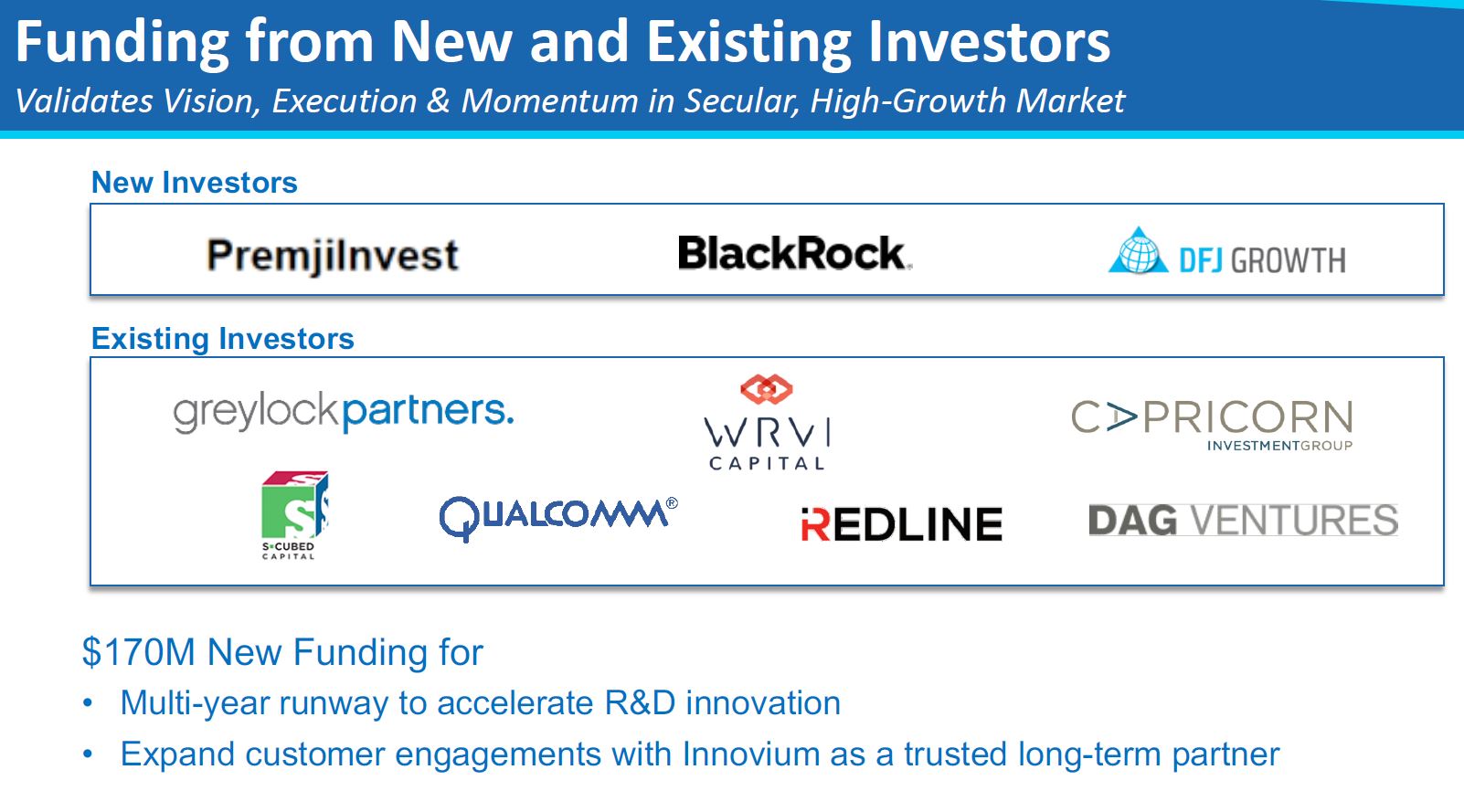

Big news from Innovium today. The company has raised $170M in additional funding (reportedly at a >$1B valuation) to fuel growth and expansion. VCs tend to focus on software plays so seeing a chip startup get a large cash infusion like this outside of the AI accelerator market is actually quite notable these days.

Innovium Raises $170M in Funding

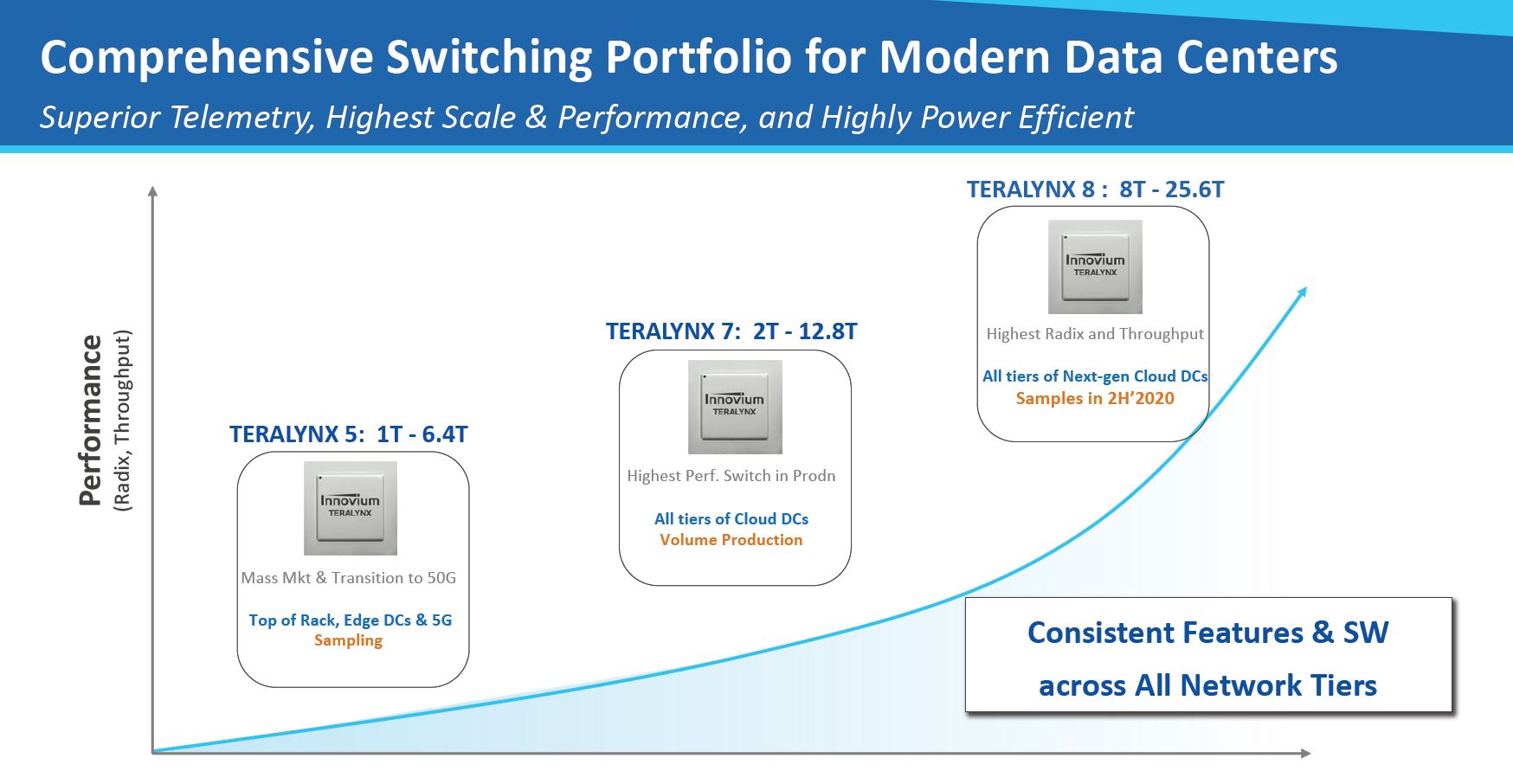

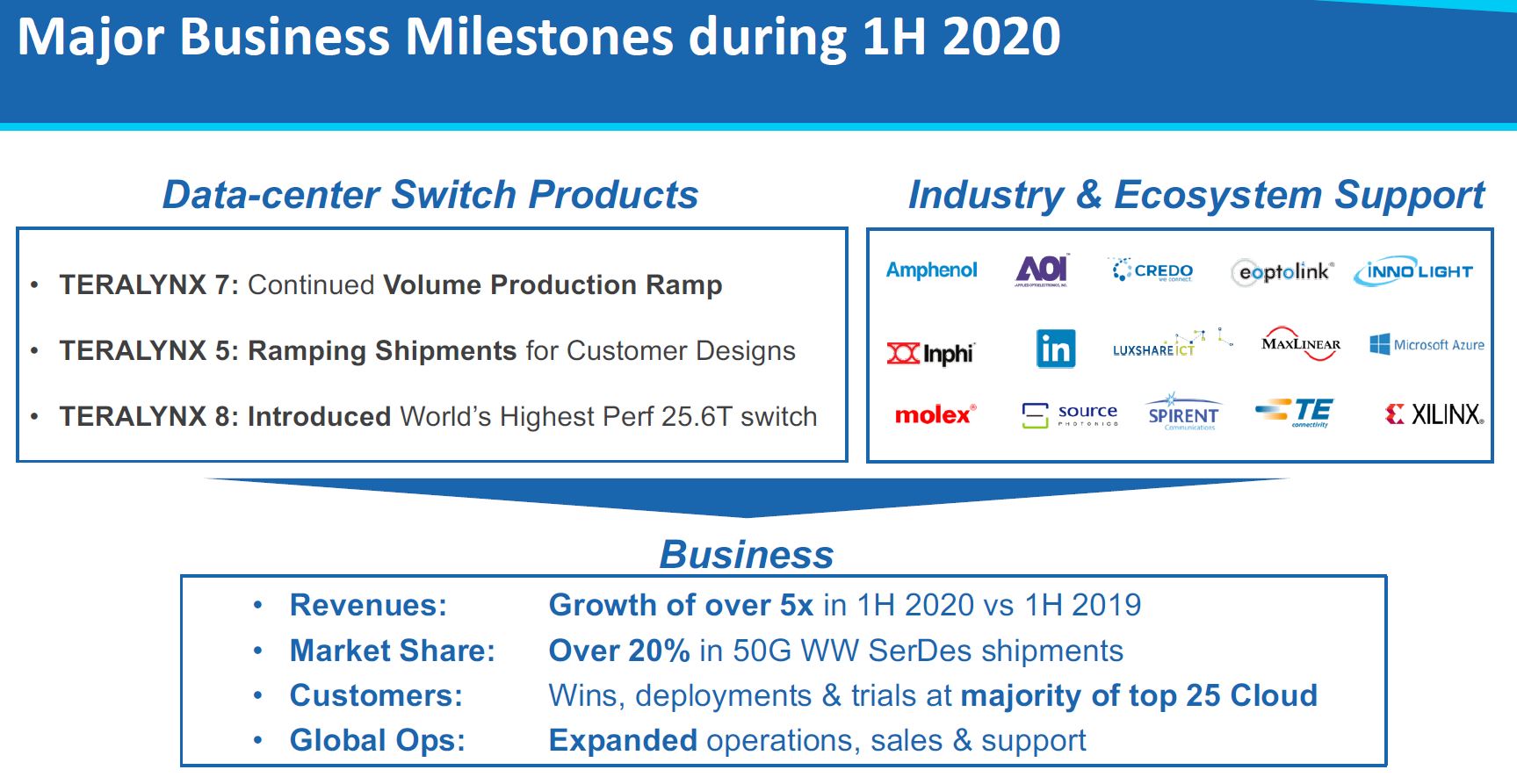

As a quick level-set on Innovium, the company makes high-speed switch chips that compete with Broadcom Tomahawk and Trident series switch chips. It has its Teralynx 7 12.8Tbps product out now, the lower-end 6.4Tbps Teralynx 5 product is sampling, and the Teralynx 8 25.6Tbps product will be sampling later in 2020. Figure it takes several quarters between when a chip is sampling and when it can feasibly go into production switches after testing and validation.

The market for these tends to be more of cloud and hyper-scalers right now, however companies such as Cisco have lines based on Innovium products. Innovium’s solution promises both the performance and programmability of Broadcom’s two main lines in a single solution so customers do not have to pick one or the other.

With this round of funding, PremjiInvest, Blackrock, and DFJ Growth funds are entering the equity pool. It is good to see that Innovium is attracting new money from new investors, not just additional capital raises from existing investors.

Although specific valuations were not disclosed, the company is touting “Innovium becomes the first network silicon company to achieve unicorn status.” The term “Unicorn” is generally used for startups that have valuations in excess of $1 billion USD.

Final Words

For Innovium, this is a big deal for a number of reasons. Principally, it gives the company more runway to continue developing next-gen products. While few in the industry expect that the giant Broadcom will exit the switch chip business in 3 years, that is a risk with a silicon startup. By securing a large chunk of funding, the company now has the runway to continue developing products and showing potential partners and customers that it will be a player for the foreseeable future.