In a move this morning, Intel is set to acquire Tower Semiconductor. This is a big move to bolster Intel Foundry Services or IFS. Over the past year, Intel has been focusing on building its business to compete with TSMC as a foundry destination, and this is a $5.4 billion jumpstart to that effort.

Intel Acquiring Tower Semiconductor

If you have never heard of Tower Semiconductor, they make many of the non-logic semiconductors such as radio frequency (RF) CMOS, power, silicon-germanium (SiGe), and industrial sensors.

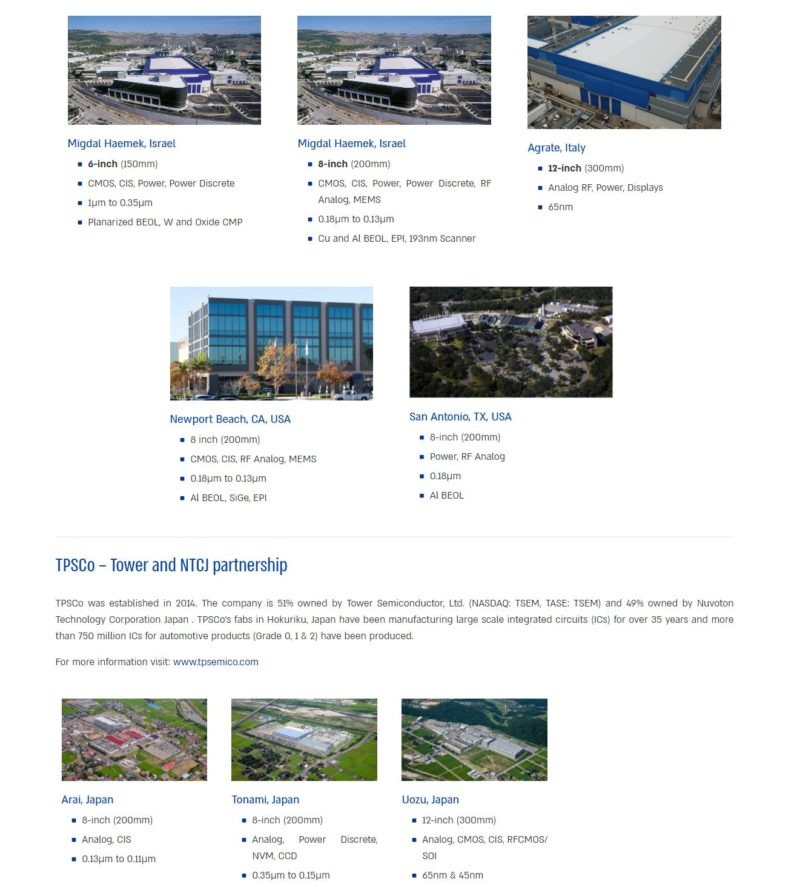

Perhaps the biggest one is that Intel also gets several fabs either directly or through TPSCo. Pat Gelsinger, Intel’s CEO, has been lobbying governments to fund building fabs outside of Taiwan and China, such as the recent Ohio fab campus. Tower’s facilities are in Israel, Italy, and the US, with JV facilities in Japan.

For our readers, Nuvoton is a brand we see on many server motherboards and is the 49% JV partner in Tower’s Japanese fabs. Nuvoton is a spin-off of Winbond and it purchased Panasonic Semiconductor Solutions Co. in 2020 which had the JV with Tower.

Overall, this makes a lot of sense for Intel to look to expand in this direction.

Final Words

From a business perspective, this is a strong move for Intel and IFS. Intel wants to become not just the place where silicon is made, but also the place that packages IP from multiple fabs. One way to do that is to offer a broader portfolio of silicon types, and then also show how they can be packaged together. Bringing aboard a foundry that does not directly compete with Intel’s main product lines is a step in adding non-traditional customers to the IFS roster. In terms of whether this means Intel spins IFS, it is possible, but it would be strange to see that happen without a better IFS story.

With that said, there are challenges. Although the companies do not compete directly in manufacturing, regulatory agencies have been stepping up scrutiny of deals lately. Also, semiconductor manufacturing is a hot topic on the international stage so we will have to see how this goes through the regulatory progress.

Pat Gelsinger’s strategy seems clear: he wants to be the chipmaker’s chipmaker by building, acquiring, and hopefully getting some governmental funding and procurement preferences along the way.