As we noted in the Trends in Server Compute 2017 overview piece, NVIDIA is poised to have a great year. The push towards AI/ machine learning is largely built upon NVIDIA GPUs. NVIDIA is finding willing partners with POWER and others looking to break Intel’s stranglehold on the data center. We have certainly seen great interest in machine learning and have been aggressively gearing the DemoEval lab to take advantage of the trend.

NVIDIA Volta – Get Ready

It is little secret that the P100’s found in the NVIDIA DGX-1 are in short supply. We have heard IBM POWER plus NVIDIA and NVLINK with some HPC wins but the P100 is in short supply. In 2017 we expect to see Volta and it is little secret that NVIDIA is in the driver’s seat for future IT spend as companies look to add AI/ deep learning capabilities. Companies are going to pay top dollar for Volta. In a perfect world (for NVIDIA) it would not have a strong AMD competitor on the graphics side and would be able to save Volta purely for the data center. We do expect that NVIDIA is going to have another iteration on getting top dollar for high-end Volta supply learning from the Pascal supply struggle.

With that said, NVIDIA is still going to be straddling a fine line. The company has been trying to get these AI workloads onto Tesla cards where they can earn a higher margin. At the same time, the company’s biggest asset is that you can get started with CUDA using a consumer GPU and have a lot more capability than using a starter x86 Intel system. With AMD in play, NVIDIA does need to keep is traditional GPU business refreshed with new chips but the big money and margin is in the data center. With the company supply constrained in the Pascal generation, Volta is either going to be a great opportunity or a supply chain nightmare.

We are also keen to point out that NVIDIA is racing to push its technology by large multiples per generation. Intel has not kept pace but is surely aware that if it wants to keep NVIDIA at bay, it will need to re-ignite the innovation engine on the CPU side. Knights Landing is perhaps a step in that direction.

What Else?

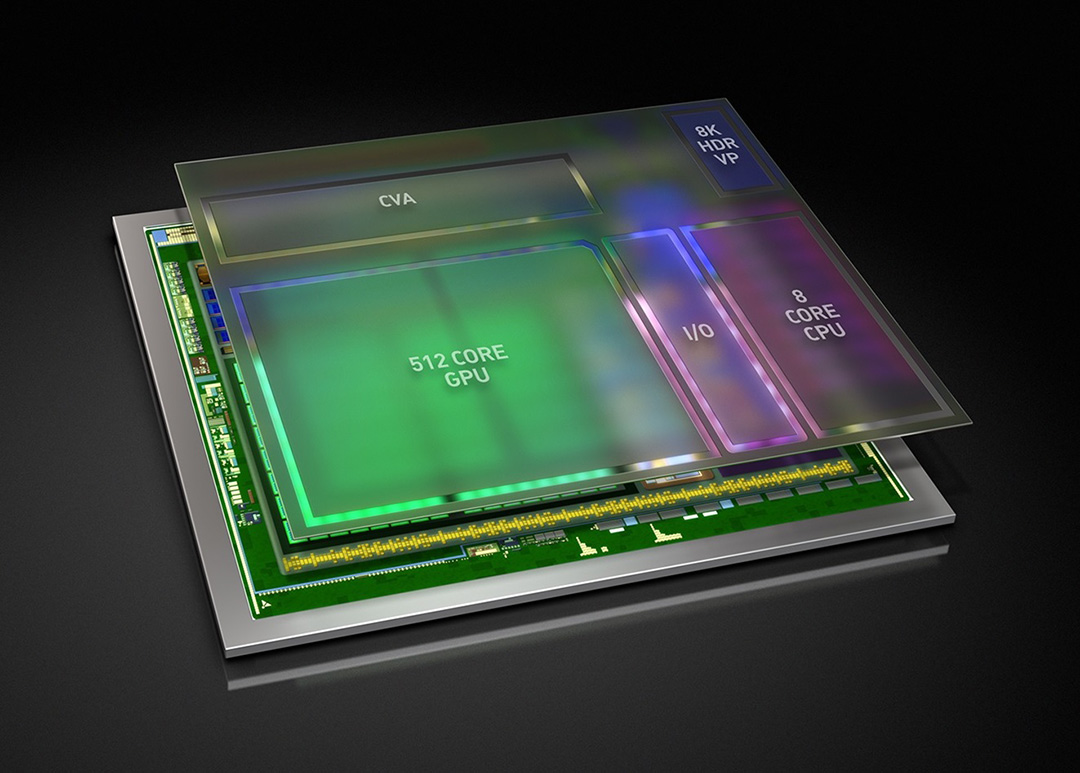

The big question for NVIDIA is what else can it do? AMD is going to be much stronger with Zen in 2017 on the CPU side and will be able to offer CPU + GPU. Intel will be able to offer CPU, many core (KNL), FPGA, and high-speed interconnect. NVIDIA is playing in a very narrow market. We thought Jetson TX1 and TK1 would be harbingers for things to come on the data center side, but the idea of an ARM-based NVIDIA CPU along with GPU cores is in dire need of a refresh.

We may very well see the company try to own the AI inference market with a next-generation ARMv8 SoC that bundles newer GPU architectures but it seems as though focus in that area has been in the automotive space.

Strategically, NVIDIA’s share price is very high so if it did want to make a move it is likely going to be an acquirer. On the flip side, it has marketed itself as the GPU solution you plug into other systems (Intel, POWER, ARM) so moving to fill in the CPU space will surely help ensure it loses a partner in the process.

One thing is clear, entering 2017 NVIDIA has a lot of momentum and opportunity. The question then becomes how will the company ensure it can take an even bigger part of the data center pie while managing potential channel conflicts.