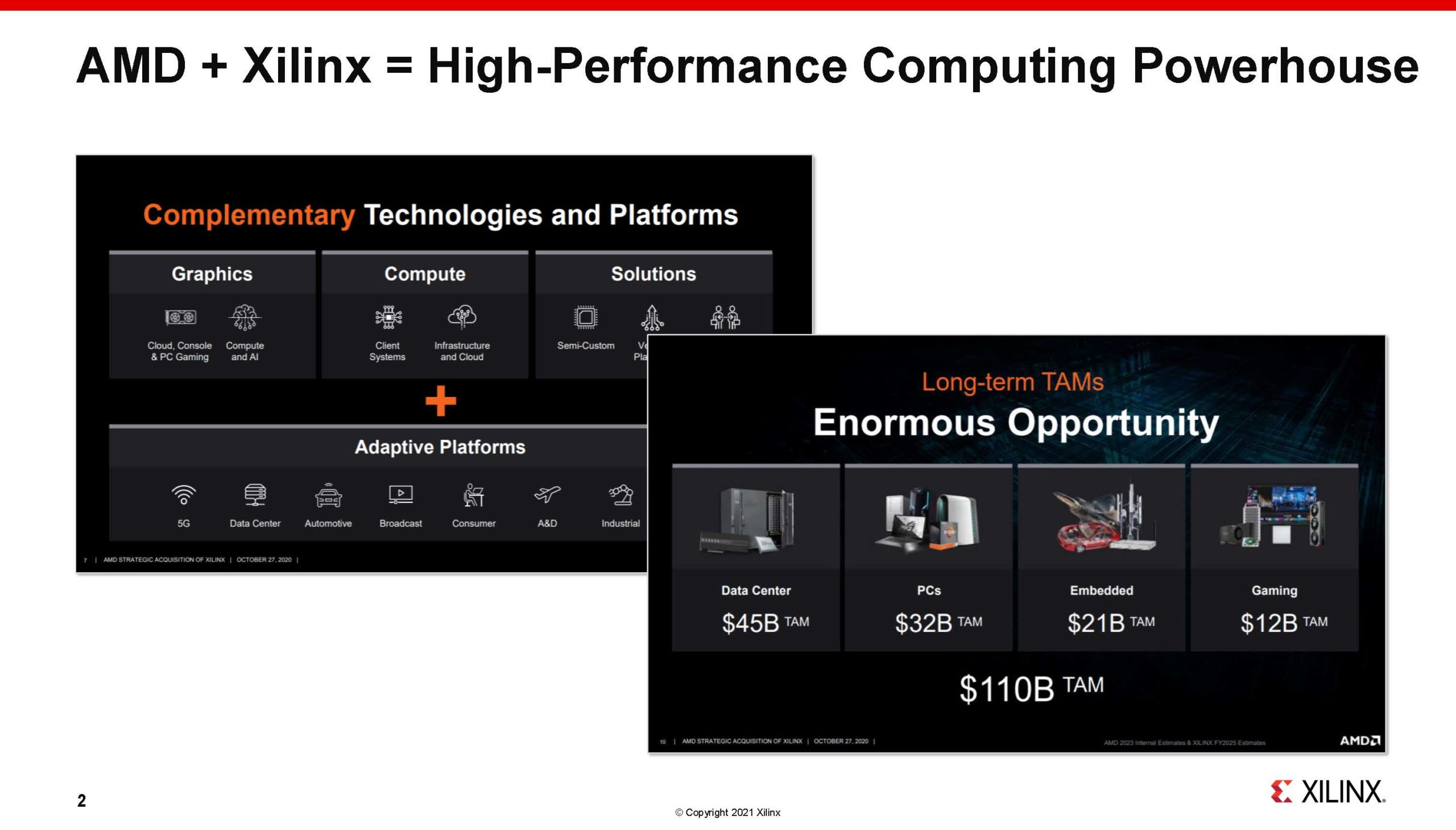

The first part of the discussion was an update on Xilinx. The first major topic was that the AMD acquisition of Xilinx was approved by the shareholders of both companies and is on the road to closing in the future (pending regulatory approvals.) AMD has been taking share in the data center with the AMD EPYC 7003 “Milan” series and between the two companies they have a broader portfolio to compete against Intel (and NVIDIA.)

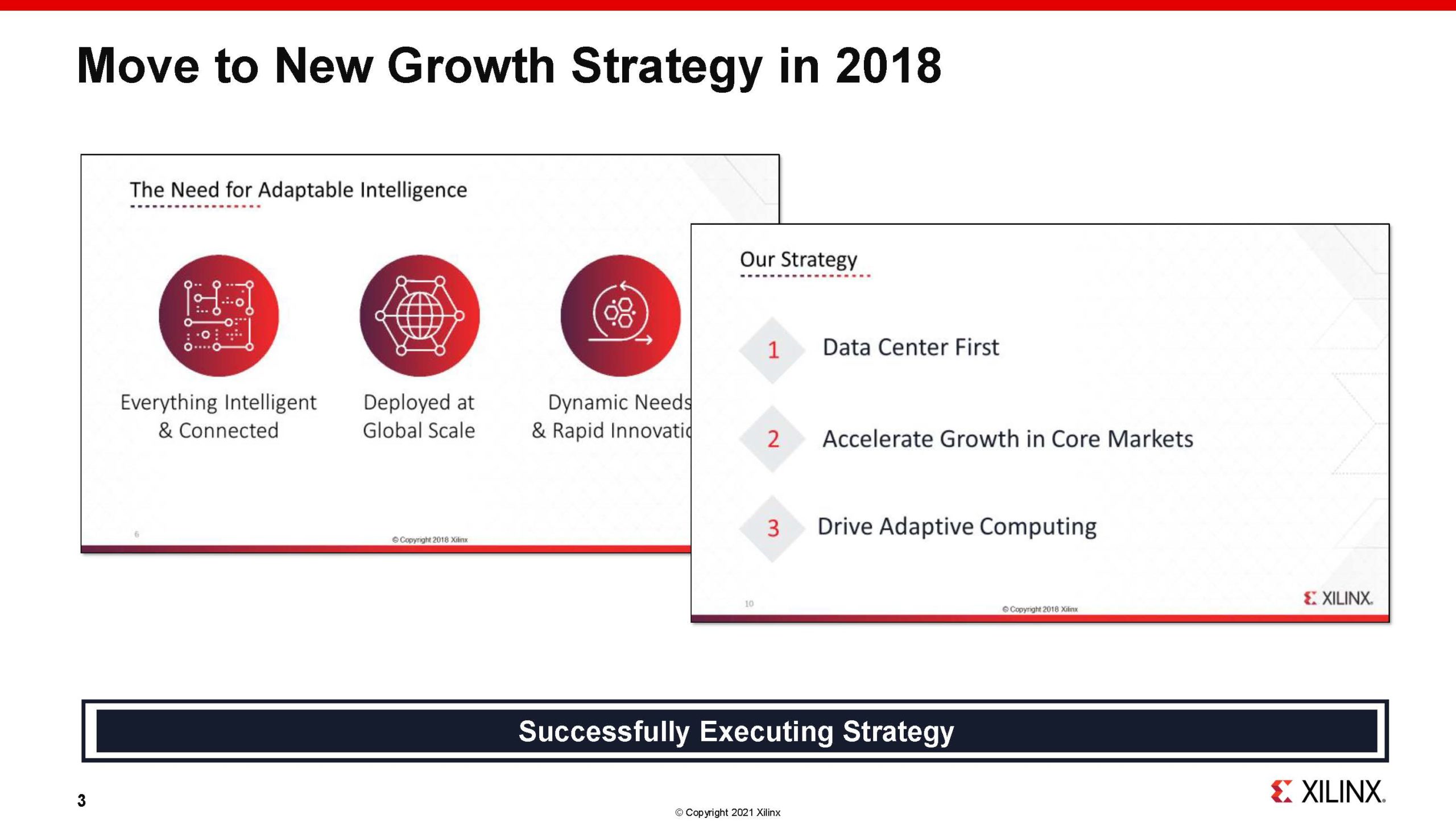

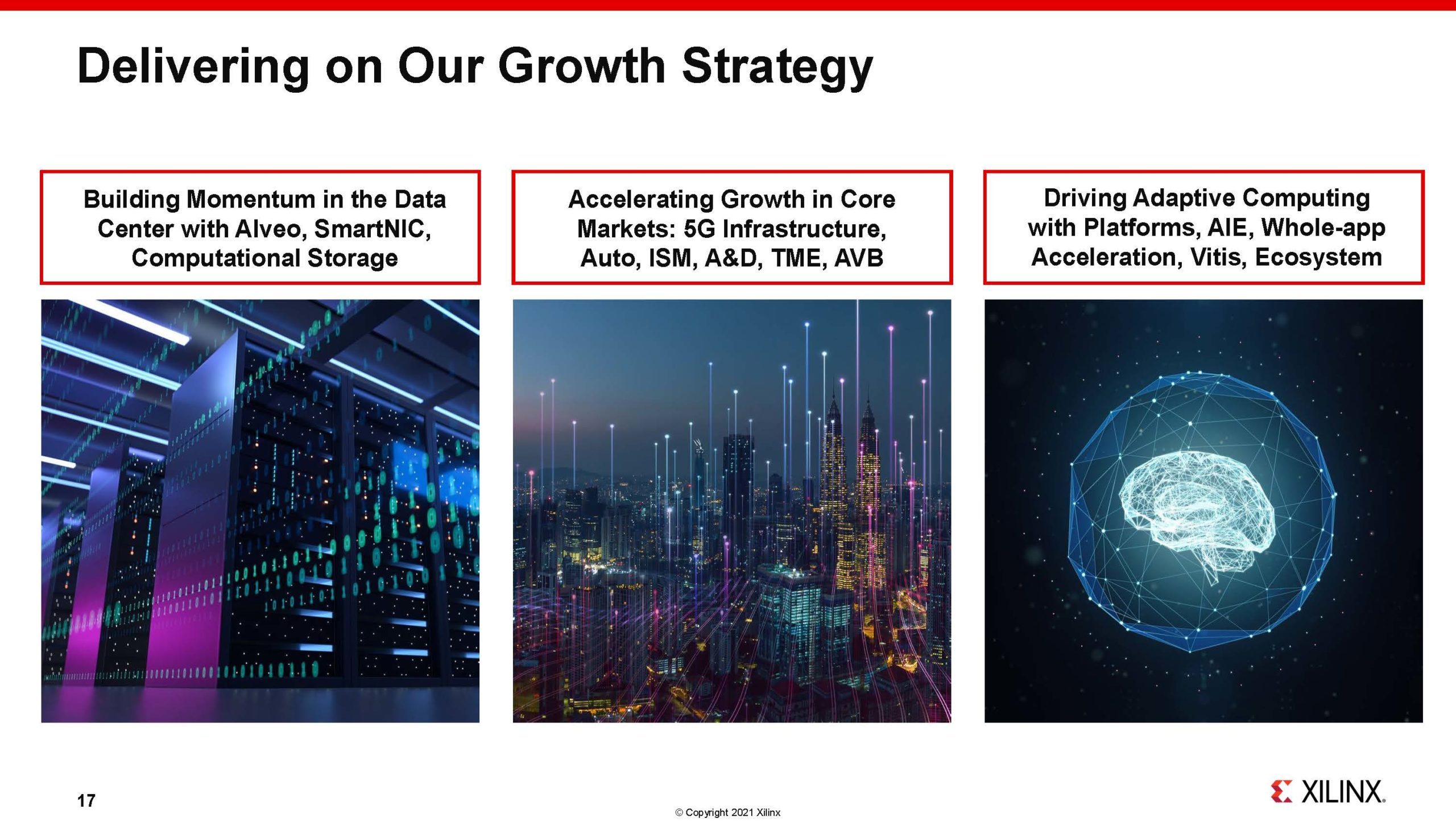

There was a quick nod to the 2018 growth strategy that focused on the datacenter market as well as a move to adaptive computing with the Versal ACAP.

Three years later, Xilinx has made a number of advancements executing on its strategy.

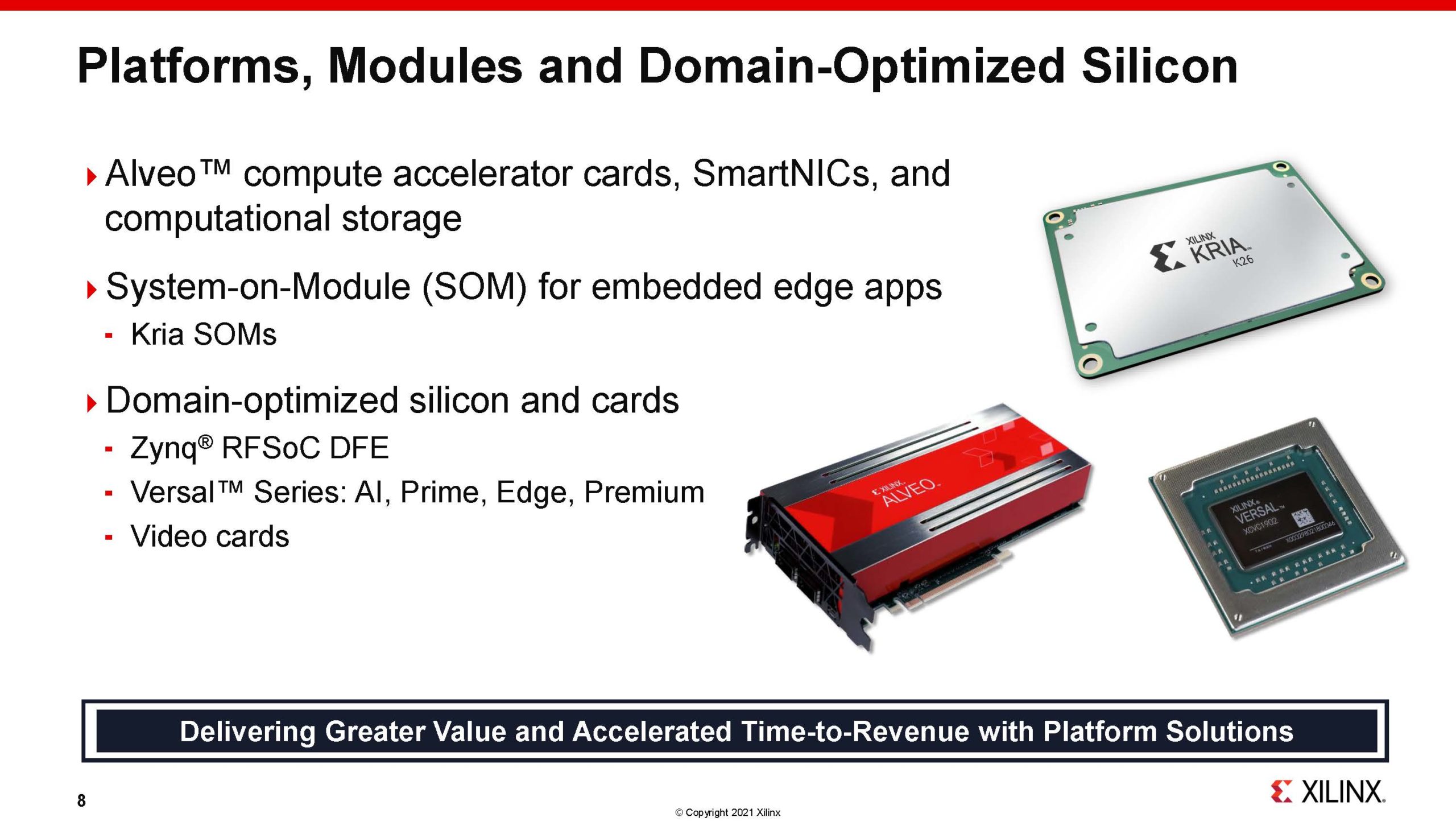

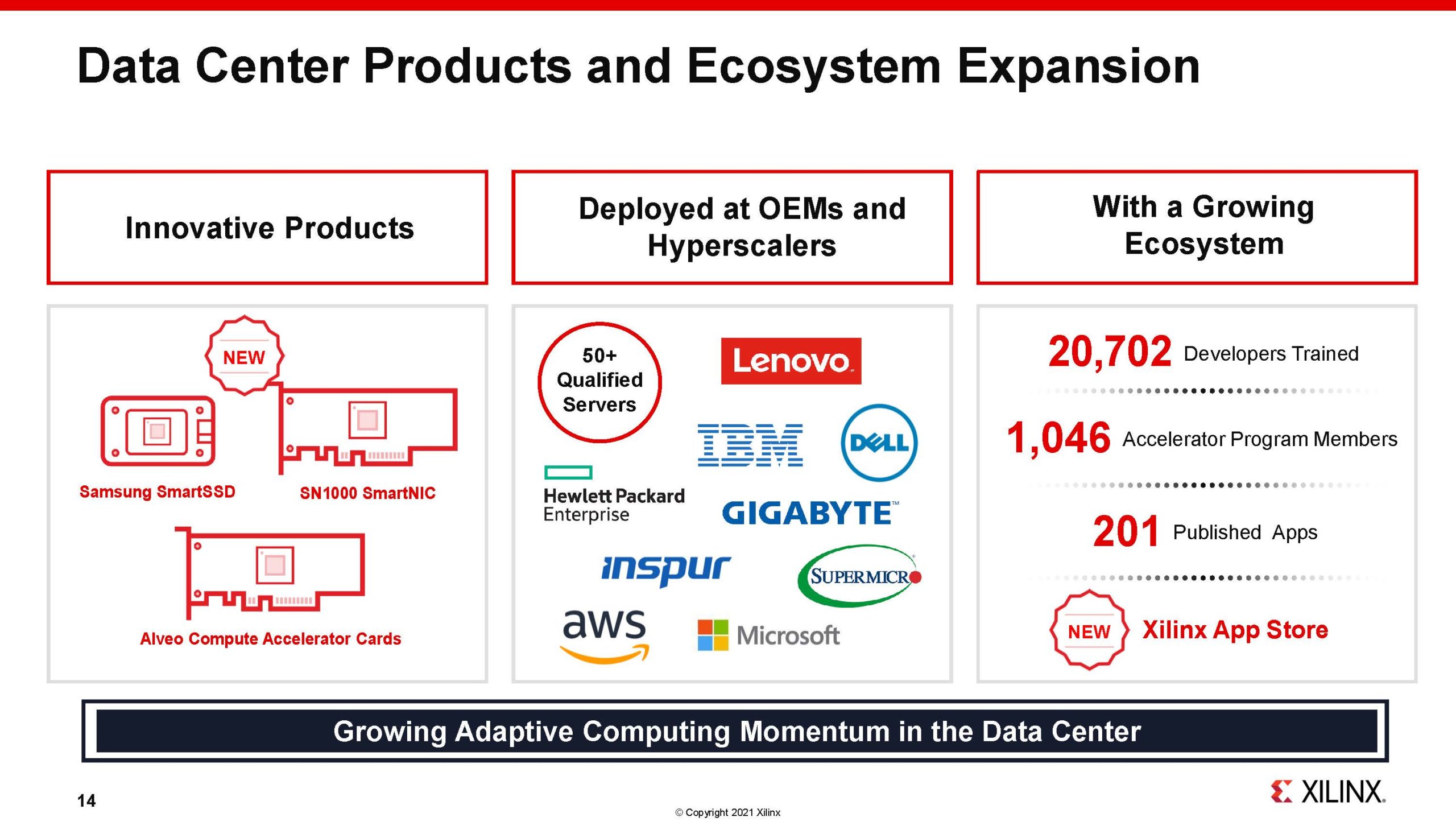

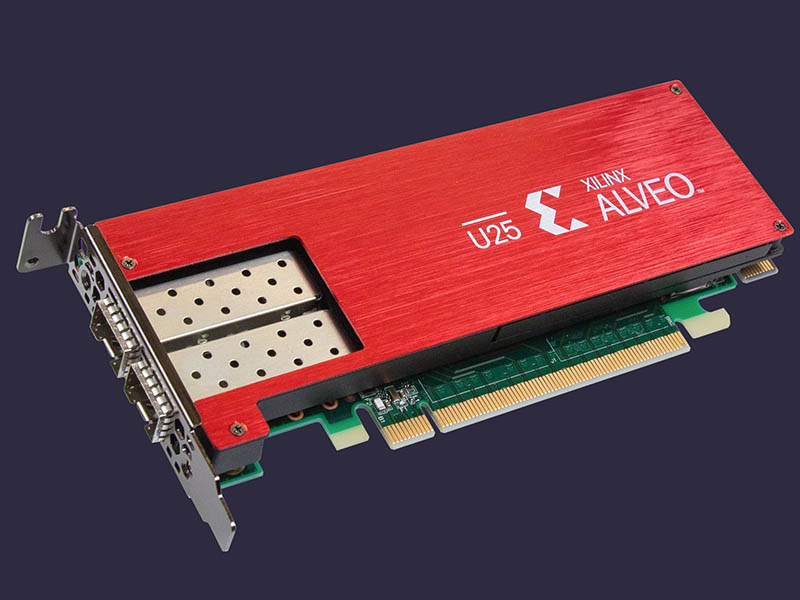

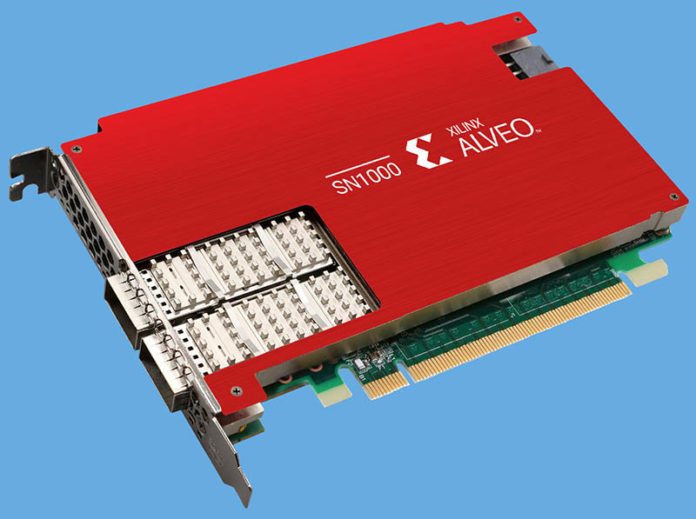

One of the big ones is that Xilinx has moved away from being a FPGA supplier. The company has moved into providing higher levels of integration with its Alveo line which includes compute cards, SolarFlare acquisition-based SmartNICs, and most recently its Kria SOM which we will be showing soon.

These products have had an impact. Years ago, it was uncommon for a major server OEM to have a qualified Xilinx part, or line of parts. In executing the company’s data center growth strategy, it now has a number of OEM partners that can integrate its new hardware like the Xilinx Alveo SN1000 FPGA-powered 100GbE SmartNIC.

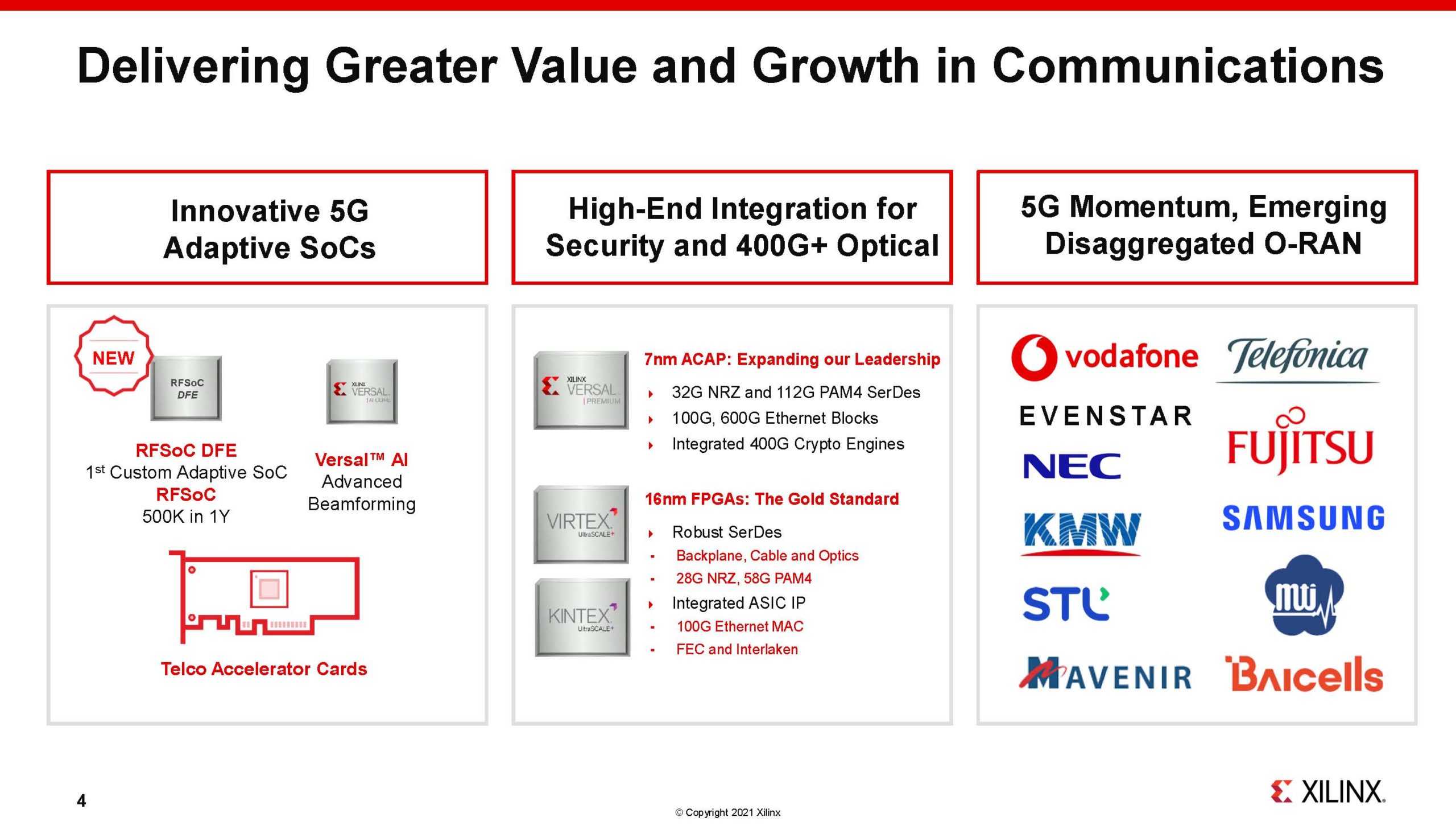

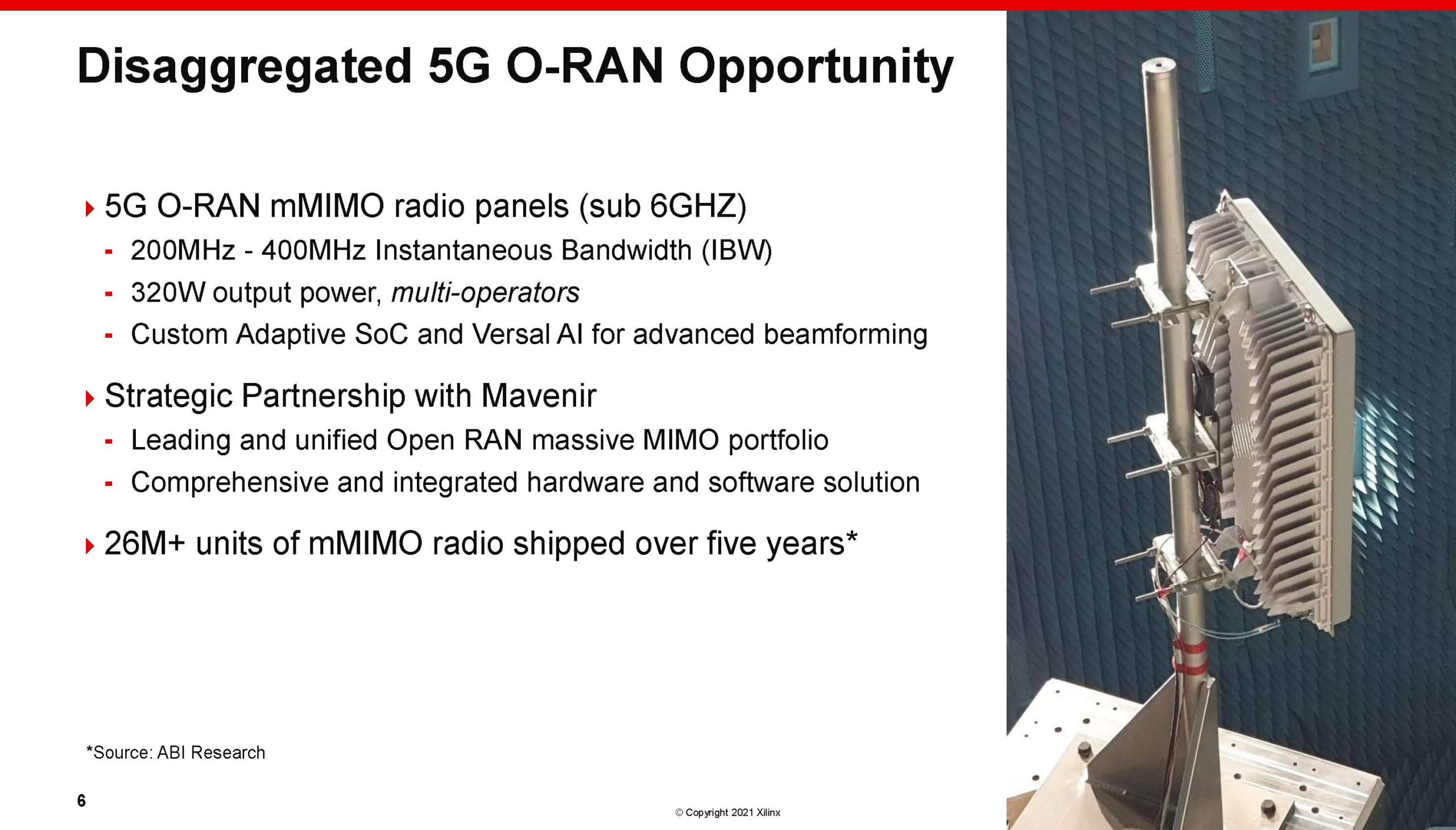

On the communications side, this is another big growth driver with solutions such as the Xilinx RFSoC FPGA for 5G Networks. As the need for higher-speed I/O as well as 5G infrastructure gets deployed, Xilinx has a number of solutions for those markets.

Xilinx has gone a step further and has new products such as the Xilinx T1 FPGA for ORAN Baseband Units that we have covered. The 5G ORAN market very large and FPGAs can be used at multiple points, especially before some parts can convert to ASICs. As a result, Xilinx FPGAs are a good fit there.

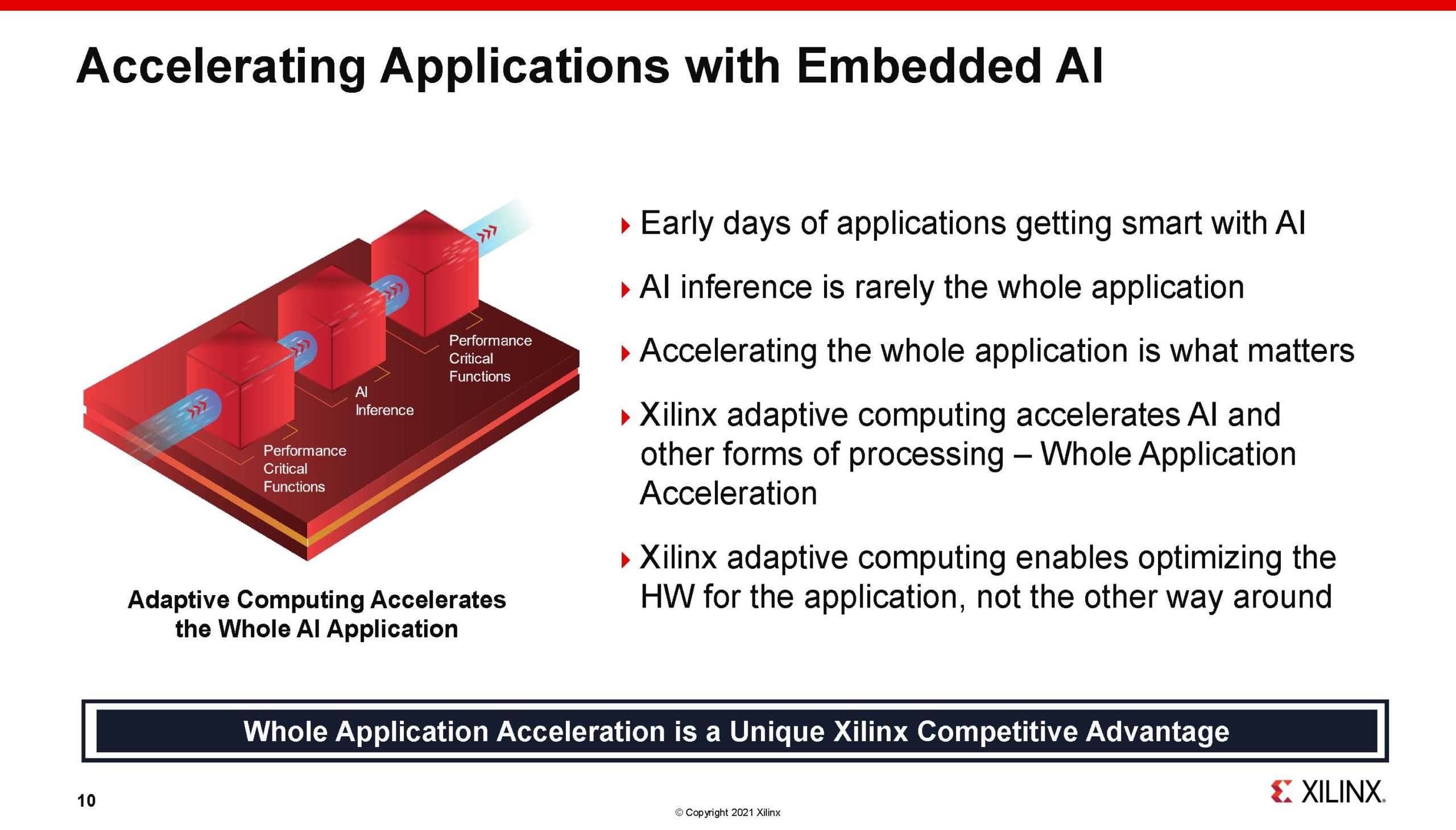

Xilinx made a bet on AI inference performance with its new Versal ACAP. Between the AI acceleration and the programmable logic/ memory flexibility, Xilinx is finding customer engagements taking advantage of these capabilities to provide something different and potentially faster with lower power than traditional GPUs for inferencing.

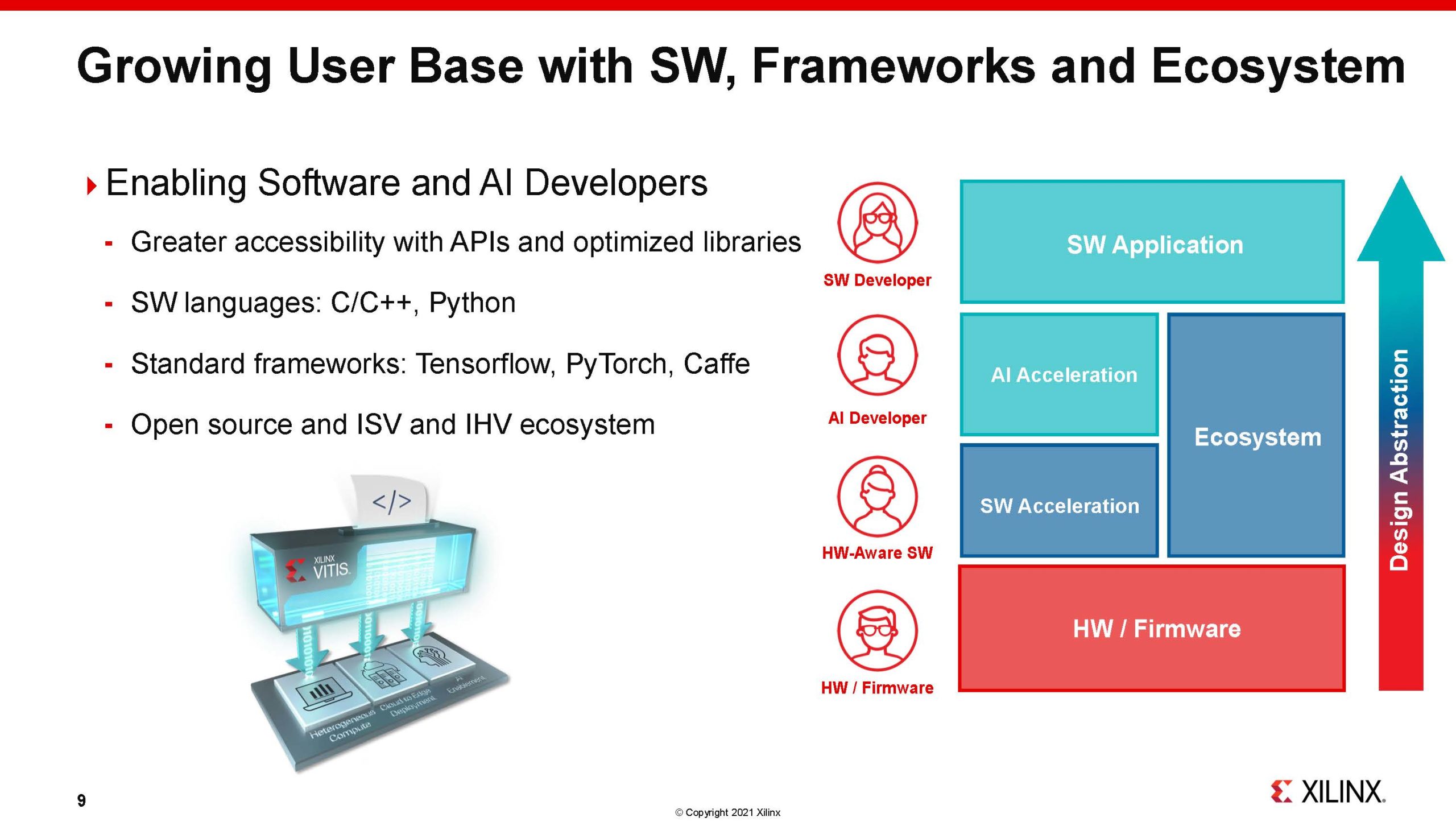

Another key to Xilinx’s expansion efforts has been changing how it engages with developers. Xilinx realized that requiring a developer to be an expert in lower-level placement tools was not the path toward mass adoption. With Vitis, Xilinx is building tools with features such as the base shell to get FPGAs running and then allowing programming via higher-level languages such as Python.

With this new developer focus, Xilinx is contributing more code to Github and is starting to see more users develop for FPGAs since the barrier to go from idea to functioning product is now much lower. An example of this is that Xilinx now has an app store to make running an application on FPGAs an almost turnkey experience. This is a huge change in the go-to-market strategy for the company, or perhaps better said, an expansion of that strategy.

A Few Quick Questions

Given the limited time, I had the opportunity to ask Victor a few questions about the narrative.

First, I asked Victor specifically about lessons learned and the adoption of Alveo. Alveo was a huge departure selling a FPGA on a board with PCIe for easy integration into other systems. Before Alveo, Xilinx was mostly focused on selling chips. My sense of seeing the products roll out over the years is that this has been a successful launch, but whenever a company tries something new there are usually lessons learned in the unknown.

With Alveo, the original idea was that Xilinx could just sell pre-integrated boards instead of FPGAs. What the company found was that just having a FPGA on a board was not enough to drive use by a broader community. As a result, Xilinx launched Vitis and now has the concept of the shell to get a card up and running with interfaces, memory controllers, and such without requiring a developer to program those basics. The app store model is the next generation towards making these cards flexible turnkey accelerators. I certainly got the sense that launching Alveo and subsequent cards have been successful and is something Xilinx is going to continue to do more often in the future, but there were lessons learned that will be brought to other areas of the business.

I also asked Victor about Xilinx’s growth in the data center and where it is seeing traction. Specifically, I was probing on enterprise versus cloud provider adoption. His response was as one might expect. Xilinx is seeing demand from the cloud provider/ hyper-scaler market to a greater degree than the enterprise data center. His comment was basically that the cloud providers are able to do major shifts in their infrastructure and take advantage of the flexible and programmable nature of FPGAs better. There are other markets such as (high-frequency) trading markets where there are resources to utilize FPGAs as a competitive advantage.

This makes a lot of sense. Enterprise buyers tend to like to have solutions rather than having to purchase hardware, then have teams to take advantage of hardware at the level of taking advantage of a component. For example, most enterprises purchase network adapters and expect them to work rather than buying network adapters for servers that they need a specialized team to program and get value from. My sense after the discussion is that Xilinx had this realization. The reason we are seeing features such as the Xilinx app store is that Xilinx is working its way toward bridging the traditional FPGA usage models with those expectations for devices in the enterprise data center.

Final Words

Overall, it was great to get this update from Victor on the state of Xilinx. One challenge with the global pandemic is that it cut into some of the time we would otherwise have to get these business updates. Zoom calls are sometimes less effective in getting to the lessons learned than an in-person event. Thank you to Victor and the Xilinx team for taking the time to pause and give this update.

What I don’t get is this.

The King of Breathless Press Releases bought Altera but quarter after quarter they have less and less to say about it. Are they trying to pretend it never happened?

AMD had a big competitive advantage over Intel in that it didn’t have a botched FPGA acquisition hurting customers and investors. Why is AMD giving up that advantage?

That’s simple Intel does not know what to do with FPGAs. It’s like the innovators dilemma except backwards. You see something with the potential to eat your lunch so you buy it and bury it.