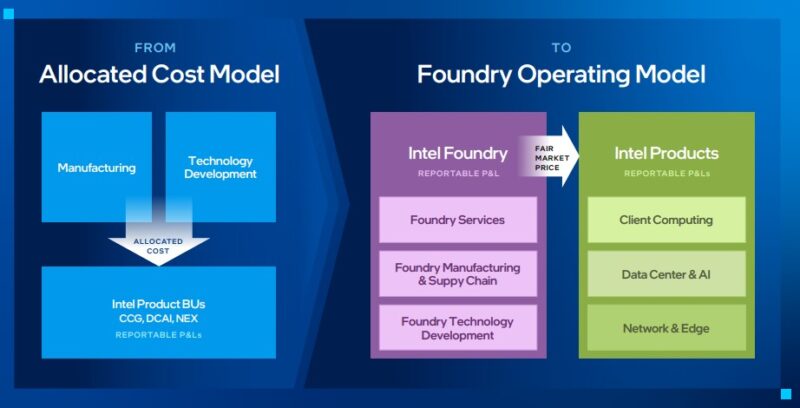

Intel today showed its recast financials using the Intel Foundry Operating Model. This is a big deal because it, in theory, is going to allow its products business (the one that makes Core, Xeon, and more) to be more competitive, while also getting serious about Intel Foundry operations.

Intel Foundry Operating Model Shown with Path to Process Leadership

We covered the plan to do this in our Intel Foundry Model Announced, but Intel has made it official with an 8K that included the company’s financials recast into new operating units (Altera was in there too.) This may not seem like a big deal, but Intel has been looking to woo 3rd party customers for its Foundry business, and this split makes the Foundry and the Intel Products group somewhat separate businesses.

With the new model, Intel Foundry will sell products to Intel Products. Intel Products, can choose to source packages from Intel Foundry or other parties like TSMC. Given we are in a chiplet world already, it might be more accurate to say Intel Products can source from a number of manufacturers and then put the pieces together to make parts. Something to keep in mind however, is that process nodes and products can often have long lifespans. As a result, a lot of products from Intel and Altera will likely be fabbed at Intel.

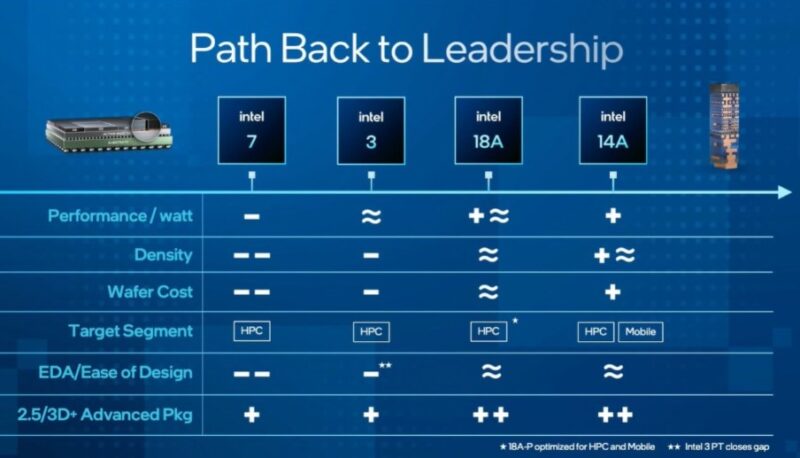

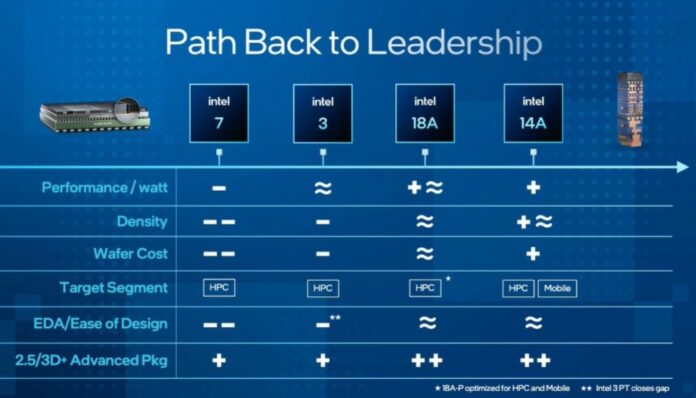

Intel says that this change will help as it charts a path back to leadership. We will soon start to see Intel 18A where it will be roughly on par with TSMC, but it says 14A will be ahead of TSMC. Notably here the change is also that “mobile” becomes a target segment.

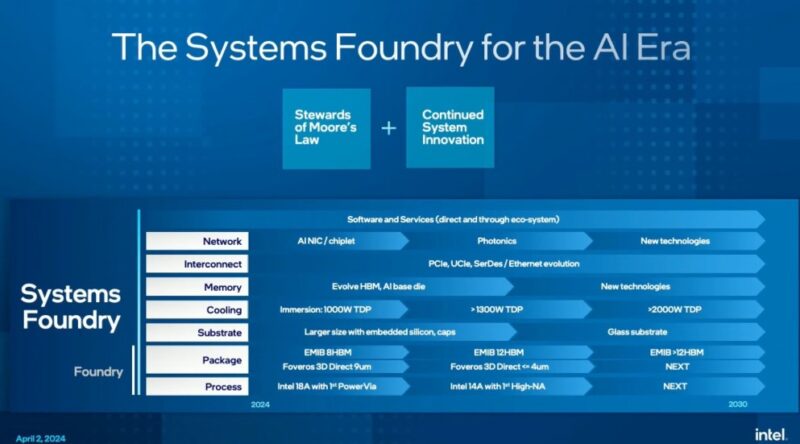

Intel for its part is getting ready for much larger systems foundry business for next-gen AI servers. 2kW TDP parts are much harder to fab as a single chip, so to hit that target, there will be larger packages. Larger packages mean advanced packaging and that means a new step for Intel Foundry to target.

Overall, this is a big step for Intel.

Final Words

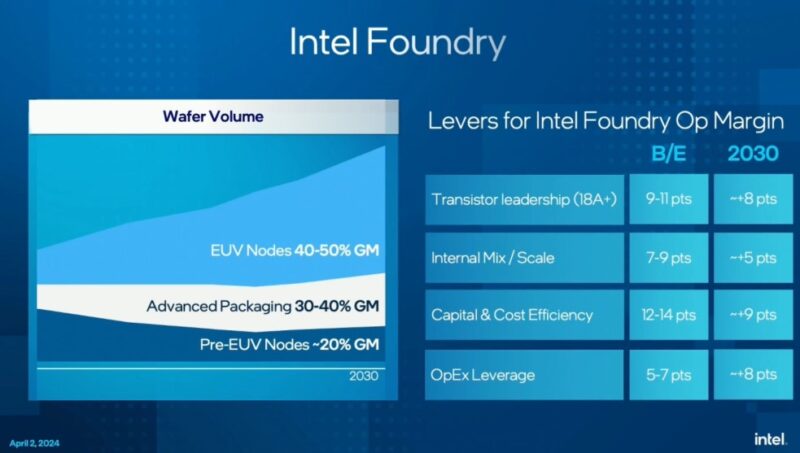

The big question with this step is whether it is getting the market ready for an equity sale in the Foundry business. Intel announced huge losses on the Foundry business, but expects break-even to happen around 2027 as EUV production ramps. We suspect that it would be harder to make an Intel Foundry offering until it starts to turn a profit and it shows that it is competitive with TSMC. At the same time, this reorganization is the first step in that process.

One thing is for sure, this is a bet the farm, or maybe state size ranch move. Intel has plans to invest $100B, it just got huge CHIPS Act funding. If it does not regain process leadership, and the Intel Foundry business therefore cannot attract new customers and wafer volume, then it is going to have a massive investment without massive returns.

Years and years they have been saying they are ahead of TSMC…

I’ll believe it when I see it

No word about the massive 7B loss they just posted for the foundry business?

David.

All semicon foundries are cash intensive – and Intel expanding rapidly with new fabs being built all over.

Now run along.

Operating revenue declined with 31%, doesn’t sound like new fabs being built is a plausible explanation for that. Also expanding rapidly while customer demand is declining sounds like lighting your cash on fire, and not like solid economics.

Like who is Intel building these fabs for? It’s clearly not internal customers as they also appear to be shopping elsewhere.

“No word about the massive 7B loss they just posted for the foundry business?”

“Intel announced huge losses on the Foundry business, but expects break-even to happen around 2027 as EUV production ramps.”

David, if you don’t think 7B is “huge” mind adopting me?

Intel’s moves to regain process leadership has had a huge price tag attached to it. Getting the latest machines from ASML before competitors is a huge strategic maneuver toward that. To go alongside the fabs Intel has been investing heavily into packaging technologies which they do arguably have some leadership here today.

I do think Intel has been short sighted by selling off their network switch division right when that market is set to move to integrated photonics. They would have had good designs coupled with an in-house manufacturing advantage. Companies like Cisco, at least publicly to my knowledge, were fine with this and continued to leverage Intel’s foundries. This does however open up room for companies like Broadcomm who may have a different opinion on the matter since they sell their silicon to the same customers Intel was targeting.

The real question now is where are Intel’s customers? Altera is the obvious one but only because they were spun off from Intel themselves recently. Who else is there?

At this point it is time to face facts: Intel is only going to do that which gives the stock holders a return, even if it is at the cost of the company itself. The US taxpayers have at this point given Intel similar if not more than was given to the auto industry. If they want anymore, they need to get rid of the private shareholders’ stock, hand them over to Uncle Sam, and fire the current Boomer in Chief. New blood is needed. They have already slipped back into their prior this generation the same as last generation and the same as last generation just without any other of their divisions since they were lopped off to sell to make the shareholders more money.

poor earnings, poor forecasts

In chip fabrication as in baseball fields, if you build it the customers will come.

The problem for Intel will be execution.

As a long time INTC shareholder, i was happy to pocket dividends for the last 15 yrs after the “core” design and 14nm+++++continued to reap profits. But I have also known that lack of new materials engineering and sitting on your hands means that your competition will poach your talent and eventually catch up. 10nm took way too long, because the talent is at ASML and TSMC. Logic design on Atom failed to beat ARM, to no one who understands proc architecture’s surprise (arm/risc is more efficent if less powerful vs heavy lift extensions to x86).

So not only must they build anew the fabrication facilities, but they must pull back talent from firms who are already profiting from their resting on laurels. Open the pocket book and you have a shot at doing both. Get stingy and Intel becomes a shadow and footnoted great in the history books like Fairchild.

Saddest thing, tax payers are funding these fabs, Intel should have. What was once the 800lb Gorilla in the market is now getting a handout? Yeah, yeah reliance on TSMC, China and fears…I get it, but it’s still gross.

@MDF tell that to Global Foundries. You have to build it well.

—

“Fair market price”

Yeah. Whatever you say.

During the great bank bailout of ’08 the people took positions in the banks. Whether the bankers liked it or not.

Intel, we just GIVE money to Intel. CHIPs Act and Pat is pleased to let us know the Pentagon and CIA have gauranteed the order book for years into the future.

This is corporate welfare.

Patrick, I’d follow the money, too; but between this and the banner ad, et. al., you’ve proven that you’re now no longer even feigning impartiality in your analysis when Intel is involved.

I do not sell ads. STH does not sell ads. All ad sales are done by 3rd party agencies who also manage inventory, delivery, and etc. All I get to do on those ads is to say the formats STH will accept (e.g. static images in certain pixel widths) and where the ads can be placed.

This is all in our Editorial Policies and has been there for around a decade.

This fails to address the fundamental advantage enjoyed by TSMC: THEY DO NOT COMPETE WITH THEIR CUSTOMERS!

All the money goes into improving their singular product: Process technology, which is funded by all their customers at the level the customer products require, and all optimized for the scales required.

Intel has to do process evolution, device evolution, architecture evolution, design evolution and then support all the parts they sell.

Intel has spent the last two decades succeeding themselves to death.

The TSMC and Intel ecosystems have fundamentally different scaling behavior and the evolutionary dynamics are vastly different.

This is evolutionary diversity versus a monoculture. The question is not how it will end, but how long it will take and the magnitude of the collateral damage.

After consideration, it was rash of me to jump to those conclusions. Thank you for your constructive and informative reply Patrick, I apologize for the overreaction.