IDC released its quarterly server tracker this afternoon for Q1 2019. The tracker’s results are a mixed bag for the industry. On the one hand, revenue increased 4.4% year over year. On the other hand, unit shipments were down 5.1% meaning that there were about 140,000 fewer servers shipped in Q1 2019.

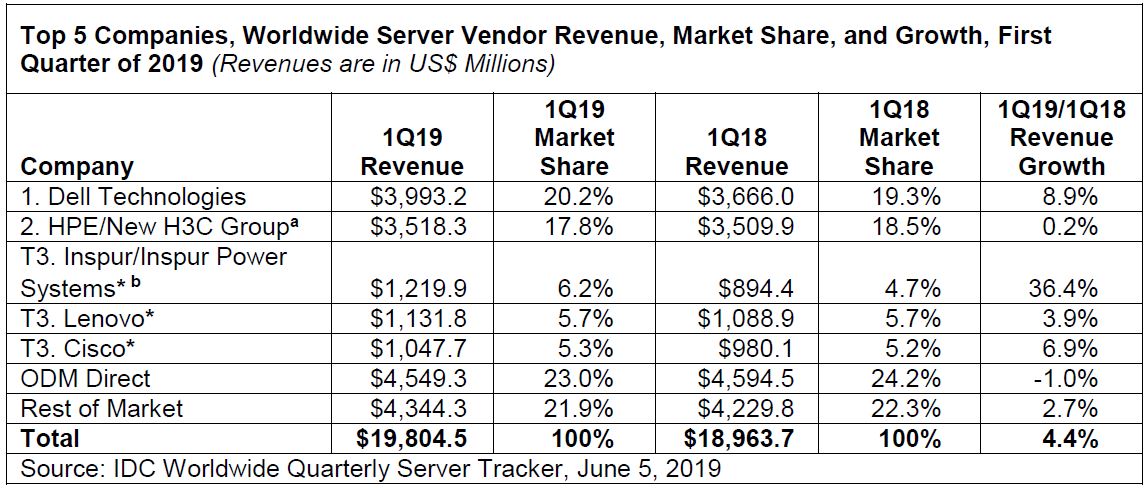

IDC 1Q19 Quarterly Server Tracker Revenue

Overall revenue for the market grew by 4.4% from Q1 2018 to Q1 2019.

That is healthy growth, but not astounding by any means. Dell Technologies took the #1 spot, now with about 13.5% more revenue than HPE. Dell Technologies grew by 8.9% or about twice the market average while HPE grew only 0.2%, well below the market average and inflation. HPE’s numbers are actually down from the year-ago quarter on an inflation-adjusted basis which IDC does not provide.

Inspur grew at a clip of 36.4% versus the year-ago quarter which is the highest of the peer group and over eight times the average.

Cisco also was above its average peer group with 6.9% growth as part of a three-way tie for third. Lenovo grew at 3.9% which is near the market growth rate.

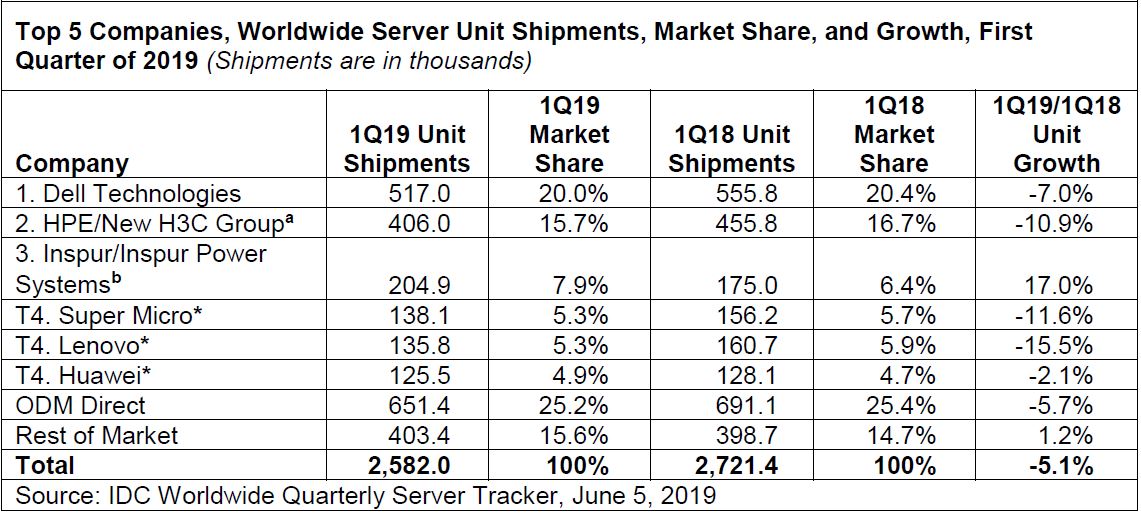

IDC 1Q19 Quarterly Server Tracker Units

The unit volume showed a much bleaker picture for the industry with shipments down 5.1% for the Q1 2018 to Q1 2019 comparison.

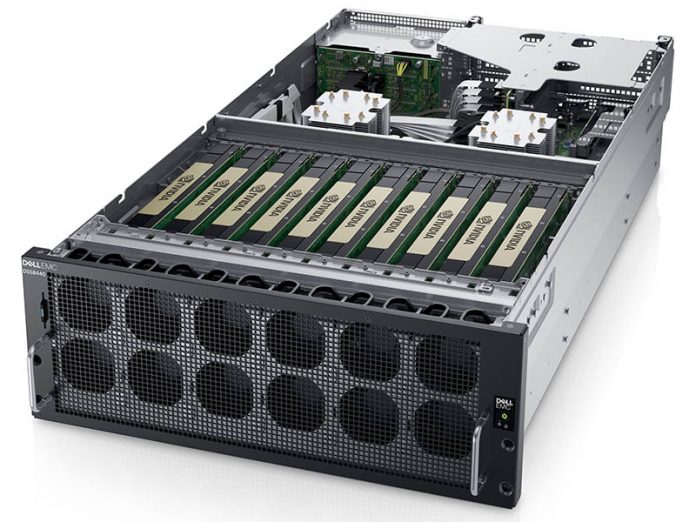

Driving the 36.4% revenue growth at Inspur was a 17% unit growth. That seems to indicate that Inspur is selling higher ASP servers. This makes sense given our Inspur Partner Forum 2019 Our Recap from IPF 2019 coverage where the company touted selling more than half of the AI servers in China. STH visited Jinan, China where we showed how the company is automating its manufacturing in Visiting the Inspur Intelligent Factory Where Robots Make Cloud Servers. Here is the video from that trip:

Dell, despite 8.9% revenue growth saw 7% lower unit shipments. HPE shipped 10.9% fewer units. Dell has an almost 27% unit shipment lead over HPE.

Supermicro remained tied for fourth even with some significant headwinds losing less unit volume than Lenovo.

Final Words

As an anecdote, STH’s growth rate was slightly slower in Q1 2019. This is because it was the last quarter of Skylake-SP. The second generation of Intel Xeon Scalable processors launched on April 2, 2019. Although Intel and its partners had a robust early shipment program, it is highly likely that server companies saw some disruption during the end of quarter purchasing with the new chips launching two days into the new quarter.

If you want to check out the IDC 1Q19 Quarterly Server Tracker you can do so here.

Can you provide a breakdown of Intel vs Amd server revenue??