Since we recently covered the Intel Earnings Q1 2022 Notes we figured would cover AMD’s briefly as well. There were a few interesting nuggets in the AMD Q1 2022 earnings release that seemed worth discussing.

AMD Q1 2022 Earnings Notes

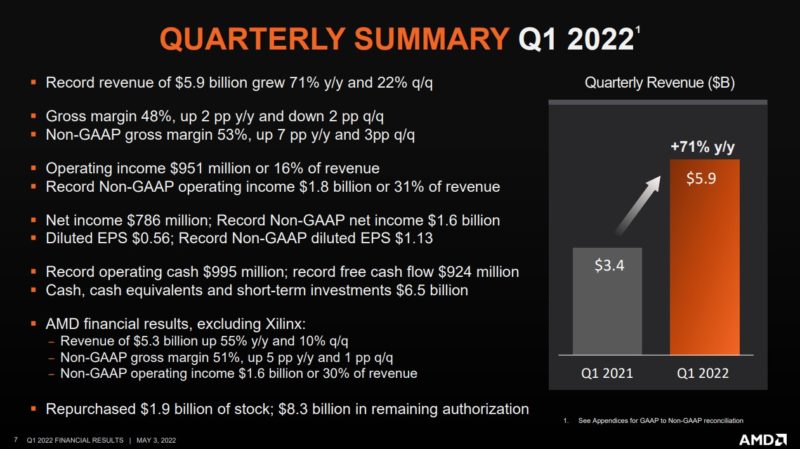

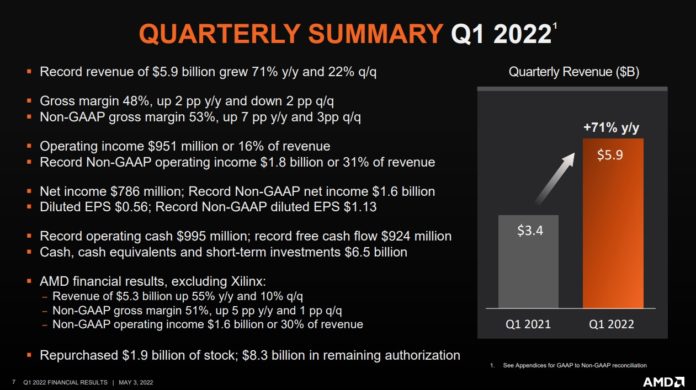

AMD had a fairly great quarter. Big revenue growth and margin up year over year.

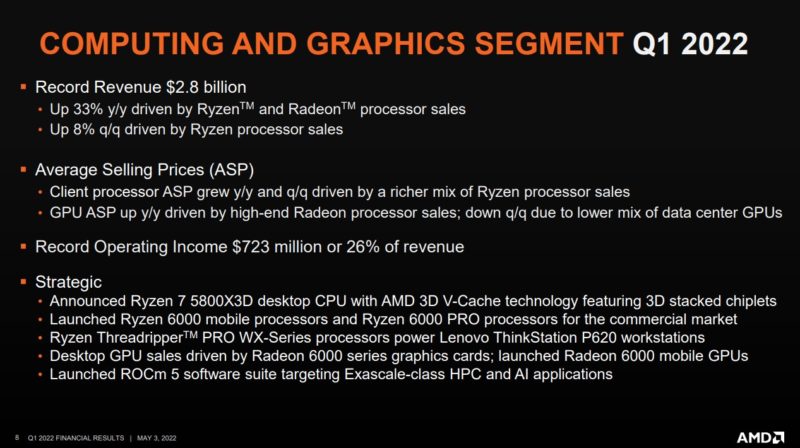

For the consumer segment, AMD is seeing some softness, but says it is focusing on higher end segments to make up the revenue. The one big one to us on this page is the quarterly drop in ASP for data center GPUs. NVIDIA Hopper is still a few months away. Intel has not formally launched Ponte Vecchio. At the same time, AMD is not able to keep the data center GPU mix high. That can just be more Radeon being sold, but it is one of the weak points in this release.

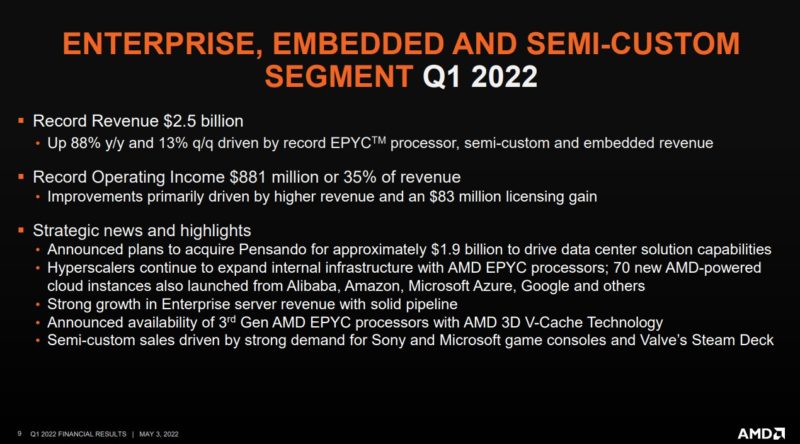

The Enterprise, Embedded, and Semi-custom segment had a big quarter. The challenge is that these are all very different segments, so reporting them together makes it harder to see. Still, it sounds like EPYC is growing briskly from the comments.

Xilinx is going to sell into all three of these areas for AMD, and Xilinx IP is not integrated yet. Still, it seems like AMD continues to grow its data center business at a healthy clip.

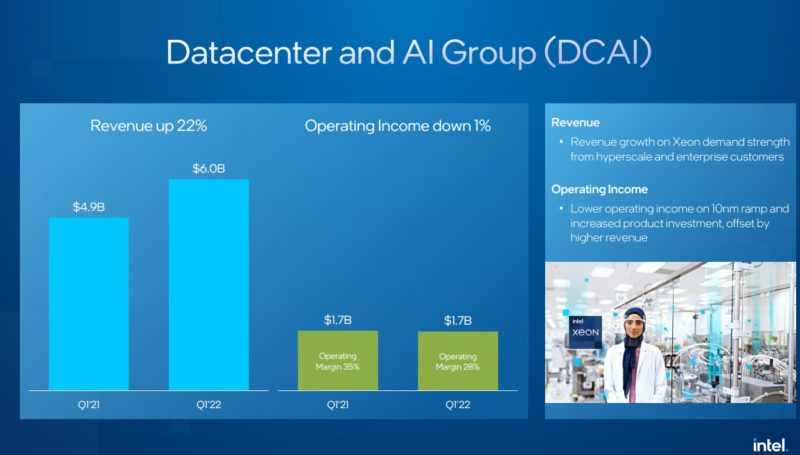

For a bit of perspective, here is Intel’s Datacenter and AI Group’s results:

Intel and AMD have different reporting segments. Still, both seem to see higher data center revenue. When we see Intel increase revenue while decreasing margin, it seems to point to competition in the market. That aligns with the storyline that EPYC is gaining share. EPYC gaining share likely leads to Intel discounting more heavily. We have also heard that is happening in the market.

AMD confirmed that we will see Genoa in the second half of this year. It is now saying that Bergamo, AMD’s cloud architecture, will target the first half of 2023. DDR5, PCIe Gen5 and the Zen4 core are coming, and it seems like we have less than 7 months for that transition.

Final Words

We will likely see the current trends continue for at least another quarter. The big question will end up being how macro economic forces impact the market and demand for server CPUs as we progress through the year.

Enjoyed