Recently I attended Inspur Partner Forum 2019 in Shanghai, China. During the event, I had the opportunity to interview Lillian Wang, SVP of Inspur Group and General Manager of the Cloud Service Provider business at Inspur. Essentially, Lillian is the formidable force driving Inspur’s growth at cloud service providers like Baidu, Alibaba, and Tencent. In turn, that CSP segment is what is driving Inspur’s enormous growth, rocketing them into the #3 spot for global server shipments. Taking the opportunity, I wanted to ask Lillian a few questions around Inspur’s JDM model and their success in this CSP market.

Interview with Lillian Wang, SVP of Inspur Group and General Manager of the Cloud Service Provider Business

As a quick note, before we begin, we were using a (great) translator for this interview. We are going to use the English translation.

Patrick Kennedy: What really makes Inspur’s JDM model different than what other server vendors are doing in the marketplace?

Lillian Wang: The JDM model is Inspur uniquely created for the CSP data centers at large scale. It is different from the OEM and ODM models and because of our focus. The cloud computing, big data, and AI segments are growing very fast and the infrastructure is realizing fast intuition. We need to agile development, agile delivery, and that is why we created this new JDM model. It’s different from OEM is because OEM simply providing a small variety of product based on certain brands. We are different from ODM because ODM is simply based on simple L6 developed product.

JDM is end-to-end lifecycle management from the acquisition of a requested requirement to design, to the grey release to the small batch release, to large scale release. It is a large scale agile delivery of the whole supply chain. It is different from OEM and ODM and it is uniquely created by Inspur.

Actually, our JDM model is leveraging the past 10 years of Inspur’s experience in serving China’s top CSP customers. It is based on Inspur’s experiences and also the business scenarios and business rules of our customers.

PK: How will Inspur use what it has developed with cloud service providers to expand its addressable market to additional customer segments?

LW: JDM has its own organizational design because if you want to deliver something, you need to have the relevant organizational structure. So for the JDM model, we have a dedicated CPM team, supply team, service team, and quality team. For a different segment, like Finance, Smart Retail and other cloud customers, for example, we have bundled solutions and the relevant organizational designs, those for large customers. For smaller and medium-large customers, we have a virtual organization structure. They are very fast, flat and high coordinated, so it can be very well matched with the business and technology teams of our customers.

For example, the “Fuxi” lab we launched together with Pingan Technology, it is an incubator to quickly incubate the team and technologies of Inspur into Pingan Technology.

It has something to do with copying the more advanced capabilities from competitors, or even the market, and copy them to our customers. For example, in the supply chain, we had agile delivery before the JDM model usually of PO plus 30 days, especially for some dedicated products. Now, it is PO plus 7 to PO plus 15 days of delivery. That means we are always improving our enterprise standard to provide better competitive solutions to improve our customer satisfaction.

Inspur is actively participating in open source communities like OCP and ODCC. We have a consensus with our customers that we will release or share advanced and matured modules into those open source communities. This is so customers can utilize them at a very low cost. In this way, we can quickly promote and manufacture the models for our customers. With the open source community gaining more and more impact, increasingly organizations are willing to share. That is why the new solutions and models of Inspur can be quickly spread to other customers.

PK: Is Inspur helping any of its customers market their software and solutions to the broader market?

LW: Yes, we help our customers promote their software and solutions as well. Actually, we have several types of CSP-native customers serving consumers and other businesses. They mainly provide online digital services. Inspur has been a business-to-business vendor for the past 5 years and thus, we have had less integration with other customers.

Now, because of the development of cloud computing, big data and AI in the Chinese market, we see the transformation from the consumption Internet to the industrial Internet. This is actually a bigger market that includes the government market and the big business-to-business market. The supply chain here is very long, including IaaS, PaaS, SaaS, and all of the stack. We need to promote our solutions together as an integrated solution through the ecosystem. That is why Inspur will jointly promote the partners or customers’ solutions to the market as well.

PK: How will Inspur continue its rapid growth against companies like Dell, HPE, Lenovo, Huawei, and others?

LW: This is a question that everybody is interested in. In the past few years, Inspur has enjoyed very rapid growth. According to IDC and Gartner Research, Inspur is the fastest growing server vendor in the world, so people may wonder how we will sustain such growth.

I will talk about the growth rate. We first need to look at the scale of the market or the space for our development. First, I will say something about the Chinese market. Among the Super 7, Chinese customers, Tencent, Baidu, and Alibaba are our customers. There are some others like Toutiao, and some newly emerging industrial customers like Pingan, which is the leader in the Internet finance vertical. The Chinese market space is very large for us, and especially as I said, the consumption Internet is transforming into the industrial Internet that will add to some spillover effect. China’s customers actually account for about 15-20% of the world’s total market. The US accounts for more than 40% and the European markets are more than 10%. So, Inspur is also actively expanding its business in US and European area, where is establishing R&D centers and production lines. Based on the experience we gained with this CSP market in China, I think the foundations are very solid for our future growth.

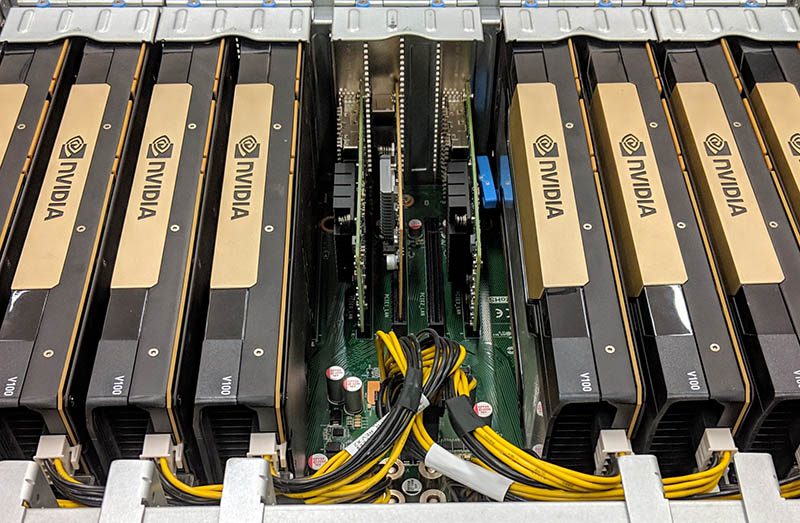

The market space is one aspect. The core still lies in the product competitiveness and product innovation, especially our product for the hyper-scale data centers. Actually, at IPF 2019 we showcased a series of new products, including the rack scale servers, which fit into a lot of open standards, open community standards. We also showcased the full-stack layout of the AI-related areas. For the whole group in 2019, our R&D investments will increase by 36%.

PK: What does Inspur need to do differently to grow in Europe or EMEA?

LW: So currently we are still focusing on the North America and European market, and we will deepen the JDM model based on past experience. Because North American and European markets are still new markets for us, and we want to strengthen the early joint design with our customers, including R&D, sample machines, and testing. That way the customers can experience our capabilities, culture, and product design themselves.

PK: What does Inspur need to do to grow in the US and North America?

LW: The important activity is to build up the marketing and sales team for the North America market. For the marketing side, we need to expand the brand, our reputation, and awareness of Inspur, so that more customers know about Inspur, its capability, and its success cases. For sales, we need to do capacity building, so it can cover more areas in the market. The core strategy is still to deepen the JDM model, but it has to transform the Chinese JDM model to the US, so it is not simply copying. We need to have a corresponding strategy and the core still lies in the product innovation system and the IT system building.

PK: Are there other products or product segments that you see opportunities for Inspur in the next 3-5 years to take advantage of?

LW: Three areas. First, we will continue to invest a lot in AI, and improve the product layout and make a more complete system concerning AI. The second is the edge. We will increase focus on edge computing. For example, we will try to do more with the ecosystem from the cloud to the endpoint. We will provide end-to-end total solutions together with our partners. The third is with key components such as the SmartNIC. Because computing and servers are the core of Inspur business, we will leverage our advantage in x86 servers and SDN to include the SmartNIC to form a total solution in this area.

The first ODDC standard rack scale server we launched in 2009 has achieved great success in the Chinese market. The Chinese market will increase faster than before. Globally, we also see more and more customers are building their data centers independently. So the rack scale server will certainly gain scale and we will increase focus in this area as well.

PK: Thank you so much, for being here for this interview. It is awesome to learn more about Inspur’s business.

LW: Thank you very much!

Final Words

I wanted to say thank you to Lillian and the team at Inspur that coordinated this interview and our excellent translator. Getting to sit down and discuss with Lillian what Inspur is doing to achieve growth several times higher than other vendors was certainly interesting.

Having the opportunity to discuss the market with Inspur as well as Dell EMC and HPE all within two weeks was enlightening. The top three vendors in the space have very different approaches to the market. Over the next few years, it will be interesting to see how Inspur’s model grows as it wins business outside of China.

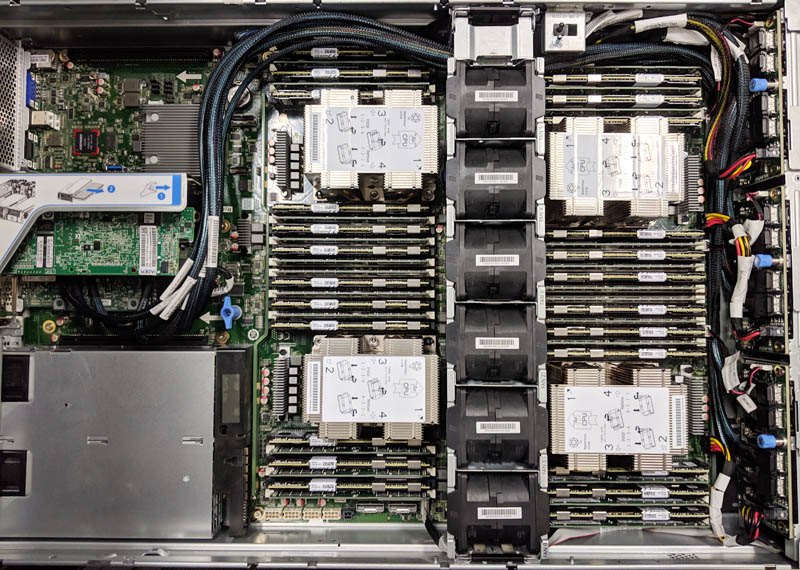

At STH, we have been making an effort to cover Inspur and its products. You can read our hands-on reviews in Inspur Systems NF5468M5 4U 8x GPU server and Inspur Systems NF8260M5 4P Intel Xeon OCP server. We have more reviews planned since this is often the first place our readers outside of China will see an Inspur server.

They’re basically taking the opposite approach of Lenovo, Cisco, HPE, Dell, IBM and others. That’s fascinating. Thanks. They’ll need more resellers here in Germany if they want to get anyone to buy their servers

What’s the mix of L6 to L11?