Ampere this morning is updating the market on some of its progress. There appears to be a lot happening with the company, and we have certainly been hearing more about them from customers over the past few quarters. As part of an event we were pre-briefed on, the company is announcing a number of new details, some are going to be a big surprise. Perhaps the biggest is in the headline, that the company is designing its own custom cores.

Ampere Strategy and Business Update Q2 2021

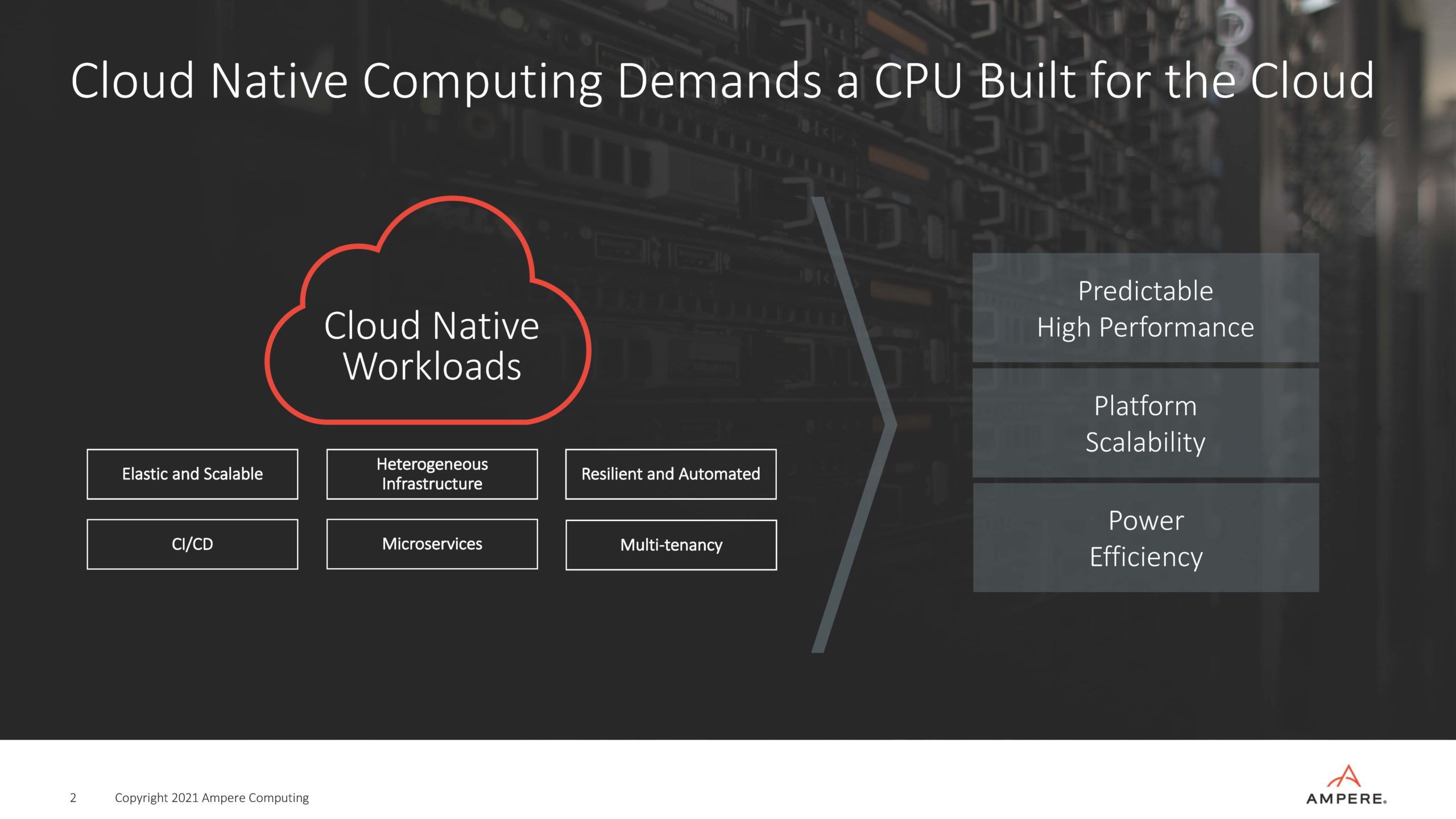

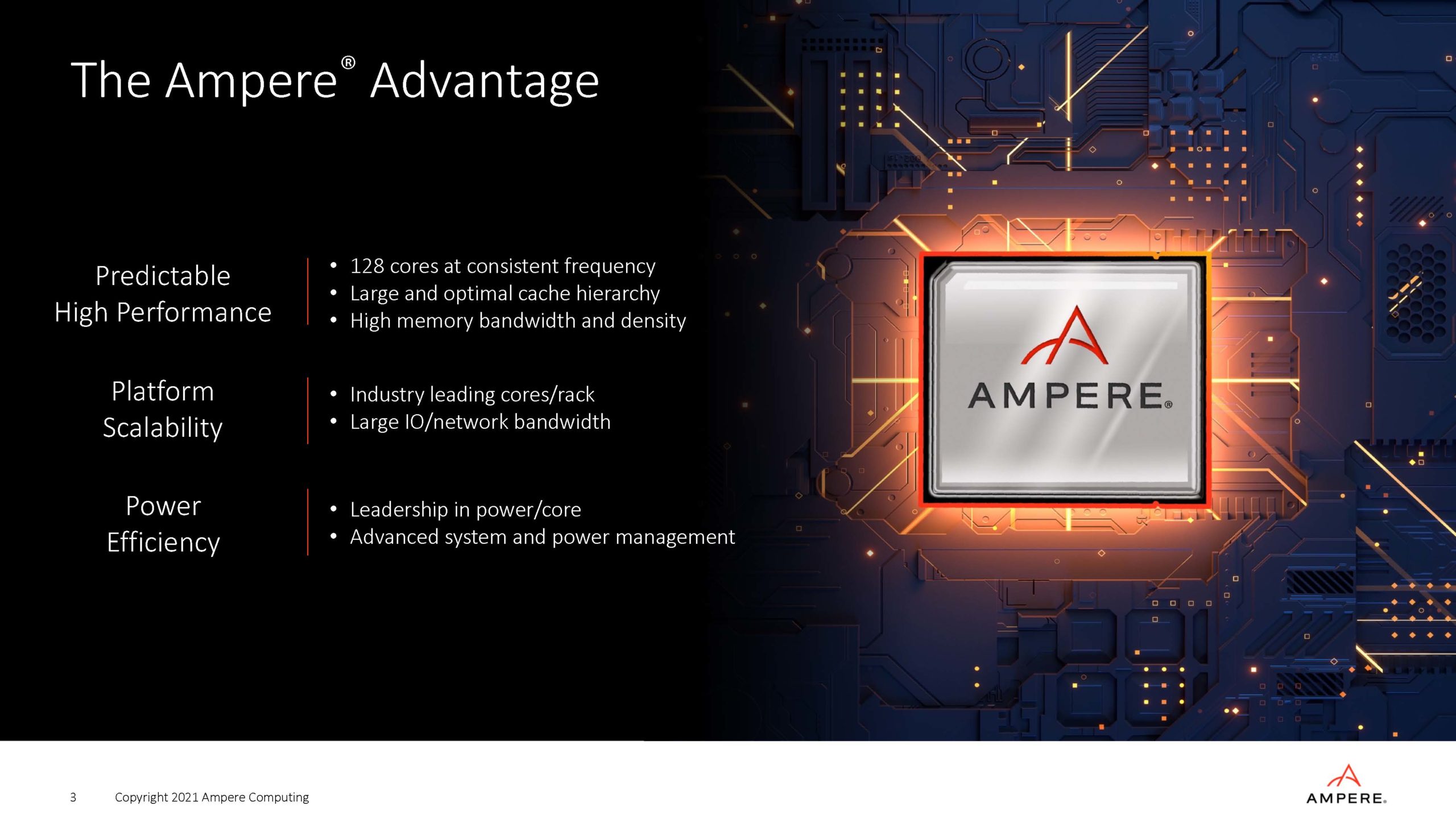

Ampere is basically focusing on cloud workloads, and to be more clear, it is focused more on running scale-out workloads that have become a major component of the overall landscape. We are going to discuss why this is important later.

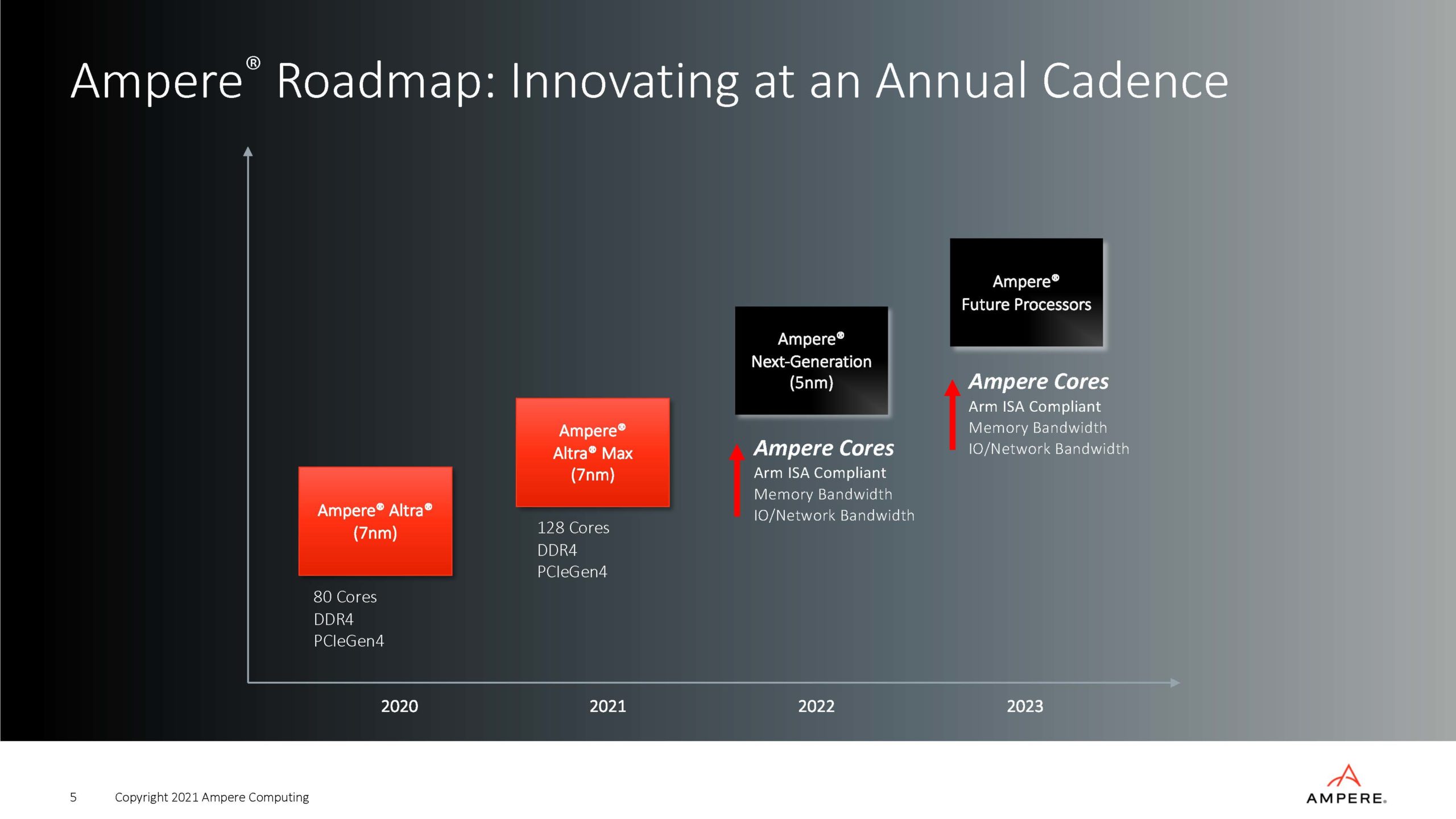

As we covered in our Ampere Altra Max M128-30 128 Core Arm Server Update, the 128 core parts are coming soon. While AMD is using SMT=2 to get to 128 threads with 64 cores, Ampere is offering full cores. As a result, the goal is to get more cores without resource contention on each core.

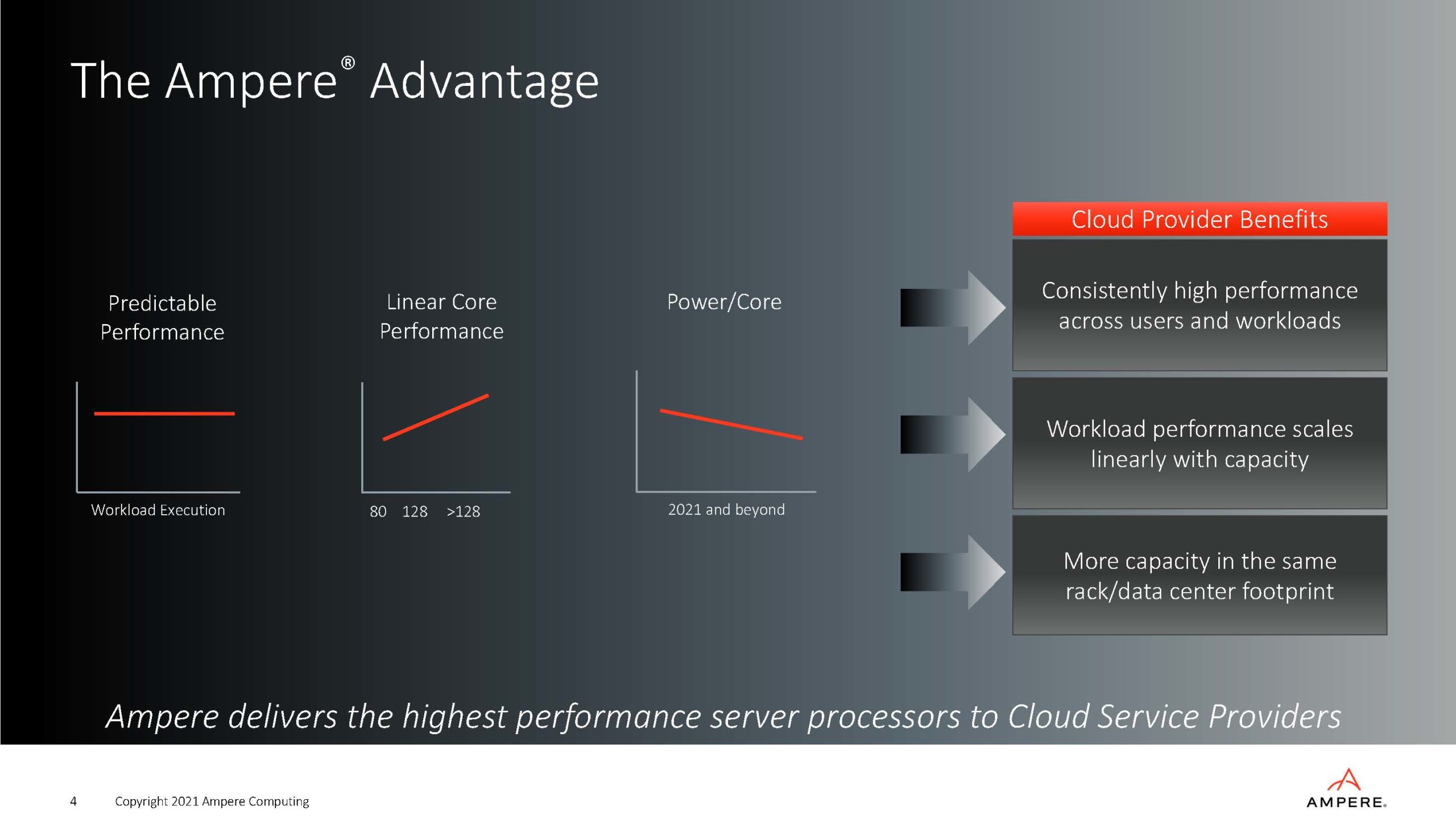

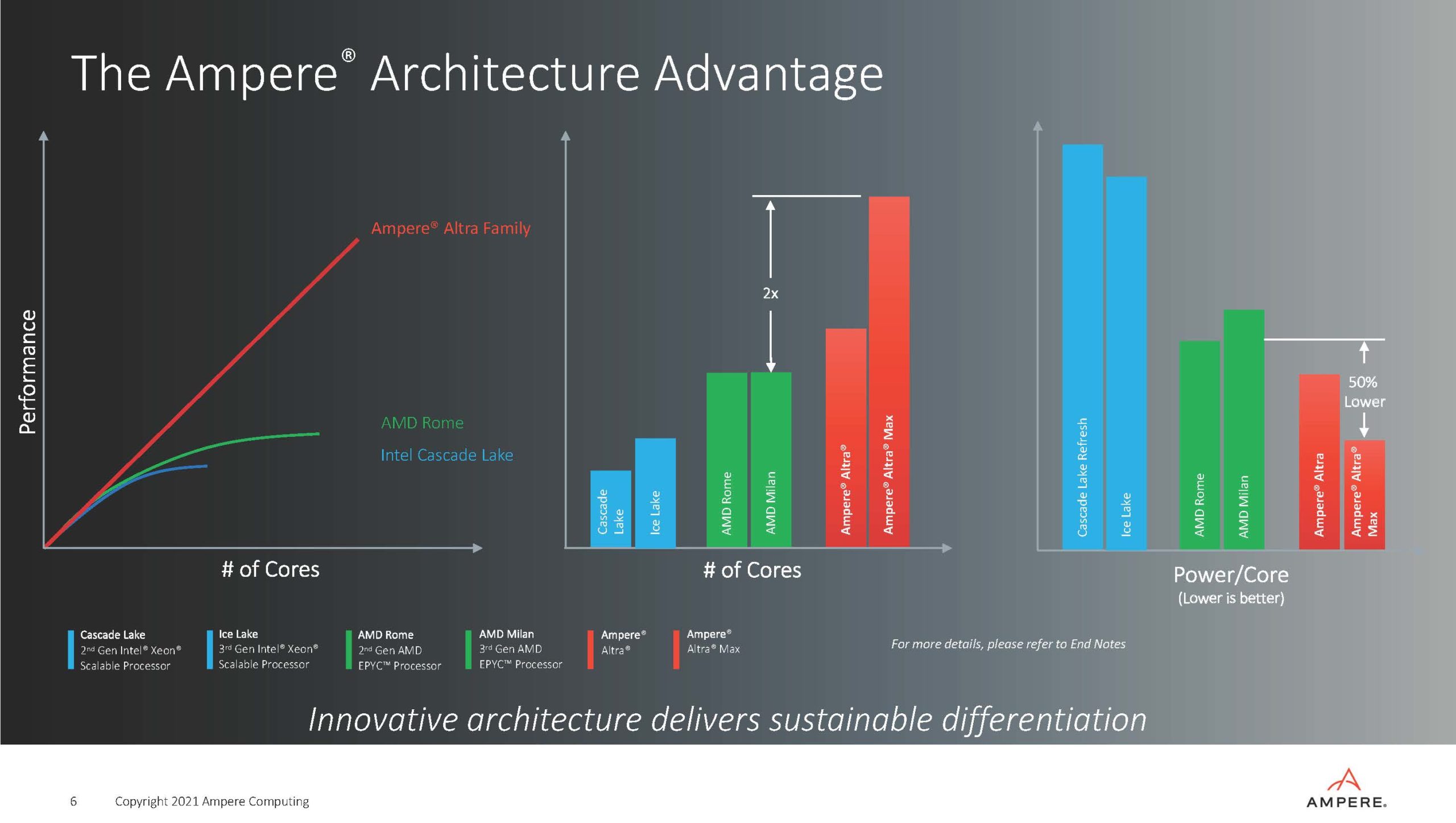

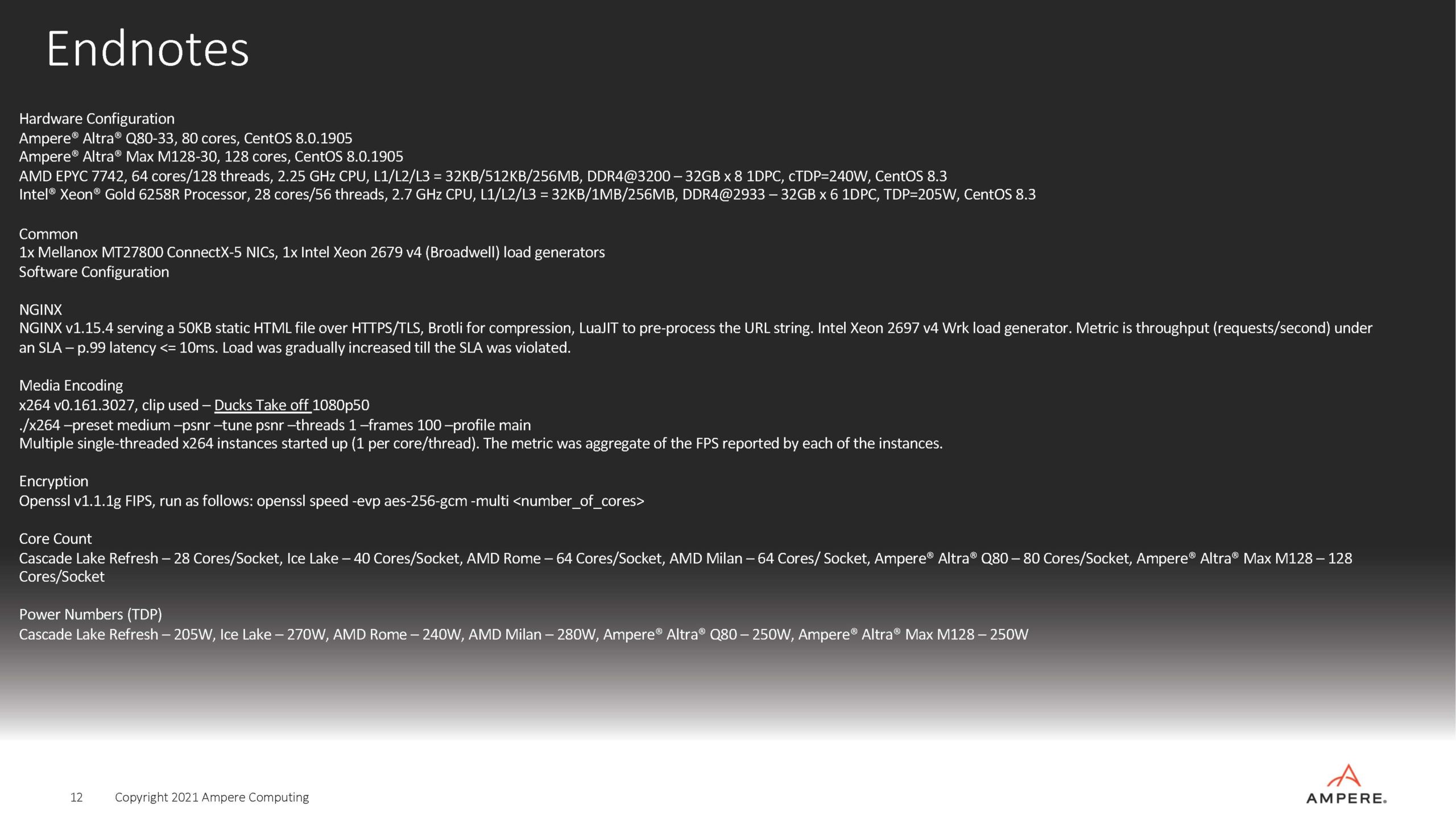

Through a single thread per core, Ampere looks to scale-out its architecture. A few quick notes on the three charts below, specifically the second and third. The Linear Core Performance chart shows a clear trend well over 128 cores which will be the Max part for 2021. The Power/Core chart makes sense since we would expect Ampere to go to TSMC 5nm with future generations. Today’s EPYC 64-core CPUs may be pushing 280W TDP, but they are clearly vastly superior on a performance per core and power/ core versus the Xeon E5-2687W so that is more of a general trend with process improvements.

Now for the big one, Ampere’s next-generation 5nm part and future generations will be coming out with an annual cadence. Starting with the next generation, Ampere is designing custom cores. I had the chance to ask Ampere about this and it makes a lot of sense. While the Arm Neoverse N2 and V1 are focused on offering more floating-point performance, as are the x86 cores, Ampere’s chips are focused on cloud workloads. Typically we see the important metric there is integer performance. Given that, Ampere can gain a benefit by focusing its cores on the balance of instructions and data types that matter for the cloud, rather than being a general-purpose processor. Ampere does not want to compete with Fugaku’s A64fx in supercomputing. Instead, Ampere wants to make cloud customers happy. Also, Ampere can focus its architecture on larger scale-out chips, instead of smaller chips.

Perhaps the best way I can describe the conversation is that Arm is trying to compete more directly with Intel and AMD x86 with N2. Ampere is simply focused on winning cloud segments. In all transparency, both Intel and AMD would likely be well served looking at this model and deciding if there is an opportunity to have a more integer-focused chip for cloud providers if little is running AVX2/ AVX-512. Ampere has a manufacturing advantage over Intel at the moment with TSMC, but AMD is also using TSMC so that is not purely the case.

On the topic of advantage, here Ampere is discussing metrics in terms of cores, ignoring SMT (or Hyper-Threading for Intel.) That is being called out, but it requires careful reading in order to not be misled.

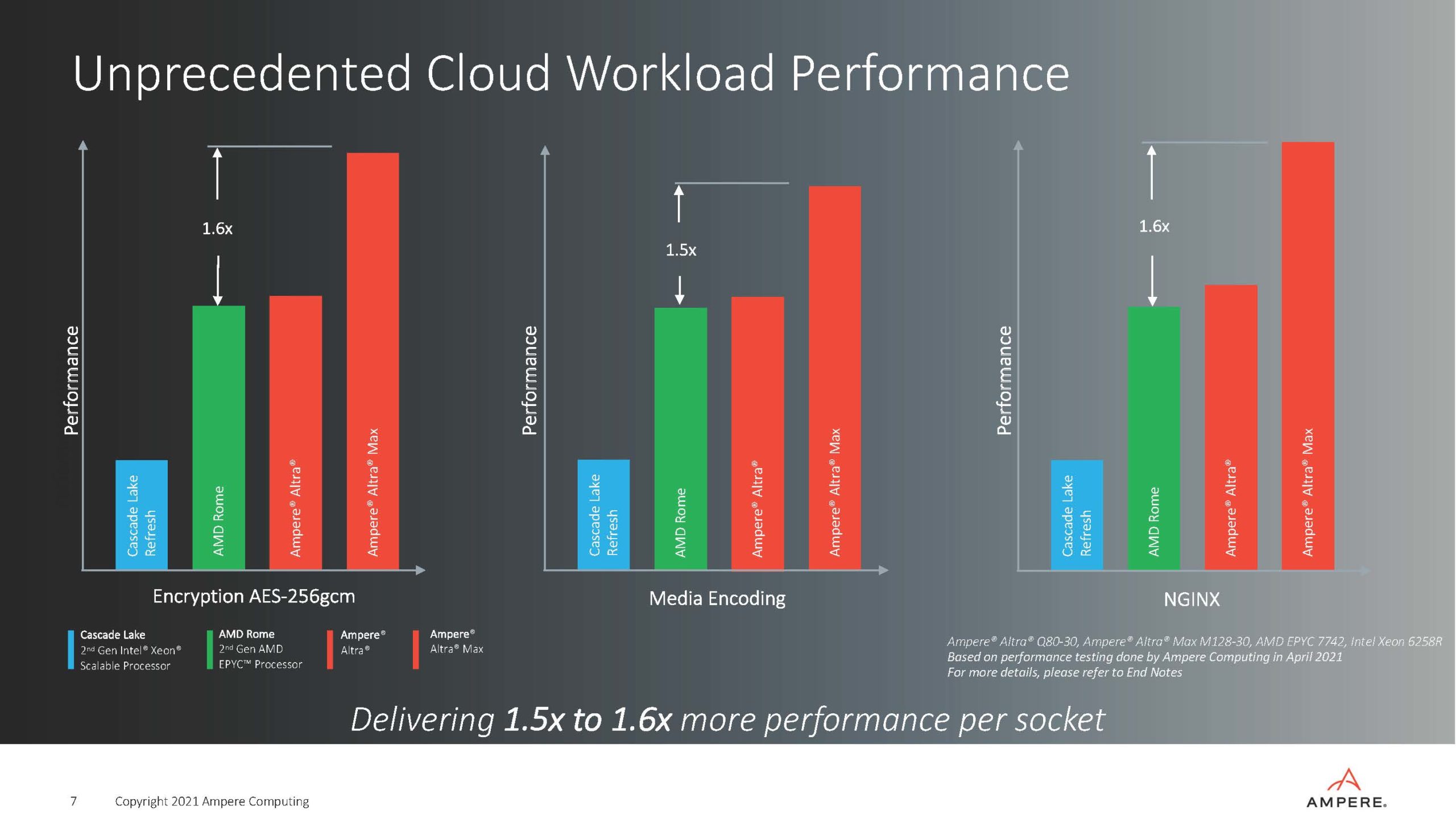

For a lot of these, AMD ended up seeing 20-30%+ improvement with Milan and Intel saw large gains with Ice Lake as well. Ampere will still have an advantage with workloads like nginx, but it will be much more muted than shown below. Of course, there are supply constraints in the market so we need to take that into account as well when discussing what is available.

Here, Ampere is using what is basically its best/ most optimized workload and showing that it can be faster than a more general-purpose x86 CPU. At some point, AMD and/ or Intel may decide to do similar optimizations. One will note AMD and Intel have much more diverse sets of workloads they are competing on, whereas Ampere focuses on NGINX. On the media encoding, this is interesting since one may see the market moving to architectures such as the Google YouTube VCU at cloud scale.

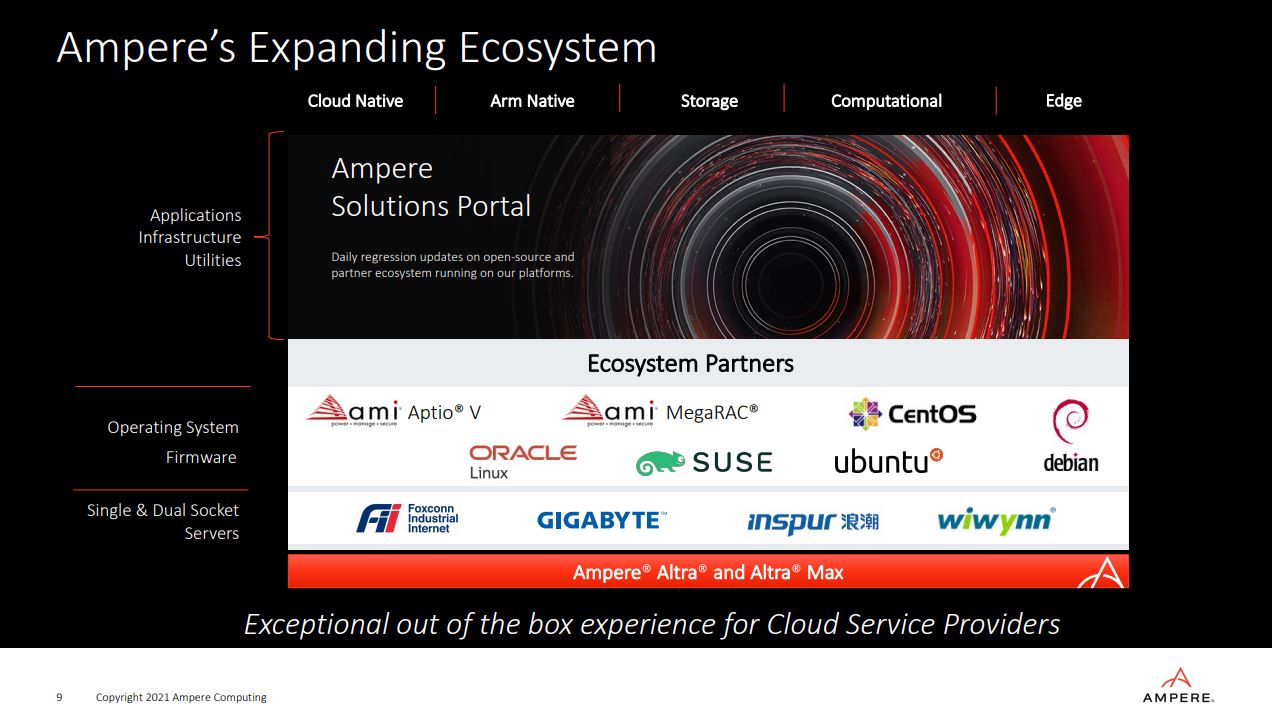

There are new software ecosystems. For those wondering, you typically see AMI Aptio when we show BIOS screenshots and AMI MegaRAC when we show BMC IPMI WebGUI screenshots. On the remainder of ecosystem partners, Red Hat has gone full IBM and said farewell to CentOS so one of those OSes is something we cannot recommend. If you are deploying a new server architecture, it would be difficult to deploy a server OS that is almost out of support.

We already covered Gigabyte and Wiwynn‘s Ampere servers. Perhaps the bigger additions are Foxconn and Inspur as ecosystem partners. STH readers will know, given the Inspur NE3412M5 Edge AI and Storage Platform Review we did yesterday, we cover the China market hyper-scale community the best we can. We had heard Inspur was getting customer interest in Ampere Altra a few months ago so it is great to see they are officially a partner now.

On the customer side, some big moves with Microsoft, Tencent, and others joining the list. We will have more on Oracle in the near future. In terms of geographic mix, it seems like Asia and North America are pushing ahead with Ampere while Europe’s Scaleway is the only EU or UK organization on the list. Scaleway is much smaller than Microsoft, Oracle, and Tencent as examples.

In summary, Ampere is showing that it is gaining momentum, which is a lot better than the X-Gene-derived IP was doing years ago.

Overall, this is a big deal for Ampere. Announcing that it is breaking from the tradition of using stock Arm cores and will not be using the N2 and instead focusing on its own design is a big step. That will allow Ampere to differentiate itself from competitors using N2 IP. On one hand, this is important to gain a competitive advantage. On the other, this is a road that many have tried in the past.

Endnotes

Of course, we urge our readers to read the endnotes. Here they are which you can click to get to a larger version.

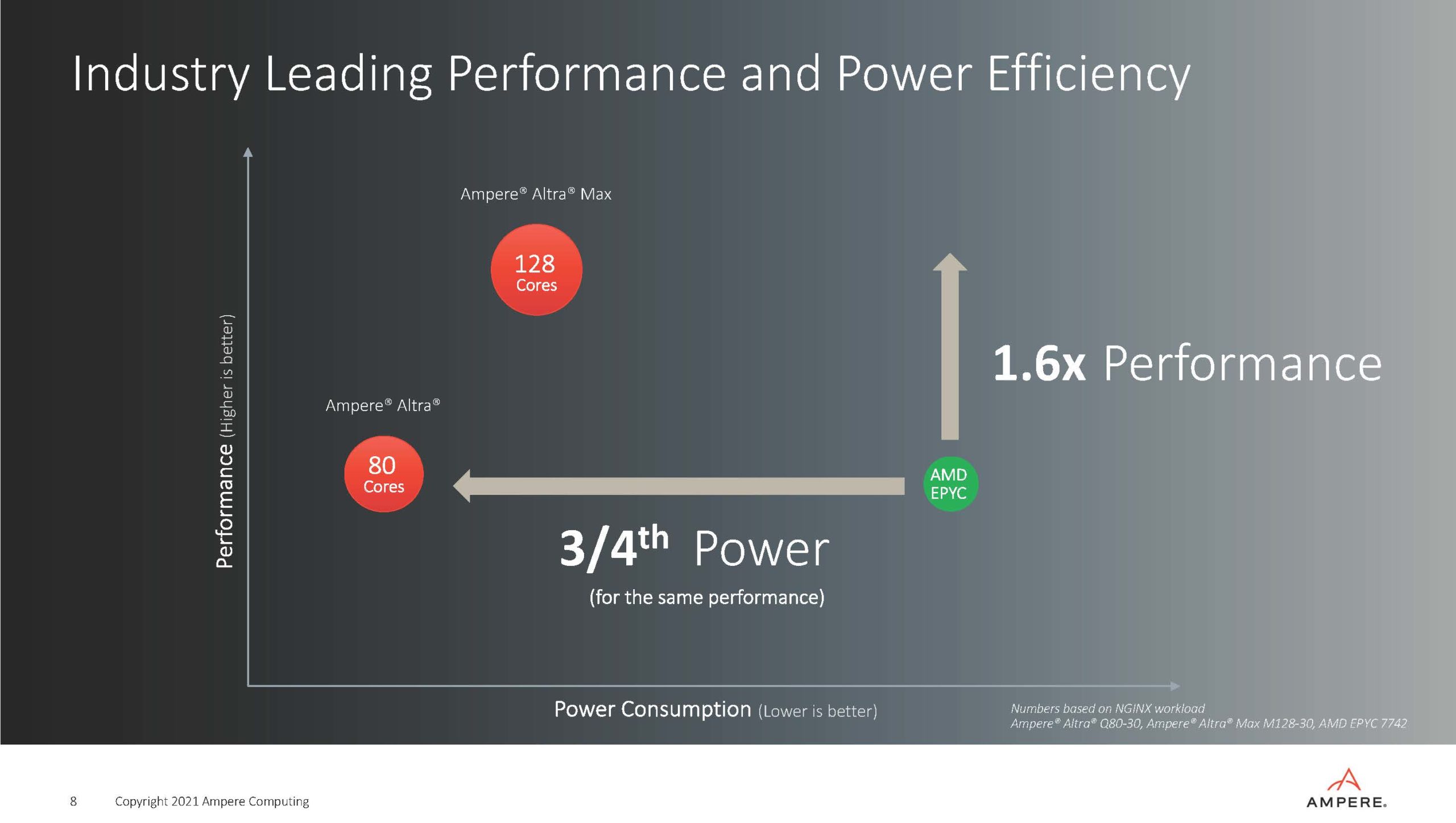

Even for an unlabeled marketing graph, that power/performance slide is simply egregious. 3/4th the power moves to 1/5 the x position? This kind of stuff needs to be called out.

While the power/performance graph looks egregious, the previous slide on parallel scaling shows Amdahl’s law for the EPYC and Xeon and an exact linear speedup for the ARM.

Given the fact that CentOS is still listed among the preferred operating systems, one can only hope the product isn’t as bad as the marketing.

I agree with Jim and Eric about the graphs.

This is the kind of stuff I expect from companies marketing to teenage gamers, not to industry professionals.

They’re former Intel people, so of course their graphs are as honest as Intel graphs