Gartner released their Q1 2014 server market share figures and there are two trends. For those that are not familiar, Gartner is a firm that provides research/ analyst information. It is one of the companies that attempts to track server market share.

In general, market share figures do vary quite a bit. This is because data comes from different sources but these are often third party sources with information gaps are prevalent. There are many government purchases that are never counted in server numbers. There are firms like Google, Facebook and others that have their own design capabilities, often not reporting results to analysts.

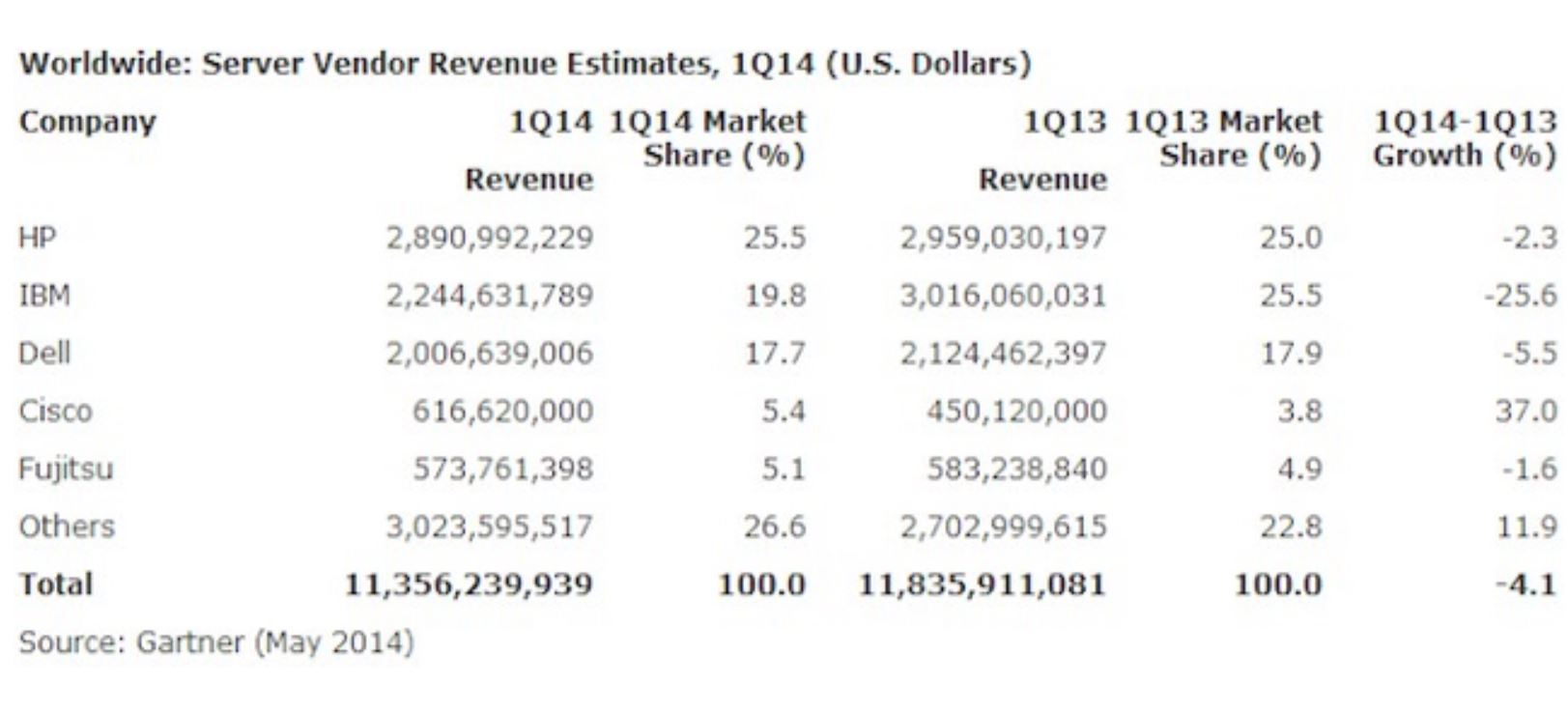

Here is the Q1 2014 data from Gartner:

One can see a few trends. First, Cisco gained 1.6% market share which led to a big relative growth figure. On the other hand, IBM lost 25.6% Q1/ Q1 which means a nominal figure of 5.7%. “Others” includes companies like Quanta and Supermicro. The “others” group picked up 3.8% of the market share by revenue for a relative growth rate of 11.9%.

So what are the big forces at play here? First, Cisco continues to go after HP with their UCS line. This has been happening for years but as HP moves into networking, Cisco moves into servers. HP and Fujitsu gained market share on declining revenue. Dell lost a small bit of market share <= 0.5% which is a fairly normal variation.

IBM’s loss was simple to understand. IBM announced it was selling its lower end server business to Lenovo. The market has reacted significantly to this with other vendors preying on the IBM and Lenovo businesses. The figures are down about $800M Q1/ Q1.

The Others is certainly interesting. There is now over $3B USD being estimated for the Others category. That is a clear trend that has been gaining momentum for some time now. With Facebook pushing its OpenCompute platform, there are less engineering resources needed to go direct to the Chinese ODMs. An example of this, on the networking side was the Quanta LB4M “Google” switch that was a popular deal on the forums.

At HP Discover the company released its vision of “The Machine” and its memristor technology. This is an example of a strong defense traditional players are putting out innovation to stop commoditization.