At Dell Technologies World 2021, the company introduced the next evolution in Project Apex. For those who have been in the industry long enough, this will seem very familiar as we noted in our Dell Technologies Cloud Console and Project Apex piece previously. In reimagining the future, Dell is taking a page from the past as it is asymptotically approaching the service scope of EDS in its heyday.

The EDS Model as Background

For those readers who are not old enough to remember, EDS thrived in an era where large organizations such as major automobile manufacturers, airlines, government agencies, and similar size companies would contract EDS to outsource IT. Since companies outsourced large portions of their IT infrastructure to EDS, and the switching costs were high, the contracts were often signed for 7-10 years in length.

Much of my 2008 was spent working on the HP-EDS merger as I was one of the first 10 outside consultants working on the massive due diligence efforts. My specific role was to lead the contract due diligence effort where we looked at a large number of EDS contracts to see where they were in their lifecycle. After the deal closed, I spent more time at the EDS headquarters building in Plano, TX (which was awesome) working through some of the valuation models used for estimating and accounting purposes.

Even more than a decade removed I still do not want to go into specifics on the contracts. Also given the scale of these contracts, many that were valued well over $100M each in 2000’s dollars, they were highly negotiated and customized for customers but there were a few key principles. What I can say is that for the data center segment, the model was presented to customers simply. Customers basically paid for units of compute time, storage, network usage, and time. There were sometimes special additions and provisions for certain machines/ characteristics. EDS usually managed the equipment installations/ professional services and upgrade cycles.

While we can focus on the data center side here, and that is perhaps the initial focus of Dell Apex, EDS also extended this to client computing devices. A major part of HP’s acquisition thesis was that it could turn customers to HP gear from servers to notebooks/ desktops and printers over time within the existing EDS contracts. EDS also operated equipment in data centers and when one would fail, it would sometimes bring down major societal functions such as airline booking systems.

The challenge with that business model was that as x86 servers gained market share, and costs went down, thanks partly to Dell’s model, customers started to push back. Contract durations shrunk. One of the key challenges I heard from EDS customers was that allowing a vendor to manage upgrade cycles meant that EDS had little incentive to get the newest technology since it made more margin the more it could extend equipment lifecycles. That extended, in some cases, down to the in-wall network wiring at customer sites. Another key concern was that while outsourcing was easy, the lock-in this created made switching costs high and EDS used that to further push margins on deals.

That is important context when we discuss what Dell Apex is aiming to do. The world has changed. Using “cloud” is now mandatory. Still, the business model is tried, true, and exactly what Dell is going to do.

Dell Apex

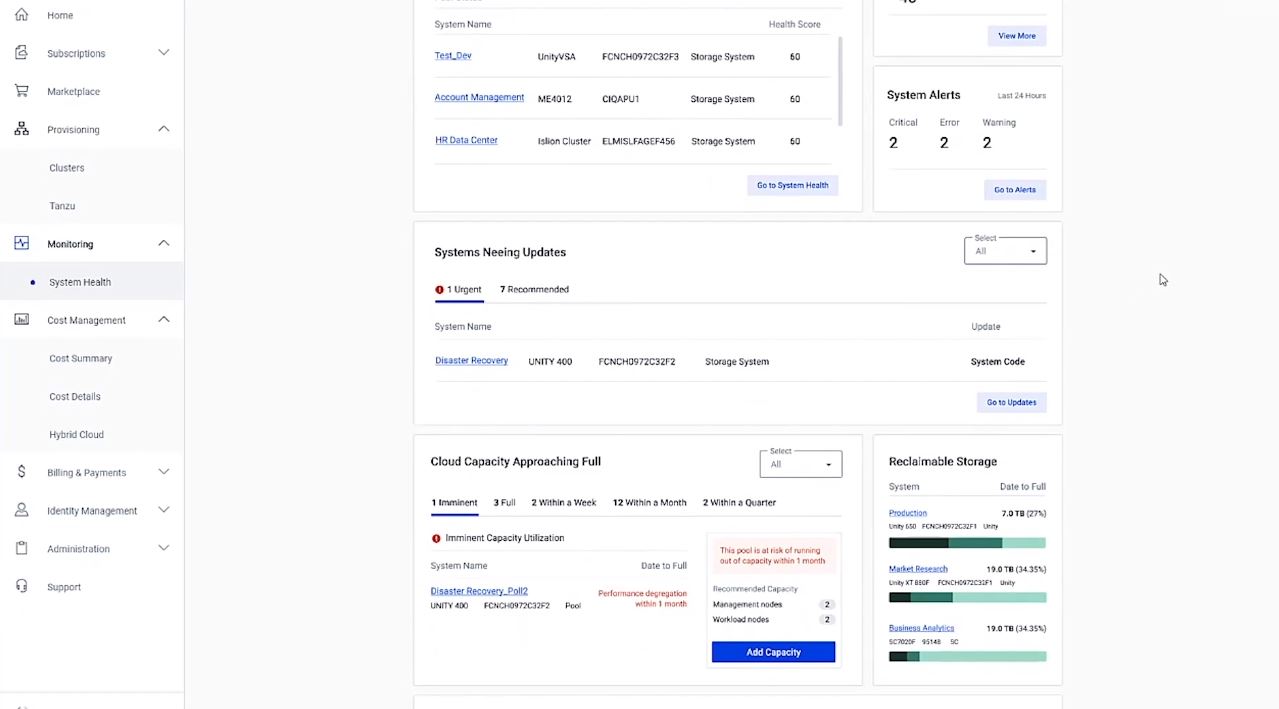

Dell Apex, in its current form, is designed as mostly a data center, or perhaps a data center to edge platform. It is not yet focused on client devices, but it does not take imagination to see that as the future, especially given the Dell + VMware client as a service offerings continue to expand.

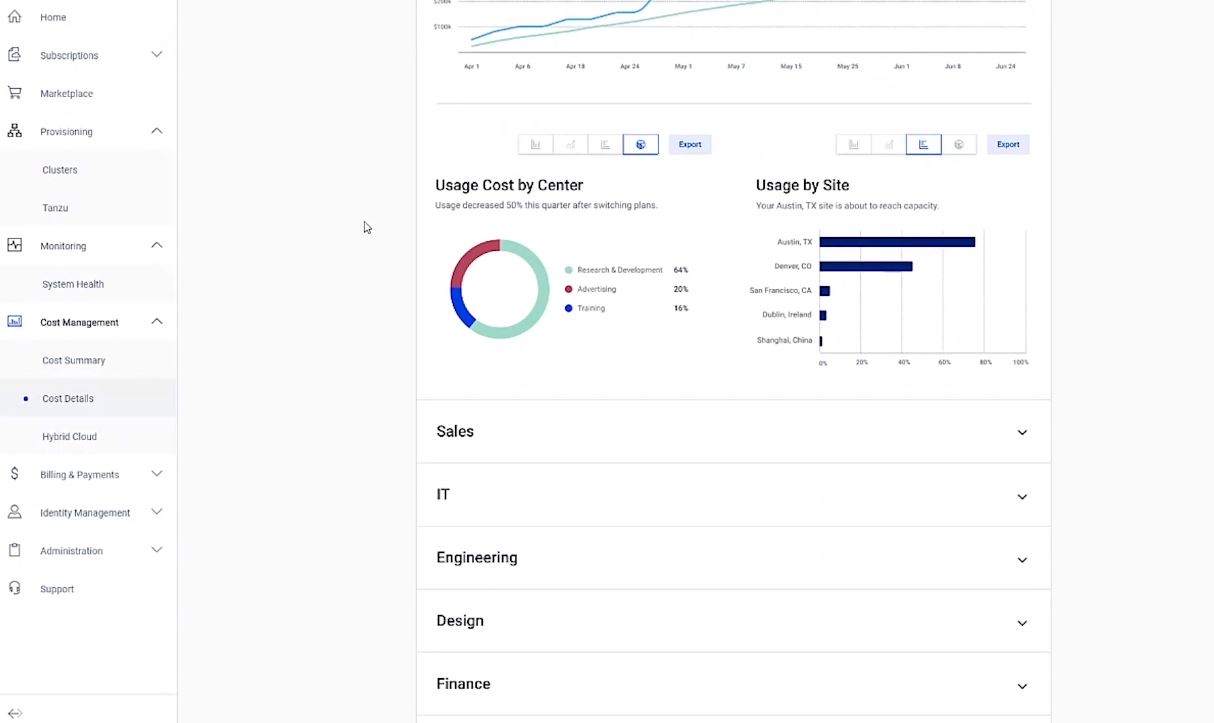

With the purchase of EMC, Dell became a major player in storage. Storage also has a unique place in IT infrastructure since data transfer costs can be high and latency is important. As a result, storage has its own “gravity” which necessitates compute and networking be built alongside. Dell Apex has base and on-demand capacity and usage models that really leverage the company’s products and software offerings alongside Dell Financial Services’ expertise to make this possible.

Of course, many customers are not just trying to replace storage with an on-demand or consumption pricing model. Instead, they are trying to replace compute and networking infrastructure as well. That is where the Apex Private Cloud offering comes in. For organizations that want on-prem or colocated private infrastructure, this is the offering.

One of the big thrusts in modern enterprise IT is the move to a hybrid cloud approach. Most organizations use at least some public cloud, but on-prem can still save a lot of money and also help with some compliance tasks. As a result, Dell is embracing that approach. We also saw that with VMware Tanzu and Cloud Foundation 4.0 for Enterprise Infrastructure. This hybrid cloud approach has been important to Dell for some time.

Dell further has consumption models with Flex On Demand and Data Center Utility that we covered a bit more in Dell Technologies Cloud Console and Project Apex some time ago.

The main thrust is that Dell wants to have a model where customers can consume its products and services focused on outcomes (usage of storage capacity, compute units, memory, and so forth) rather than focusing on the underlying hardware. Project Apex eventually means that Dell can use whatever hardware is the least expensive to service a customer. That may be a white box server from another vendor and indeed during Michael Dell’s keynote, one of its customer success stories was already showing non-Dell hardware.

Like the EDS model, once a customer is comfortable with Dell managing infrastructure, Dell can install servers from other vendors. Perhaps instead of PowerEdge, Dell can increase margin with Open19 or OCP servers sourced from third parties more like a hyper-scaler.

Still, having professional services and a consumption model is much easier when one also controls the facilities. Here, Dell and Equinix have a partnership to allow one to provision and deploy Apex at one of Equinix’s data centers.

The advantage of this arrangement is that it simplifies the deployment of services. Also, if a customer does not pay its bill/ discontinues using Apex, reclaiming technology is easier which helps with financial models.

One of the intriguing aspects of this model is also how services can be deployed. Dell can offer compute and storage while Equinix provides interconnect, bandwidth, power, cooling, and other physical infrastructure/ security. Those can be made available to customers from Dell/ Equinix’s pool rather than what is in a specific cage. With Equinix’s Packet acquisition this is clearly a model that Equinix is pursuing. It is also a model that has high utility value and ease of operation while also providing a high switching cost.

As a quick disclosure, I led a session at Equinix’s KubeCon EU GIFEE day event yesterday and my father is on the board of directors at Digital Realty Trust. Still, this is a great partnership.

Final Words

Dell needs to adapt to customers who are increasingly expected to purchase on a consumption basis. Given the fact Dell is using a well-established Texas business model that has a high switching cost, this makes a lot of sense. In the future, it would be almost shocking if we did not see client desktops/ notebooks as a service added to the Apex umbrella and that becoming a major growth area for Apex. That simply makes too much sense and many companies used this during the EDS era.

I doubt that Dell calls this the EDS model, but as one of the folks that had the opportunity to review a huge number of legacy EDS contracts over a decade ago, Apex feels exactly like what I would envision for a modern EDS offering, minus the client side of the equation. Overall, this is a great effort by Dell and one we hope to see more of in the future.

all anyone who can support the scale of operation needs to do to forever have my corporate heart is to offer the EDS model nicely diet successful, on a purely a la carte menu with comparables between services that include ostensibly the same jobs / provisions / facilities by necessity inclusive but in practice in very different ways eg the difference between public content distribution of edge content DNS and bundled DNS queries in support of a on boarding identity management scheme of customer acquisition and client convenience / availability, which I’m sure are clear can’t be the same SKU (sic) but give me service clarity and accounting transparency and I will settle for ratio metrics to differentiate budget items – basically just remove as much of the sales organisation and plough that back into a straight split half to me the rest to build a rep with the best resources available who gets paid from my divisional bonus pool as well as the employer / outsourcing company, and I will sign up and actually invest manpower to work with you to iterate and develop your next contract specification.

sell your corporate operating capabilities not replacements for my department and you’ll find I’m willing to run my department in ways that shares more intelligent understanding than you can ever get across any paper Chinese walls.

eg

the bottlenecks involved with purchasing presently are easier overcome using combined outsourcing services company heft and application insights I’m not wanting to share under any current model

I’ve just realised that I wasn’t at all clear that I have been thinking about how to sign up customers who are potentially unicorn scale saas businesses who may be able and willing even enthusiastic about giving the outsourcing company state of the art orchestration experience and best practices in return for a viable alternative to AWS during hyperbolic growth.

in fact naturally potentials typically don’t have competition who are outsourcing clients, but many outsourcing clients who have ambitions to reduce their dependence on manpower and other difficult to scale operations, are interested in successful and proven hyper scaler operating procedures and obviously proximity to such a team gives you confidence in the opportunity for real. Hockey stick growers need to acquire capacity on the scale of major outsourcing clients. Some hyper growers might be able to capture revenue from their devops capabilities if there was a reliable and responding sensible daily operating team available such as the outsourcing services company can provide.

I meant “unicorn potentials” at the beginning of my previous comment. of course it would be a lot more nuanced in reality but the skills commonplace to the ultimate throughput operators just don’t permeate corporate networks despite there being a considerable opportunity for efficiency and eliminating of expenditure. You won’t find the BIRD border routing daemon standard tech at your typical corporate, but intelligent network design could result in both less expenditure and also lower management overheads. The opportunity for using thoroughly proven software to replace highly expensive CISCO and Juniper and even Ciena systems is a substantial savings to a outsourcing customer, who might receive such a benefit via a interoperating agreement between the outsourcing services company (OSC) and a unicorn potential client (UPC) under which the UPC oversees and implements requested AS provisions for new OSC customer installations.

I remember when EDS founder Ross Perot was running for President and warning that NAFTA would lead to a ‘Giant Sucking Sound’ of jobs going to Mexico.

We all know what really happened, but today that sound is the sound of AWS sucking all the business our from under other server-hosters. it’s hard to say you have a business plan if you are in that business.

26 years after Win 95, remote management is for real, and Apex’s hope for survival is that ex-Apple, Big Tech is bad at client devices.