Today Intel announced a number of updates in its manufacuturing operations. Intel has a plan to regain process leadership and redefine how it does business. Intel announced IDM 2.0, but the next step is interesting since it is effectively one of the key steps one would take if it was planning to spin off a business.

Intel Manufacturing Gets its Own Profit and Loss Potentially Gearing Up for a Spin-Off

Intel has two main challenges right now. First, it is seeing declining revenue, partly due to a cyclical market and partly due to missing product launch windows. Second, it is trying to ramp capacity in its fabs, while it is also utilizing TSMC for some leading-edge designs (further shifting capacity.) The second one really boils down to trying to ramp new costly processes. As such, the announcement today had a heavy cost focus.

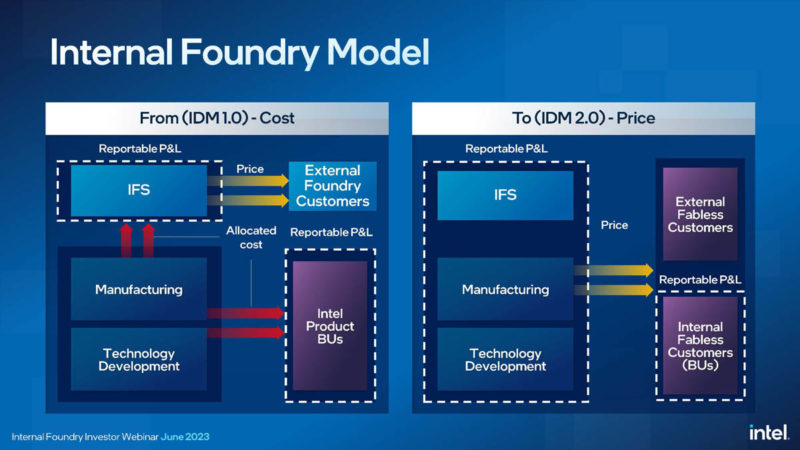

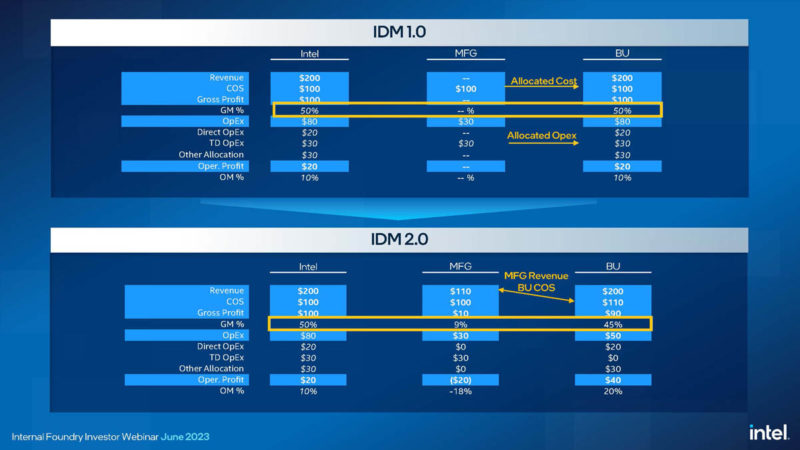

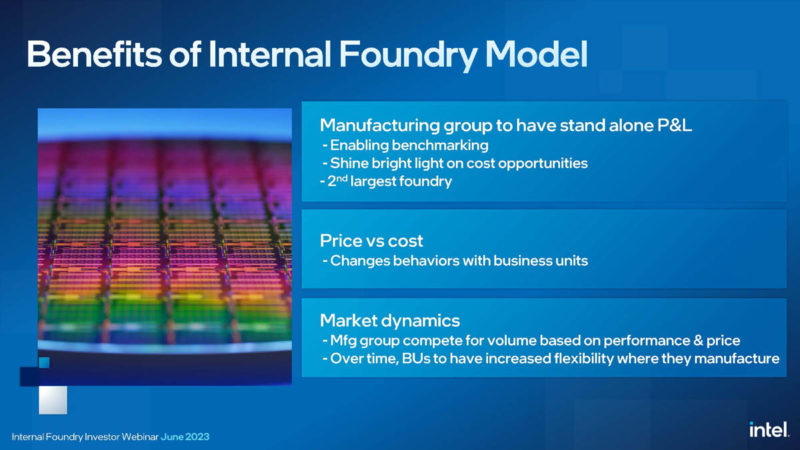

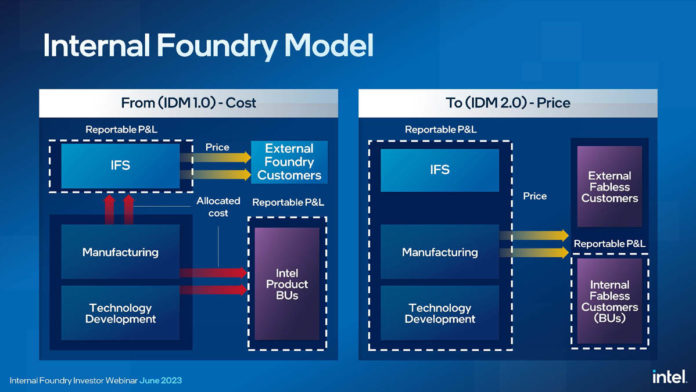

One of the biggest concepts was that Intel is transitioning to IDM 2.0. We have covered this multiple times, but the transition will change the way that Intel looks at its manufacturing organization. Intel is going to start treating its internal business units more like external fabless customers. That means, revenue from IFS as well as its internal customers will now have its own P&L.

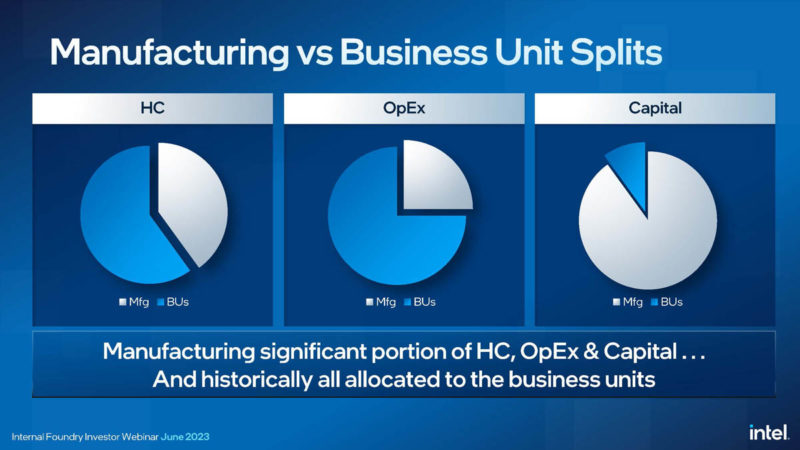

Intel explained that this is partly due to the resource allocation between Intel’s Manufacturing and BU sides.

Reading between the lines, Intel seems to have concluded that its internal customers have been taking advantage of the fact that the internal customers had a different price than market price on doing things like making small iterations on chips. Effectively, Intel’s BUs were behaving differently than if they had gone to external foundries.

In the IDM 1.0 world, that worked. Intel had process leadership and could charge a high margin for its products. This is what the picture looked like when Intel had technology leadership.

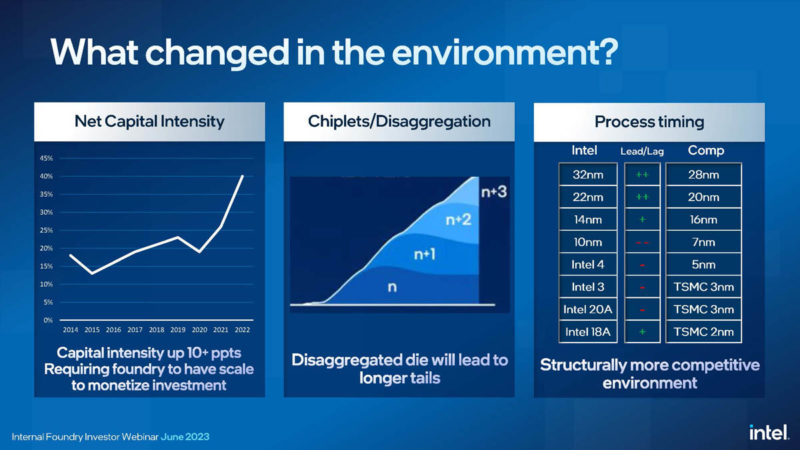

In one of the more honest slides, Intel said it went from leadership in the 14nm Intel v. 16nm TSMC era, but lost leadership in the 10nm Intel/ 7nm TSMC era. Intel also says it will take until Intel 18A against TSMC 2nm at this rate to regain process leadership. Intel 3 and Intel 20A seem behind TSMC 3nm from Intel’s slide projections.

To deal with this, plus the fact that with chiplets nodes will be used longer, Intel is going to start charging its BUs as it would an IFS external customer.

That will leave to a standalone P&L statement for the internal foundry. We mentioned how Intel is trying to change its BU behavior. Intel even had a slide saying as much. Here is the key: Intel in many ways will need to regain process leadership. If 18A slips, then its BUs may find external foundries more attractive. Intel says 18A is on track, but that is the risk here.

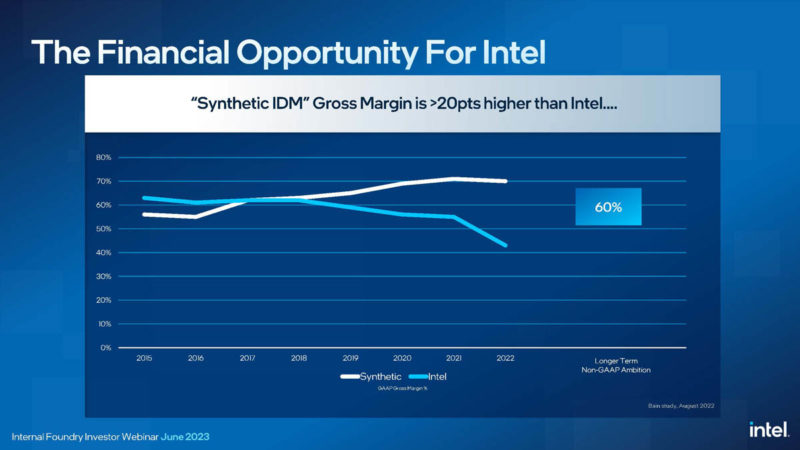

Intel thinks that it can improve margins.

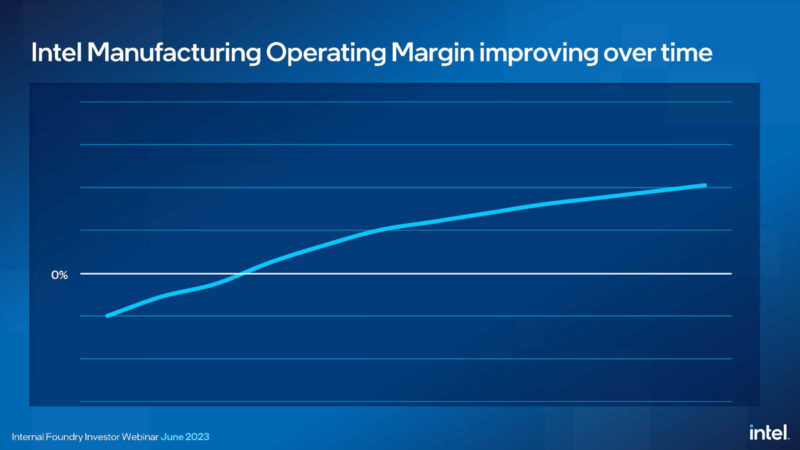

Intel also thinks that it will move from a negative operating margin to a positive one over time. There is no time scale with this, nor magnitude. Just a line crossing 0%.

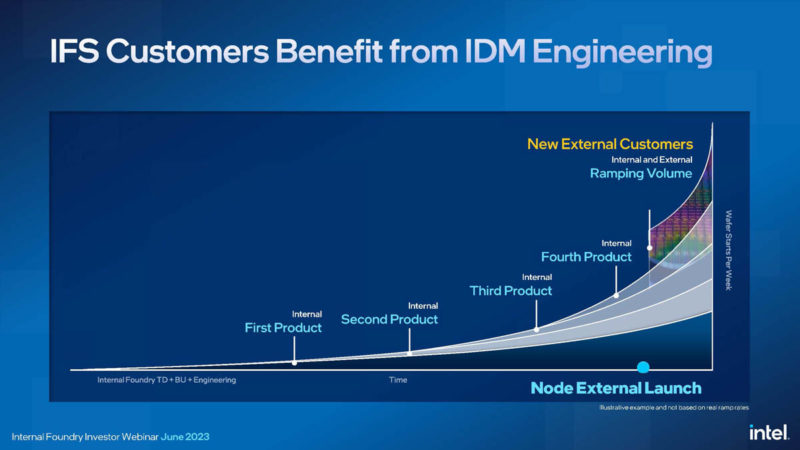

Intel said it expects to land its first external customers later this year. Perhaps that is part of the Intel IFS and Arm SoC Manufacturing Deal. The chart below seems to show that it will give some priority pre-volume ramping to its internal customers.

Intel has a number of cost savings opportunities it hopes to achieve with this new model.

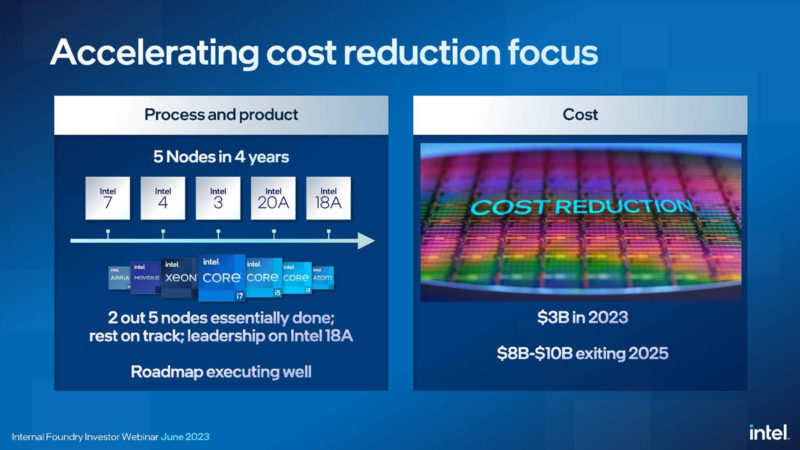

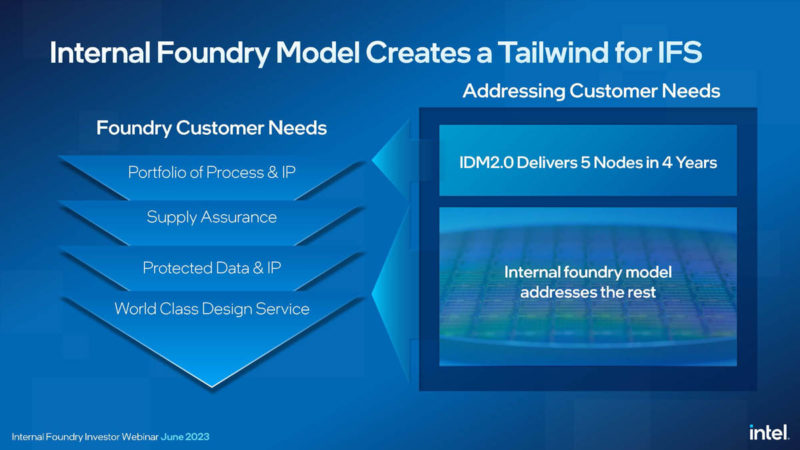

Intel also says it is focused on delivering 5 nodes in 4 years.

We have heard this a lot, but the question will soon pivot to what is next.

Final Words

Intel’s vision is that it regains process leadership and continues building chips for other customers. At the same time, it is really hard to look at messaging that Intel is creating a P&L for its foundry business that charges Intel BUs prices more in line with external customers to give a true P&L as anything but a setup. It feels like this is a setup to announce a spin-off in a few years. We know it is a capital intensive business, but Intel in its IDM 1.0 and 2.0 accounting slide shows that it is planning to show the businesses as two P&L’s. That is exactly what one would do before spinning off fabs. Intel has sold stakes in a number of its businesses to raise capital, and having another P&L helps with that as well. Still, it is hard to shake that feeling given Intel’s direction.

Our guess is that once chiplets become mainstream, Intel can point to the concept that chiplet IP is coming from multiple sources as the market change leading to not needing a vertically integrated model anymore, and therefore a reason for a spin-off.

We shall see on that one.

Some good analysis. Hopefully they can do a fab spin off in a few years from a position of strength and not desperation.

The restructuring is likely a condition of the State funding(s) Intel is getting for building new factories in EU and USA.

Poland, Germany, and Israel are OK with supporting foundry extensions, but it must be clear those funds are not used for increasing the profits of the main Intel.

Thus, they probably required that the prices that the foundry asks later from ANY type (internal or external) the customer must be the same, and other USA or EU chip-producing companies get the same benefits as Intel. And this was the Intel proposal to make it clear that it will comply.

At this rate, Intel might as well spin-off IFS into it’s company and seperate Intel’s Chip Design side and Manufacturing into seperate companies.