Competition is fun, but AMD’s pricing team is playing a dangerous game. They are discounting its newest generation before they even hit shelves. During the initial AMD Radeon RX 5700 XT Navi launch at E3, AMD positioned its products below the almost year-old NVIDIA GeForce RTX 2000 line. Last week, NVIDIA responded. See NVIDIA GeForce RTX 2080 Super, 2070 Super, and 2060 Super Preempt Navi. This caused AMD to cut list prices significantly just days before launch. Before working on STH full-time, I was at PwC where I did a lot of pricing work at big tech companies. For those in the pricing world, this is a very dangerous game that AMD is playing.

How We Got to AMD Navi Price Cuts

With the company’s “Super” launch, NVIDIA went to a well-known playbook. NVIDIA essentially took it’s 2018 generation of cards and added more compute and memory bandwidth to the line. This moved midrange GeForce parts up one increment of performance at the same price point.

That was NVIDIA’s competitive response to AMD’s initial pricing of:

- AMD Radeon RX 5700 XT 50th Anniversary Edition – $499

- AMD Radeon RX 5700 XT – $449

- AMD Radeon RX 5700 – $379

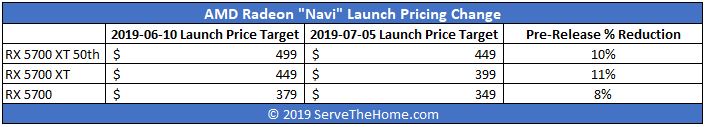

AMD’s response was to issue immediate price cuts. Here is the 2019-07-05 pricing guidance:

Taking a quick recap, this represents an 8-11% reduction in price before the cards are even available to purchase.

We wanted to quickly note here that the AMD Radeon RX 5700 only saw an 8% reduction. With 8GB of GDDR6 on all of the cards, along with other fixed costs for items like PCB, cooling, and other components, the lowest end part likely has higher margin pressure. If we had seen a $340 price tag, it would have been around 10% and in-line with the other cards. Instead, AMD is sticking to a well-defined $349 price point.

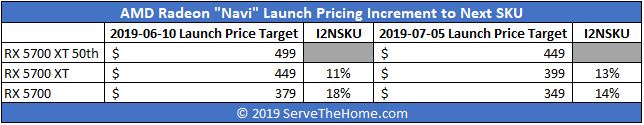

This also changes a metric we used to call Increment to Next SKU or “I2NSKU” for short. This changed significantly with the new pricing guidance.

With the new pricing changes, the AMD Radeon RX 5700 XT 50th is now 13% more than the RX 5700 XT SKU, up 2%. On the opposite end, we see the AMD Radeon RX 5700 down to only a 14% increment from 18% at the initial announcement. If AMD thought the RX 5700 XT was worth 18% more previously, it now is almost begging users to upgrade to the RX 5700 XT. Again, this is the type of price movement you typically see when your lower-end product is hitting some kind of fixed cost margin wall. The $340 price would have put I2NSKU at around 17%, or close to the previous delta.

One can argue that AMD simply snapped its product line to market points, but that is a big deal itself. With the NVIDIA GeForce RTX 2000 series, NVIDIA was able to do more than hold traditional pricing, it actively moved pricing up. It did so on the back of Turing ray-tracing. Frankly, if you are doing AI and deep learning workloads, the RTX price increases are well below performance increases so we see pallets of RTX cards being installed in AI clusters (despite NVIDIA’s desire to the contrary.)

Setting a Dangerous Precedent

If you look at pricing on the AMD Ryzen side, AMD has been quick to offer discounts. Usually, AMD Ryzen launch pricing holds for only 1.5-2 quarters and then we see pricing take a dip. AMD has a pricing strategy of capturing early adopter dollars and then lowering pricing to keep volumes up. 20% price decreases over a few quarters is common. This is in the face of Intel largely keeping pricing steady. We do know that Intel sees the new 3rd gen Ryzen as an enormous threat, so this may change in the future.

Looking to the server segment, from our own experience, AMD is discounting the first-generation EPYC series heavily. Our purchase prices of “Naples” are so good, that is almost all we are buying for the lab at this point, even with “Rome” launching this quarter. There is no way to compare AMD EPYC list prices to Intel Xeon list prices at this point.

By discounting before launch, AMD is effectively saying Navi would not have been competitive with its initially proposed pricing. It can spin this by saying it is better for gamers. It can say that the drops were planned all along. The downsides are severalfold.

- With its next launch, what happens when AMD does not cut prices between announcement and launch? Some in the market will now expect this behavior from AMD.

- The market needs a strong AMD. We need the company to deliver high-performance silicon, solid software, and a future roadmap. Cutting its early adopter margin does not help with these price cuts.

- AMD is setting up to become the low price leader, not the premium offering. This is strange if you think about AMD’s CPU products. AMD, from a CPU perspective, in Q3 2019 will have the premium x86 CPUs. The GPU side is going the other direction showing its flagship product cannot command a premium place in the market.

Alas, AMD needed to go here if it felt that its Navi cards would not sell at its initial pricing. The company did not even have enough faith in its offerings to let the product sit in the market for 60 days then enact gradual or other price cuts. A $25-50 price cut in 2-3 months may draw ire from buyers, but a $10 monthly price cut for five months would have set a different type of precedent.

Final Words

Competition is good for consumers and the industry. AMD launching a product 9 months after NVIDIA and not being able to command a price premium is not necessarily great for the company. We need AMD to get tools beyond gaming such as a legitimate NVIDIA Docker/ Kubernetes container integration. NVIDIA is still holding pricing on the Tesla V100 in the market fairly well even though that is a 2017 product because it has the software ecosystem behind it.

From a broader perspective, once Intel enters the GPU market, will this become the norm? One company announces, the other announces, a third announcement, followed by three rounds of price cuts, then a week of product launches? That is scary for anyone in the market.

In the end, the new pre-launch pricing adjustments are pushing pricing gravity towards the center of the stack and the AMD Radeon RX 5700 XT. That is likely a calculated move by AMD. Moving pricing pre-launch, or even within the first few weeks of launch, is not something that should be taken lightly. There is much more that goes into pricing than the above. Still, the decision will have serious ramifications for AMD not just in this round of GPU sales, but for generations to come.

Scott Herkelman AMD: “Jebaited”

I think it’s more of a: “oh **** we aren’t going to be competitive”

“Jebaited” was a way to save face. What so AMD’s newest chips weren’t good enough to hold the price when Nvidia tweaked last year’s models? They were worried they wouldn’t sell any to people other than AMD fanboys.

every manufacturer always prices their product to the maximum they can charge for it, that’s just common business sense. I think you need to read this more in respect to the performance of the cards compared to nvidia that in order to be competitive they need to charge less.

Apparently there is sufficient margin on the product to not let this hurt, otherwise I don’t think we would have seen a price cut before launch. If we go by known factors such as chip size and transistor count we can reasonably assume that AMD is getting good yields from the TSMC 7nm process and most likely has better margins than nvidia with competing cards. (AMD 5700XT is 10.3B transistors versus 13.6B for the RTX2070 Super on TSMC 12nm)

As a Sr Dir of pricing in the tech industry, this is pricing 101. You never do this unless it’s going to be Armageddon with your initial pricing and nobody will buy your stuff.

Jebaited = trying to hide the fact they didn’t have the right GTM strategy in the first place.

They’ve got pcie4 and they can’t charge a premium? That’s not looking good.

It’s just a reaction to the nvidia super cards. People need a reason to buy your products, one of those reasons can be the price. AMD totally destroys Intel on the CPU side with good margins(that’s where they make the money, they have different share holders than intel). Looking at the initial AdoredTV leaks, the pricing was kind of high, now things are just back to normal. AMD has to buy marketshare, NVidia has to earn money back on their Mellanox purchase, Intel is kind of used to extreme high prices(and extreme high discounts for data centre) and needs the high prices. AMD is used to keep things running with low margins(they did it for more than 10 years).

Eh, I side with the theory that this was more or less planned, knowing that the Super cards were incoming but not knowing their performance or pricing. Better to price high and come down than to underprice yourself out of margin, or to be $10 too high and have to live with it pricing yourself into somewhat lower volume or having to make such a trite price cut. The bet they’re making is that they have as-good-or-better rasterization perf/$ and that makes better value when the competitors current RT implementation probably isn’t powerful enough for RT games to hit their stride. They’re able to compete with a much smaller die, albeit at 7nm.

Their RT patent that was discovered last week suggests that their RT hardware will have much less die impact, be more flexible, but doesn’t over-reach for full BVH-traversal in hardware. They’ll be able to accellerate reflections, shadows, lighting, and AO, but not do GI — nVidia pays for GI but doesn’t reach practical performance to deploy it (in games anyway, GI for nVidia isn’t really a games play, its more for graphics workstations/offline render nodes).

AMD is very clearly chasing the gamer curve with Navi, and correctly IMHO, while nVidia is chasing the pro-rendering market with Turing. nV is in the right combination of markets to make that feasible, but all that untapped silicon in their gaming product is costing them — the Supers are the configurations/prices they should have had at launch but couldn’t.

A mid range card with mid range pricing.

AMD needs to get more competitive on the GPU side. Raja, now leading Intel’s graphics, messed AMD’s Radeon line up. Now he is starting over at Intel. Nvidia is so big.

7nm involves more litography steps and more masks than older process nodes.

Its going to be much more expensive than 12nm.

So Amd want to charge higher prices as originally announced at E3.

NV’s RTX Super derailed all of that with strong performance across the board.

Last minute emergency price cuts had to happen eventually.

This article is kinda doom and gloom unnecessarily. First of there is a good chance this was a planned move by AMD because despite STH’s article saying the Super launch was “unexpected” it had been a major public rummer for weeks prior. Second AMD’s strategy of pricing of the earlier adopter tax or whatever you want to call it has seen them lose nothing but market share for multiple generations now. Repeating such a strategy at the raised price point NVIDIA set this generation would be very unwise at the very least. Thirdly AMD needs market share to get software support. Even with the consoles they need more of their cards in the wild to justify the wide software support we would like to see Lastly AMD has not been able to compete on the high-end GPU segment for 5+ years now which means the earlier adopters are just AMD fan not the people wanting the very best who are willing to pay extra to get it.

I’d change “Dangerously” to “Strategically.”

what some of the commenting fellas forget here:

– as expensive as 7nm is, the competing cards’ die size 545 and 454 mm2 versus Navi’s 251 mm2. That is a HUGE difference

– you can’t charge premium for PCIe 4.0 on a platform where there is zero benefit from it at the moment

– planned or not planned, it is much better this way than what happened many times: introducing a good price point and then having nothing to show for it for months because of supply constrains. If this can hold, AMD could win back a bit of much needed market share

cheers